Where is the next macro trade?

Is the US economy stronger than many expect? Will the S&P500 bounce from here? Are US 10y rates a buy? And more macro trade ideas.

Each weekend, I take time to write down my thoughts and formulate macro trade ideas. This process has been invaluable in 2025, helping me stay organised and keep up with what is happening in the world. I hope you enjoy the articles, and I welcome comments, likes and feedback. Let’s dive in!

The US economy and equities

On Monday, retail sales data came in weaker than expected, yet the S&P 500 closed higher. By Wednesday, Powell’s dovish press conference fuelled further buying. By the end of the week, the S&P 500 had gained 0.46%. Bulls argue it’s time to “buy the dip,” while bears remain poised to “sell the rip.”

I find myself questioning the supposed “growth scare” that many are discussing. While soft data and survey indicators suggest weakness, hard economic data hasn’t meaningfully deteriorated. Financial conditions have eased, household and corporate balance sheets remain strong, and companies have not signalled significant demand concerns in their earnings reports.

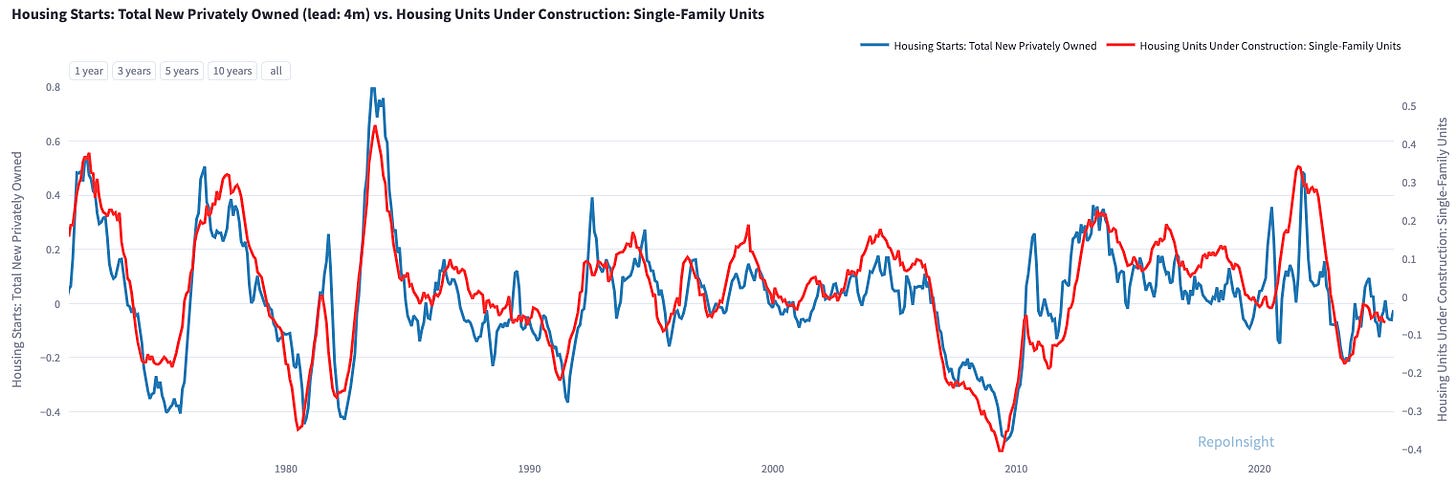

Housing starts surprised to the upside this week, likely supported by 30-year mortgage rates dipping back below 7%. As long as housing starts remain resilient, the number of housing units under construction should hold steady, preventing construction employment from becoming a drag on NFPs. However, with homebuilder backlogs now smaller, the housing sector poses a risk to the economy. That said, this week’s data does not indicate a meaningful slowdown in growth.

Equities dislike uncertainty, but with most major economic data and the FOMC meeting behind us, the landscape has become clearer. However, uncertainty lingers around tariffs and their potential impact on the U.S. economy. But is the expected slowdown due to tariffs really as severe as many anticipate? Consider these headlines from the past week:

Canadian ready-to-assemble furniture supplier Prepac has reportedly shut down its manufacturing operations in Delta, British Columbia, shifting all production to its facility in North Carolina instead.

