Will the S&P500 break above the 200-day moving average and is STIR cheap recession insurance?

In this week's article, we review last week's economic data, why STIR could be cheap recession insurance right now and how I navigated markets last week.

Hi everyone,

This article is structured in three parts: first, I review last week’s economic data, then I discuss why STIR is cheap recession insurance right now, and finally, I share how I currently navigate markets in my trading account.

These write-ups take a lot of time and effort to put together, so if you find them helpful, I’d really appreciate it if you shared them, forwarded them to a friend, or posted them on X. It keeps me motivated to keep doing the work and putting these pieces out regularly. Having said that, let’s dive right in!

Positive Growth Data and No Re-Acceleration in Inflation

Last weeks‘ economic data was promising. I would summarise it as 1) a strong labor market, 2) improving PMIs and 3) no upside surprises on inflation.

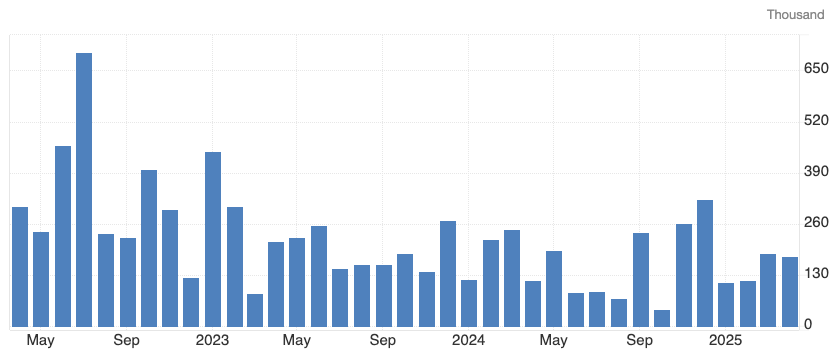

The most important labor market data - nonfarm payrolls - came in stronger than expected at 177k (vs. 138k expected). Job growth was driven by the private sector with private nonfarm payrolls coming in significantly stronger than expected at 167k (vs. 125k expected). Federal employment fell by 9k in April. The unemployment rate remained unchanged at 4.2%.

The ISM Mfg PMI came in at 48.7 (vs. 47.9 expected). New orders (47.2 vs 45 expected) and employment (46.5 vs 44.6 expected) both came in stronger. Prices paid - which is still pointing towards an acceleration in inflation - fell more than expected, 69.8 vs. 73 expected. All in all, positive surprises.

United States‘ GDP printed -0.3% vs -0.2% expected. The S&P500 sold off initially, but then reversed and closed up on the day. The price action highlights what I started to say a few weeks back: the pain trade in equities is higher. Money managers are underweight and need to chase the market higher, and nobody wants to go “all in” because 1) valuations are still high in a historical context, 2) the consensus still expects 10% earnings growth in 2025 and 3) Trump’s tariff and immigration policies could lead to a significant slowdown.

The negative GDP growth number was heavily impacted by tariff front-running. But the fact that the market bounced sharply shows that equities are becoming increasingly immune to tariff (or more broadly: negative) news. Last week, I wrote that “for stocks to enter a prolonged downturn lasting one to two years, we would need a constant flow of growth-negative news that push investors out of equities”.

Right now, the news flow is marginally positive with the US administration pulling back on tariffs. As long as the economic data is not starting to reflect a recessionary or rapidly slowing US economy, equities are supported.

Core PCE - the Federal Reserve‘s preferred inflation metric - printed in line with expectations at 2.6%.

In summary, last week’s data reflected a strong economy and higher than target but not re-accelerating inflation. This is good for equities and bad for bonds. The S&P500 closed 2.92% higher and US 10y yields increased by 5.3bps to 4.31% last week.

I am cautiously optimistic about equities, but I recognise that 1) tariffs are still in place, 2) trade deals will take time, and 3) the likely outcome of this policy mix is stagflationary. Goldman Sachs estimates that a 1% rise in tariffs is equivalent to a 0.1% fall in GDP and a 0.1% rise in inflation, i.e., a 10-15% tariff rate translates into a roughly 1-1.5% hit to GDP and a 1-1.5% increase in inflation.

