What this week's tariffs mean for equities and US yields

Trump started a large-scale trade war with allies and enemies. What does this mean for US equities and US yields?

What a week in financial markets! The S&P500 tanked and closed at 5074 points. Silver, copper and oil sold off hard. Bonds were bid with the US 10y yield dipping below 3.9%. The US dollar had one of its largest one-day declines on Thursday, but rebounded strongly on Friday. Bitcoin and Solana were celebrated for hanging in there during the week, but are selling off this weekend. Let’s try to understand what happened and what we can expect to happen in the future. Enjoy!

Trump is giving a masterclass in how to piss off your allies

Since the post-war era, the global economy has weathered numerous shocks - oil embargoes, financial crises, and pandemics. But few, if any, have been as self-inflicted as the one initiated by the Trump administration’s large-scale trade war, waged indiscriminately against both allies and rivals.

Tariffs are universally detrimental to global economic growth. When narrowly targeted and sector-specific, their impact may be contained. But under Trump, the U.S. implemented a weighted-average tariff rate exceeding 20% - a scale unprecedented since WW2.

Even countries that do not impose tariffs on the US goods now face a baseline tariff of 10%. The formula the Trump administration used to calculate tariffs other countries are supposedly imposing does not even reflect actual tariff rates and in many cases overstates the true cost of trade restrictions.

For example, according to Trump’s formula, the European Union charges a 39% tariff rate on US goods. Do you really think Meta, Amazon or Apple are facing 39% tariffs when they sell their products in Europe? They do not. Trump’s Liberation Day was equivalent to a trade war declaration. The logical consequence is retaliation.

In the United States, the tariffs are expected to lead to a 1.5% drag on US growth and a 1.0-2.0% rise in core PCE. PMIs are already reflecting the stagflationary outlook with employment and new orders falling and prices paid rising.

I am thinking of the trade war impact as follows:

Stubbornness: How stubborn will the US administration be? Will they listen to business leaders and countries to reduce the tariff burden again?

Retaliation: How much will countries retaliate? Can they afford to retaliate?

Escalation: Will the US administration escalate and increase tariffs even more if other countries retaliate?

I think the more time passes, the more the market will realise the US administration is not going to reverse tariffs quickly. The belief that tariffs might be reversed in the near future is the only reason why equities are not trading lower. But the Trump administration is not showing any willingness for compromises, negotiations or deals. Headlines from Thursday:

TRUMP ON MARKET REACTION: IT'S GOING VERY WELL

LUTNICK: NO CHANCE TRUMP WILL BACK OFF TARIFFS

The United States is in a position to keep tariffs higher for longer. I posted on X “Higher for longer applies to tariff rates now. Not US yields.” Of course, this depends on other countries’ reactions. But the US consumer market is the largest in the world - 21tn USD and 30% of global consumption. Other countries that sell their products in the United States are hit harder by US tariffs than the United States by retaliatory tariffs.

The drawdown in equities will be a drag on consumption. But if the drag is coming mainly from wealthy Americans, will the administration care? In his interview with Tucker Carlson, Scott Bessent pointed out that the top 10% of Americans own 88% of the stock market. The next 40% owns 12% of the stock market. The bottom 50% has debt. Right now, the administration is more concerned about the average American.

Many countries will retaliate in the coming weeks. The European Union, Canada, China and more. This is a lose-lose scenario. Canada already announced 25% tariffs on all vehicles imported from the US that are not compliant with the USMCA trade deal. China also retaliated and imposed a 34% tariff on all US goods imports (150bn USD).

Canada and Germany are planning on strengthening trade ties. The EU’s Trade Chief Sefcovic said the EU will diversify trade partnerships around the world. Mexico's President Sheinbaum said Mexico will diversify trade relations with other markets. Trump is giving a masterclass in “how to piss off your allies (and enemies)”. We are witnessing the restructuring of global trade.

In the current environment, if you are a long-only equities investor, your portfolio’s performance is mainly determined by Trump’s next decisions. Sky-high uncertainty. I wonder what is going to happen to Trump’s approval rating. Will he care because he wants to run a third time? Or will he ignore it and focus on executing his political agenda?