“Overall, we will procure, over the course of the next four years, probably half a trillion dollars’ worth of electronics in total,” Nvidia CEO Jensen Huang told the Financial Times. “And I think we can easily see ourselves manufacturing several hundred billion of it here in the U.S.”

WHITE HOUSE ECONOMIC ADVISOR KEVIN HASSETT: SPENT LAST NIGHT WITH COMMERCE SECRETARY & TREASURY SECRETARY NEGOTIATING WITH OTHER COUNTRIES ABOUT MUTUALLY LOWERING TARIFFS BEFORE APRIL 2ND DEADLINE.

How much of the equity sell-off was driven by deteriorating economic fundamentals versus hedge fund deleveraging? Many multi-strategy funds were caught on the wrong side, and when they all unwind at once, price action can become disconnected from economic reality.

April 2nd will be a pivotal moment, as we find out what kind of tariffs the Trump administration will introduce. The best-case scenario? A coordinated reduction in tariffs across multiple countries, easing concerns and providing a tailwind for markets.

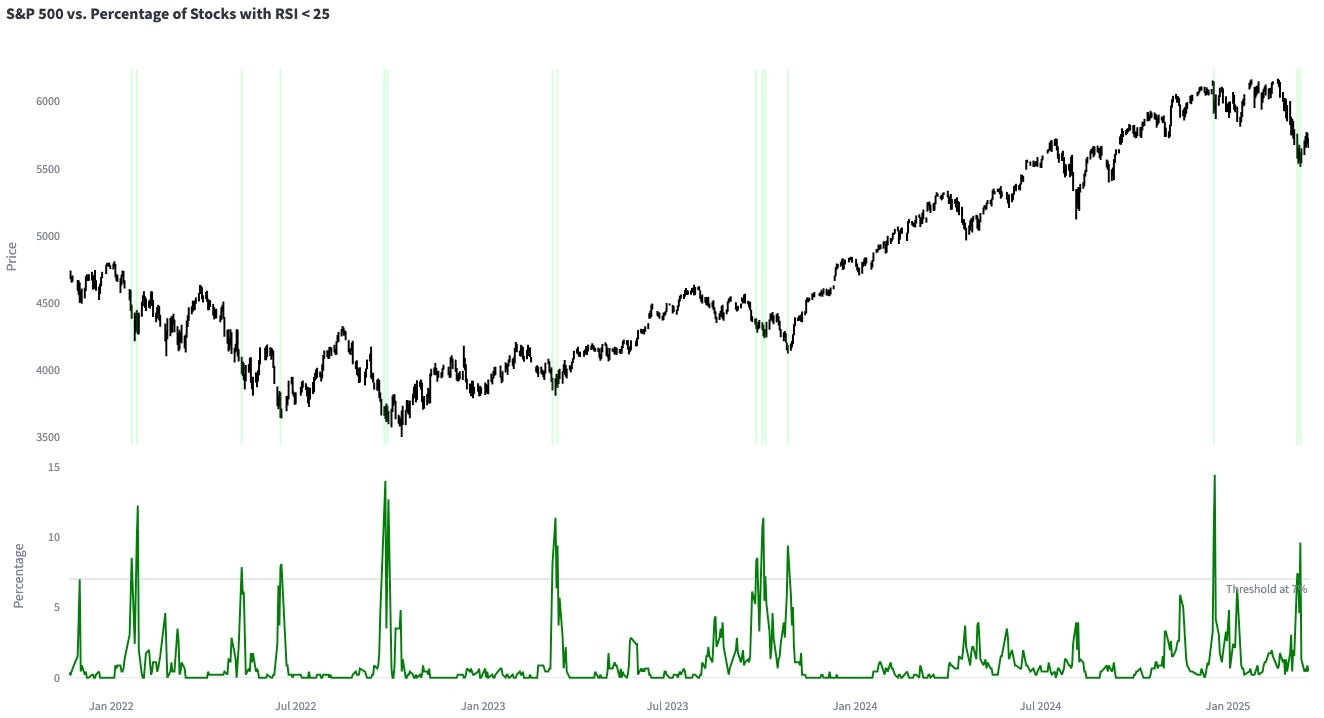

Last week, I wrote that if equities avoid a deeper bear market (decline of more than 20%), then this is likely a buying opportunity. Seasonality and sentiment remain supportive, and there are signs of an oversold market. Below is an updated chart showing the percentage of S&P500 stocks with RSIs below 25.