Although 2025 earnings estimates have come down a bit (see last week’s Substack), earnings expectations are still close to all-time highs. If the US economy falls into recession - which is a real risk - earnings expectations will have to come down and equities will have to trade lower.

STIR = Cheap Recession Insurance

If you are long equities, STIR might offer cheap recession protection right now. For the rest of the year 2025, the market is currently pricing three rate cuts. If the US economy does not slip into recession, this outcome seems realistic. Economic data released in May and June will probably be solid. The more important economic data that will reflect the tariff impact will come out in July, August and September.

The market is currently pricing that the Federal Reserve will cut in July. If we assume that data in May and June will remain solid, the Federal Reserve could cut July 30th, September 17th, October 29th and December 10th, i.e., there are four FOMC dates between July and end of the year.

If the United States’ enters a shallow recession, the Federal Reserve would likely cut by 25bps each FOMC, i.e., 100bps in 2025. If the United States’ enters a deep recession and the Federal Reserve reacts fast, it might cut by more than 25bps on one or two of the FOMC dates. The past few weeks, Fed commentary indicated that Fed officials are more concerned about a growth shock than inflation re-accelerating.

SOFR December 2025 futures look like cheap recession insurance right now. If we do not get a recession, the Federal Reserve will likely cut three times by the end of the year. That is what is currently priced in. If we do get a recession (shallow or deep), the Fed might cut more than three times.

How I Navigated Markets Last Week

I was stopped out of my long oil position. I expected a loss of around 0.5%, but it was closer to 0.75%. Saudi Arabian officials said the kingdom can handle a prolonged period of low oil prices and oil traders are expecting OPEC+ members to hike output in June by significantly more than the scheduled amount now. As you would expect, the oil price sold off as a result. I am not planning on getting back into the market in the near future, but I will continue to monitor it for crowded positioning.

My trading account is Euro denominated. Last week, I moved 50% of my cash from Euros into US dollars. US dollar sentiment is very bearish. But I think the scenario that 1) the US economy avoids recession, which would result in 2) US financial markets doing better, and 3) the world learns to live with higher tariffs is a realistic scenario, which could lead to US dollar strength.

I am still long the S&P500 from April 24th 2025. I have moved my (mental) stop from the April 24th lows to the April 30th lows, which means the risk from my entry point is around 0.5%. We are now getting to the point “where the rubber meets the road”. Everyone is comparing the S&P500 today to the S&P500 during the first leg down in the 2022 bear market, when the S&P500 failed at the 200-day moving average. The fact everyone is highlighting the same level makes me feel like it could be less important this time.

The short JPY idea would have worked out really well - unfortunately I am not in the trade. Investors were max. long JPY into the BOJ meeting. Then, the BOJ came out and lowered its 2026 CPI forecast from 2.0% to 1.7% and its 2026 GDP forecast from 1.0% to 0.5%. Going into the BOJ meeting, overnight index swaps priced near certainty for a rate hike in April versus a 36% probability now. Lower rates imply a weaker currency. JPY sold off 2% on Thursday.

In my long-term investment account, the switch out of gold and into the S&P500 paid off. Since April 22nd, the S&P500 is up 7.4% and the gold price is down 5.2% (based on closing prices). The below relative chart shows that I switched out of gold and into the S&P500 at the low. Sometimes, we get lucky.

I am not looking to add any new trades this week. The main trades I was discussing on Substack - long equities, short JPY and long oil - have played out. I am still in my long S&P500 position, I am not in the short JPY position and I was stopped out of the long oil position. The trading portfolio is up 4.7% YTD. I am in wait-and-see mode right now.

I was quite busy this weekend, which is why this Substack article is shorter and there are fewer “original thoughts” in it. Nevertheless, I hope you enjoyed it. This is not investment advise and all views are my own. I write these articles because they help me to stay disciplined and transform my thoughts into actionable trade ideas. I always appreciate your feedback, likes and comments!

Your well rounded and formed views are becoming one of my preferred reads.

As always, great write up and a great way for us to stay on top of your thoughts.

Thank you for taking the time and sharing!

Best,

Valentino