Equities - Where are we going from here?

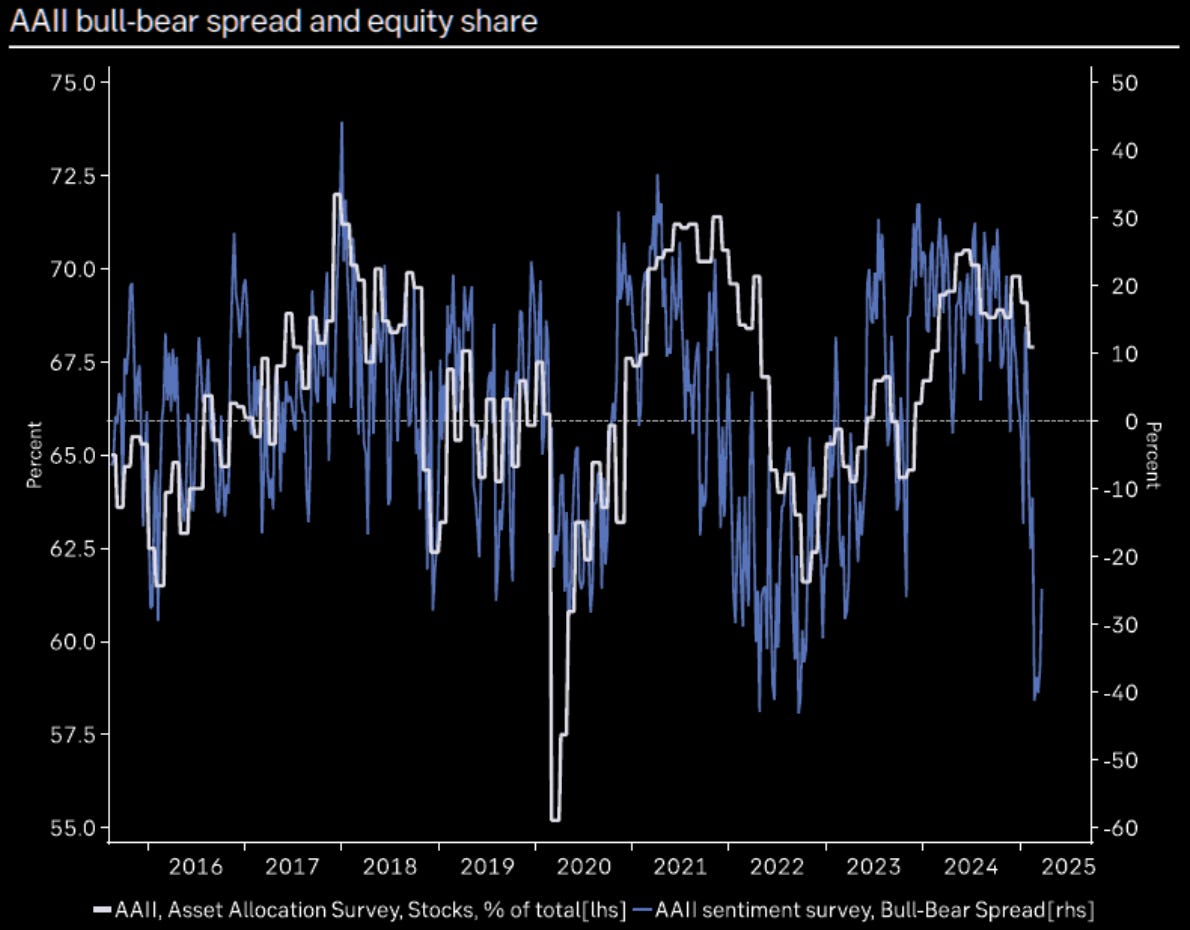

The Nasdaq-100 is down 20% and officially entered bear market territory. Sentiment surveys are screaming peak bearishness, but equity allocations are still high. Take a look at what retail investors said in the AAII investor sentiment survey (blue) versus what their positioning looks like (white).