FOMC - Dovish pause instead of hawkish pause

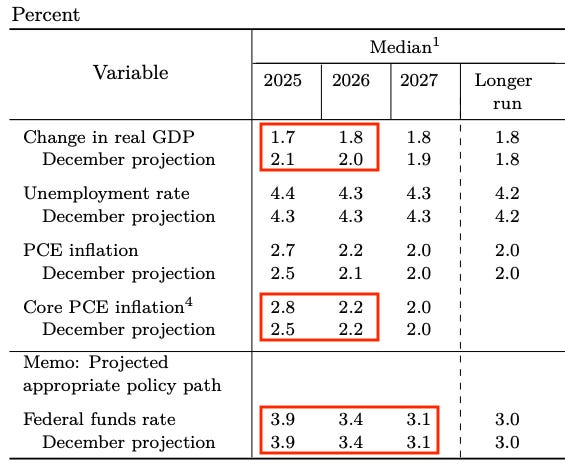

On Wednesday, the Federal Reserve updated its Summary of Economic Projections (SEP). The board expects 1) weaker GDP growth of 1.7% in 2025 and 1.8% in 2026, 2) higher core PCE inflation of 2.8% in 2025, and 3) two rate cuts in 2025 (unchanged).

Although the median Fed funds rate projection remained unchanged, the mean Fed funds rate projection is more hawkish now. The average FOMC member expects the Fed funds rate to be at 4.00% at the end of 2025, which reflects only 1.5x cuts in 2025.

The “hawkish” mean Fed funds rate projection was balanced out by dovish QT news. Beginning in April, the Federal Reserve will reduce the monthly runoff in US Treasuries from $25bn to $5bn. The monthly runoff of agency debt and MBS will remain at $35bn. In total, QT will slow from $60bn/month to $40bn/month.

I think this week’s FOMC was a non-event. The rate path is largely unchanged, risks to growth and inflation persist and the Federal Reserve board still has a dovish reaction function - especially with the White House targeting lower 10y yields. The reduction in QT was also expected.