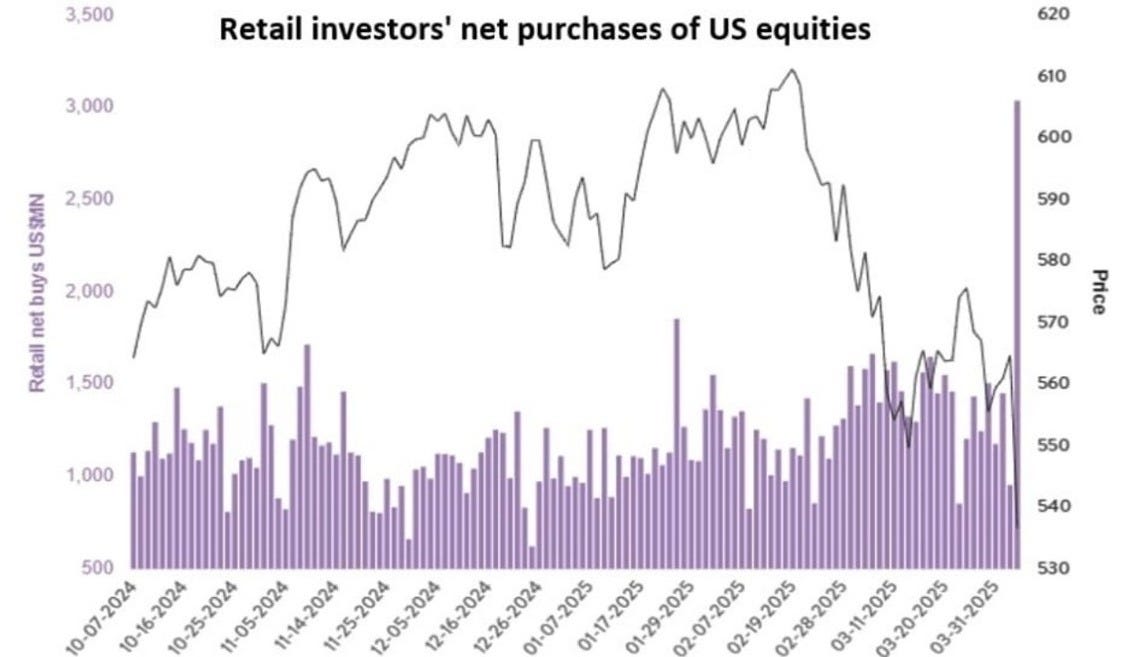

There is a big divergence between what institutional investors are doing and how retail investors are behaving. On Friday, Goldman Sachs reported that hedge funds sold global equities in the largest 1-day amount since 2010. On Thursday, JPMorgan reported retail investors bought 4.7bn USD in stocks - the largest level over the past decade.

Take a look at the below chart which displays retail investors’ net purchases of US equities. Does this look like capitulation to you? Not really.