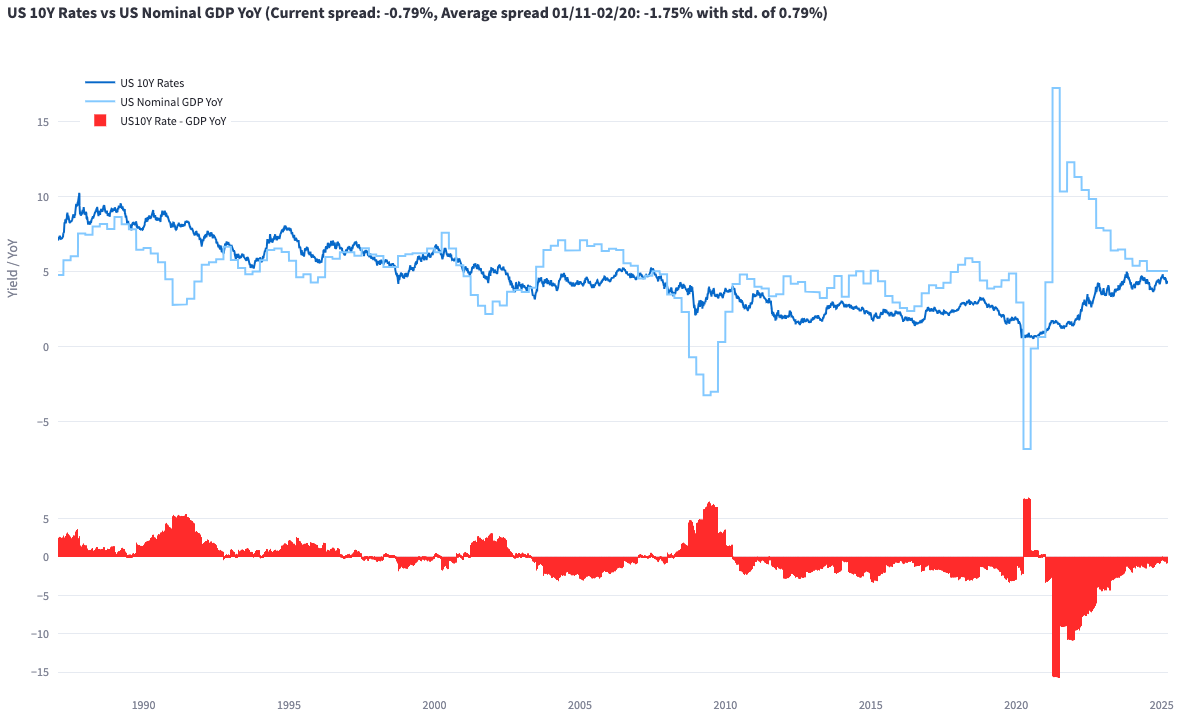

At the moment, I find it difficult to make a great bull or bear case for US rates. If growth slows significantly, let’s say nominal GDP growth falls to 3-4% and inflation converges towards 2%, US 10y yields should be lower. Take a look at the chart below, which compares nominal GDP growth to US 10y yields.

On the other hand, short-term inflation expectations are rising. If inflation re-accelerates, US 10y rates will likely sell off, i.e., US 10y yields will rise. I am still cautiously optimistic that inflation will fall to 2%. Real-time inflation proxies such as Truflation - in contrast to inflation swaps - point to lower inflation.

The below chart compares US CPI 3-month annualised to the 3-month change in US 5y yields. It shows that inflation has to come in lower in the next few months for US yields to continue to fall.

One potential risk for the long end of the curve is the crowded short positioning in crude oil. Despite OPEC+ announcing a supply increase, the oil price is trading above the level at the time of the announcement. If short positions unwind and oil prices rise, U.S. 10-year yields could move higher. If that scenario unfolds while growth continues to slow and inflation remains subdued, it could present a compelling buying opportunity for U.S. 10-year rates. (Chart below: U.S. 10-year futures.)

Idea generation - where could be the next trade?

I like George Soros’ approach of "invest first, investigate later”. Markets are moving fast and if you come up with a trade idea, you often do not have the time to research every detail before you put the trade on. I would treat the next paragraphs as “macro trade idea generation”.