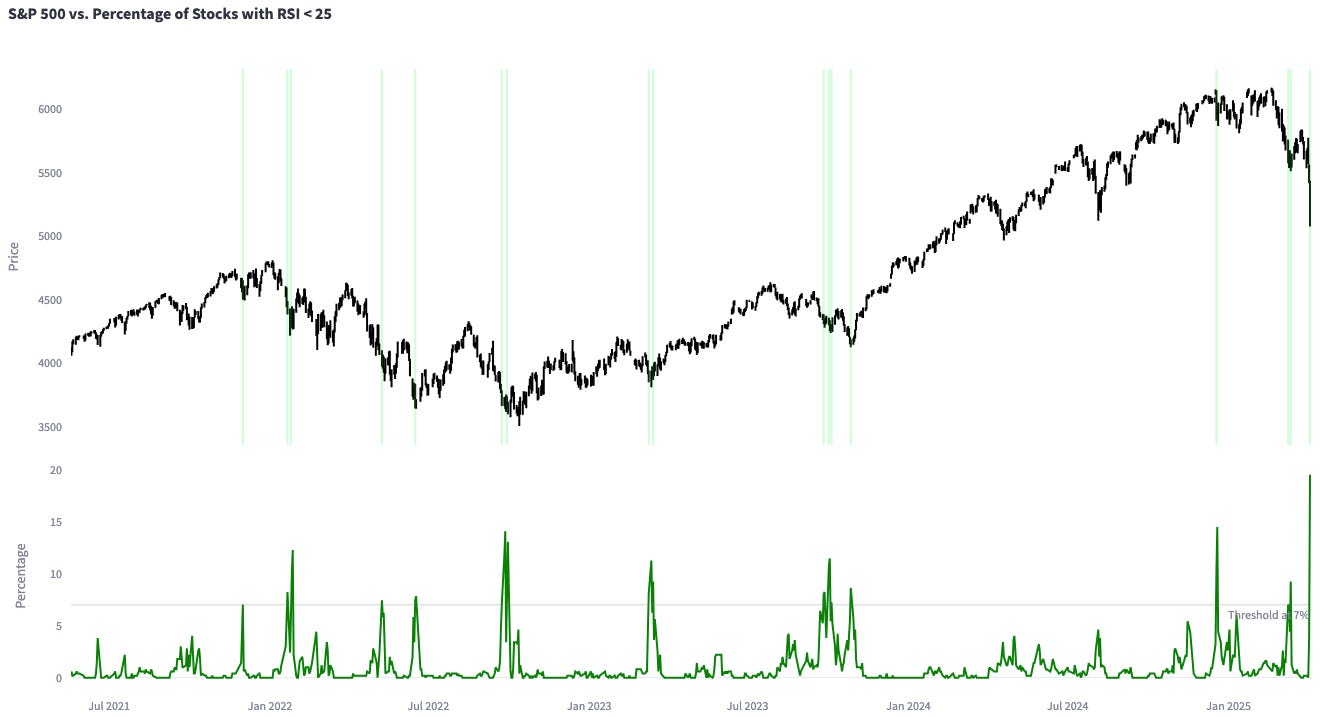

Retail investor behaviour suggests the bottom is not in yet. But that does not mean we cannot get a bounce from heavily oversold levels. S&P 500 stocks with RSIs below 25 spiked to the highest value since the beginning of 2021.

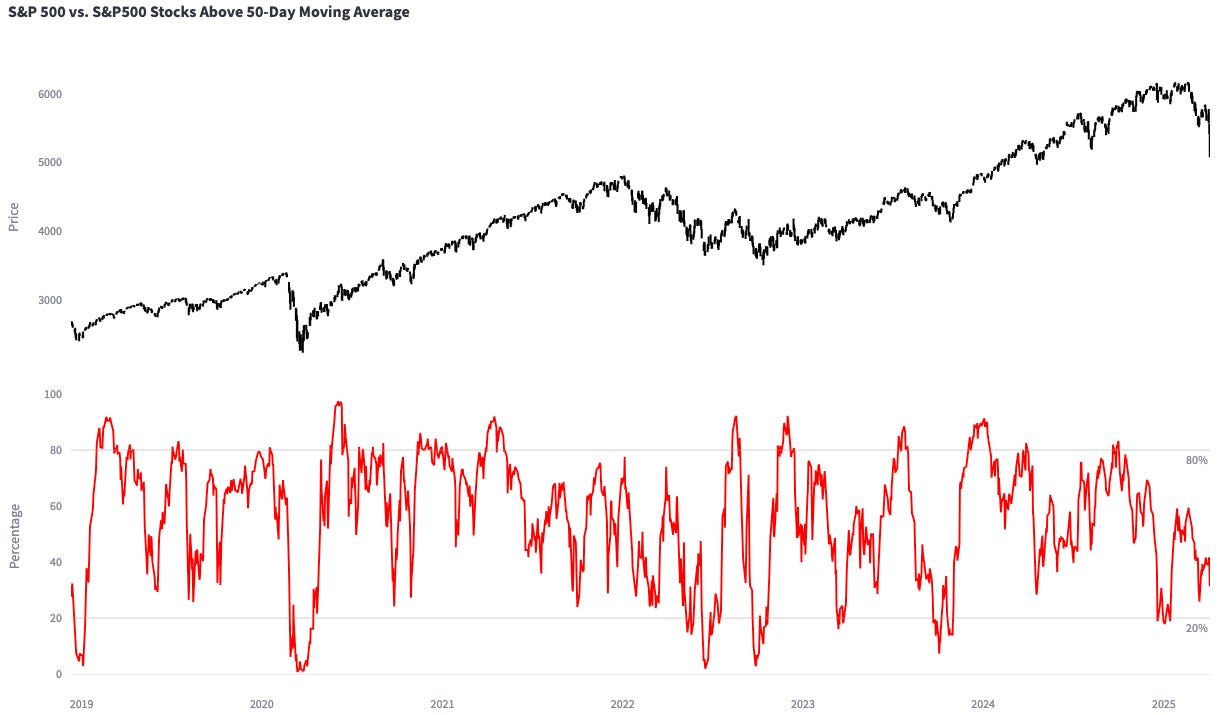

But S&P 500 stocks above their 50-day moving averages have not hit an extreme oversold level yet.

Warren Pies posted an interesting statistic on X earlier this week. In the United States, the most significant tax deadline is April 15, which is the due date for filing individual federal income tax returns. If the S&P500 increased by more than 20% in the previous year - which it did last year - tax payments tend to lead outflows and negative seasonality prior to April 15. Seasonality is not a positive factor either - that was new information for me.

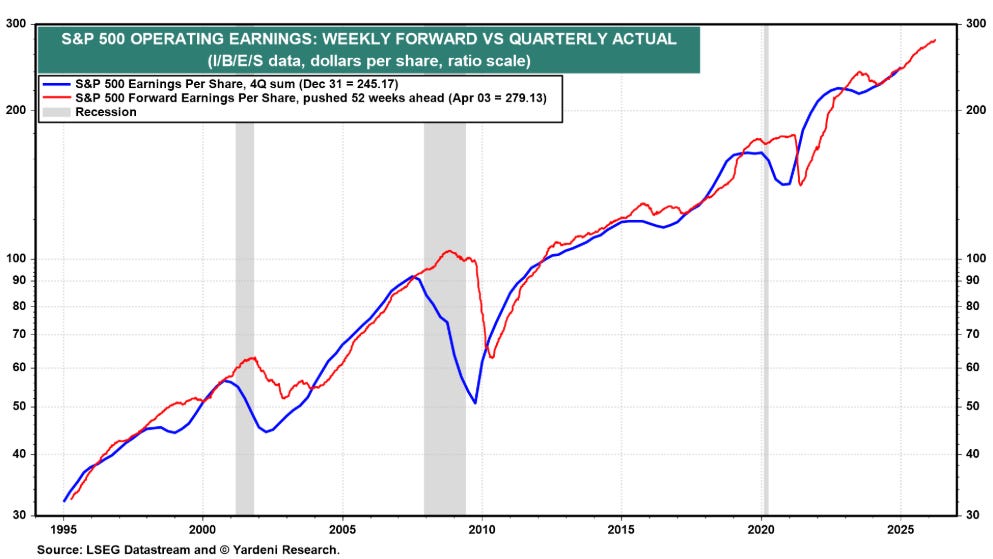

S&P 500 earnings expectations have not come down yet. Analysts are still expecting record-high earnings per share in the next 12 months (279 USD per share).