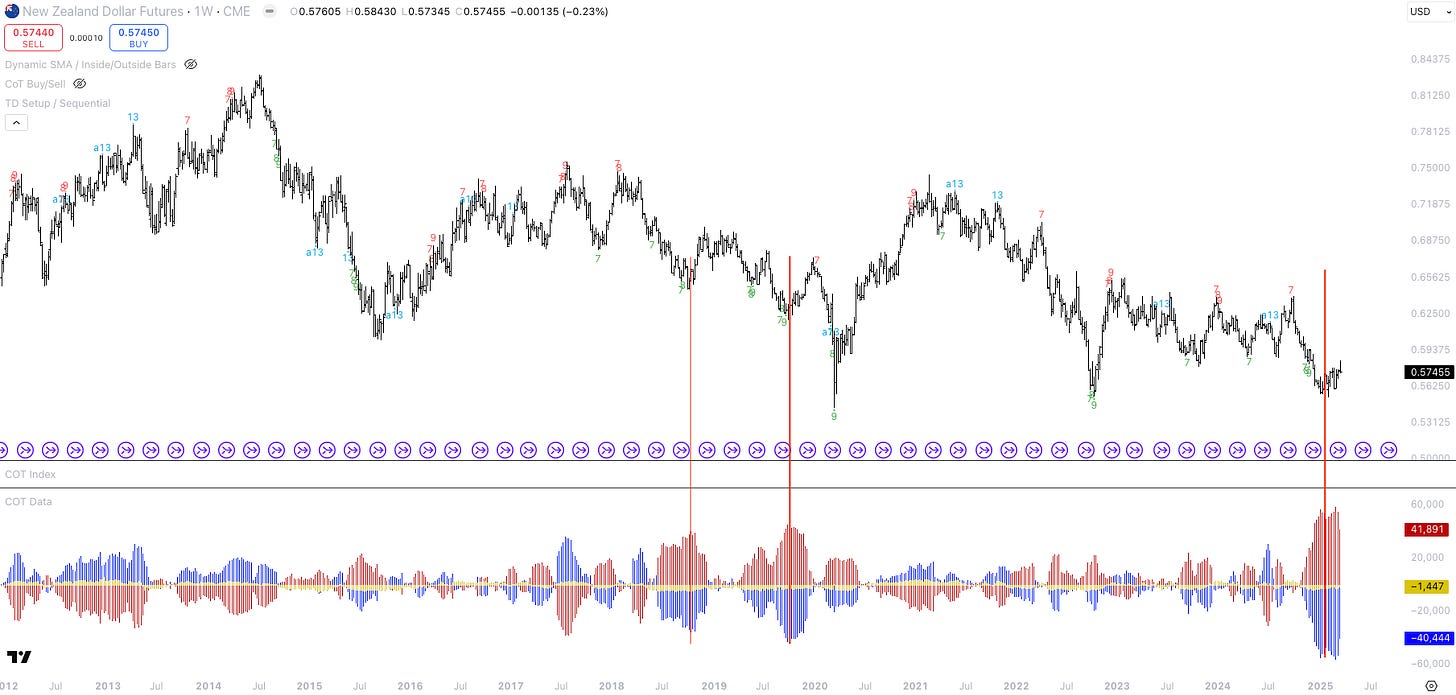

Idea 1 - Long NZD: New Zealand's economy is doing poorly. GDP contracted by 1.1% in the June 2024 quarter and by 1.0% in the September 2024 quarter. The latest GDP print on Wednesday came in above expectations, 0.7% QoQ vs. 0.4% expected. The stock market has done poorly in the past two months. However, TD13 and TD9 buy signals were triggered last week.

The combination of a possible stock market recovery and crowded short positioning in NZD could be a good risk reward to go long NZD. There is no NZD economic data coming out next week, which makes it difficult to gauge NZD’s price action. NZD sold off on the better than expected GDP numbers this week. If NZD rises on a day when the US dollar is trading strongly, i.e., other currencies are falling vs. the greenback, it could be interpreted as a correlation failure / entry signal.

Idea 2 - Long KWEB: Another idea I am currently thinking about is the Chinese tech sector (KWEB). After a one-year brutal bear market in 2021, three years of sideways action, the Chinese tech sector could be poised for a recovery. It feels like investor and economic sentiment around China is slowly improving. On the weekend, I read that some Chinese banks are offering consumer loans at 2.6% with approval times of below 60 seconds. That will certainly boost Chinese consumption, don’t you think?

Idea 3 - Short JPY: If the U.S. stock market rebounds in the coming weeks, the Japanese yen—typically a safe-haven asset—could underperform. Long JPY is a crowded macro trade, with widespread expectations of a stronger currency due to rising inflation and anticipated rate hikes from the Bank of Japan. However, when a macro view becomes consensus, the risk-reward often favours fading the trade rather than joining it late.

Idea 4 - Long US vs. European equities: And lastly, did you realise that the DAX was down 0.41% this week although the German fiscal package was approved? This could be a classic “buy the rumour, sell the news” event. The macro consensus seems to expect that Europe will continue to outperform the US. And yes, we could see better performance from European equity markets, but the structural problems in Europe have not been solved. Is it time to bet on the US outperforming Europe again? The below chart displays the DAX divided by the S&P 500.

Year-to-date, my trading portfolio is up 4.0%. On Monday, I put on a long S&P 500 position. That is the only position I have on right now. I put on the position because the stock market rallied despite weaker retail sales data and a weaker Empire State Mfg. Index. Multiple indicators that I track also pointed to a bounce in the stock market (see last week’s Substack).

I usually risk anywhere between 0.5-2.0% per trade. I should have winning trades on for two to three months. I try to identify reversals, i.e., I am not a trend follower. Right now, it feels like there are not many markets at big turning points, which is why I have to remain patient.

I hope you enjoyed this article. This is not investment advise and all views are my own. I write these articles because they help me to stay disciplined and transform my thoughts into actionable trade ideas. I always appreciate your feedback, likes and comments. Have a good one!