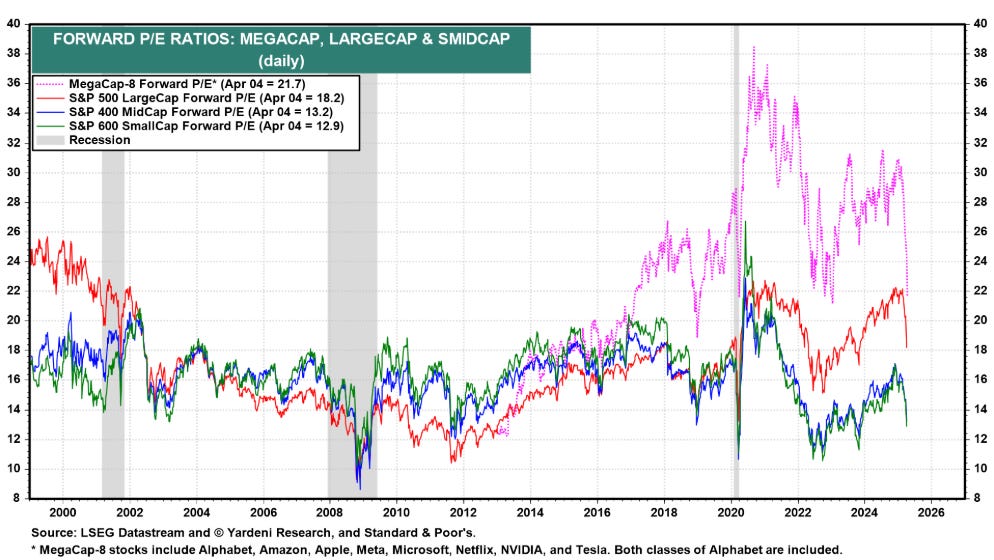

The S&P500 is trading at a forward multiple of 18.2x. If forward EPS come down to 265 USD per share (from 279 USD per share) and forward PEs reach 17x (2022 lows: 16x), the S&P500 would bottom at 4.500. That implies roughly 10% downside from current levels. By the way, Mag-7 forward PEs have already reached the 2022 lows.

Last week, I wrote equities could bounce if reciprocal tariffs come in lower than expected. But the Trump administration doubled down - higher tariffs across the board. This means, unless the administration pulls a complete 180, the bull case for equities looks shaky.

Still, as a long-term, long-only investor, now’s a decent time to slowly start putting cash to work. If you wear bearish at the beginning of the year, you should probably be “neutral” now. “Time in the market beats timing the market” isn’t just a cliché - it’s reality for most. Even if you expect more selling ahead - and I do - this is a solid time to start buying equities.

For tactical traders with a shorter horizon, playing the next bounce could make sense - but don’t confuse it with catching a falling knife. Look for divergences first: volatility markets hinting the panic’s peaked, or negative news (like new tariffs from Trump in response to retaliatory tariffs) failing to spark fresh sell-offs. Right now, I do not see any positive divergences.

Bonds - Will yields continue to fall?

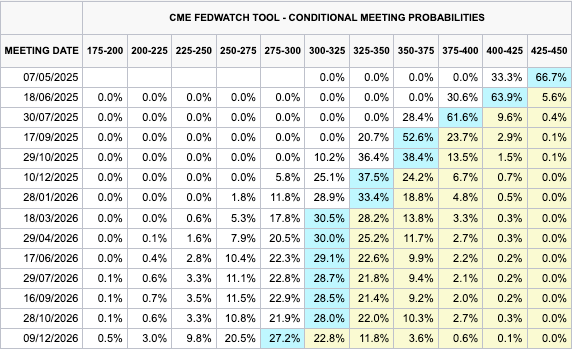

The bond market is focused on growth prospects right now. The short-end is pricing 4.5x cuts in 2025, which is close to recessionary pricing. If tariffs stay in place, and the United States enters a recession, four cuts could materialise. As of now, I do not expect the United States to enter a recession, but GDP growth of 0.0-1.0% in 2025.

The Federal Reserve is facing a dilemma. Tariffs will lead to lower growth, higher unemployment and higher inflation. The big question is whether tariffs will have a persistent or transitory impact on inflation. If companies continue to increase prices by 5.0%/year such as in the past two years - instead of 2.0%/year pre-covid - tariffs could have a long-lasting impact.

Friday’s strong NFP report suggests the Federal Reserve will be more worried about inflation than employment now. The report certainly made it easier for the Federal Reserve to argue in that direction. NFPs came in a 228k vs. 140k expected. Private payrolls printed 209k vs. 135k expected. The unemployment rate increased by 0.1% to 4.2%.

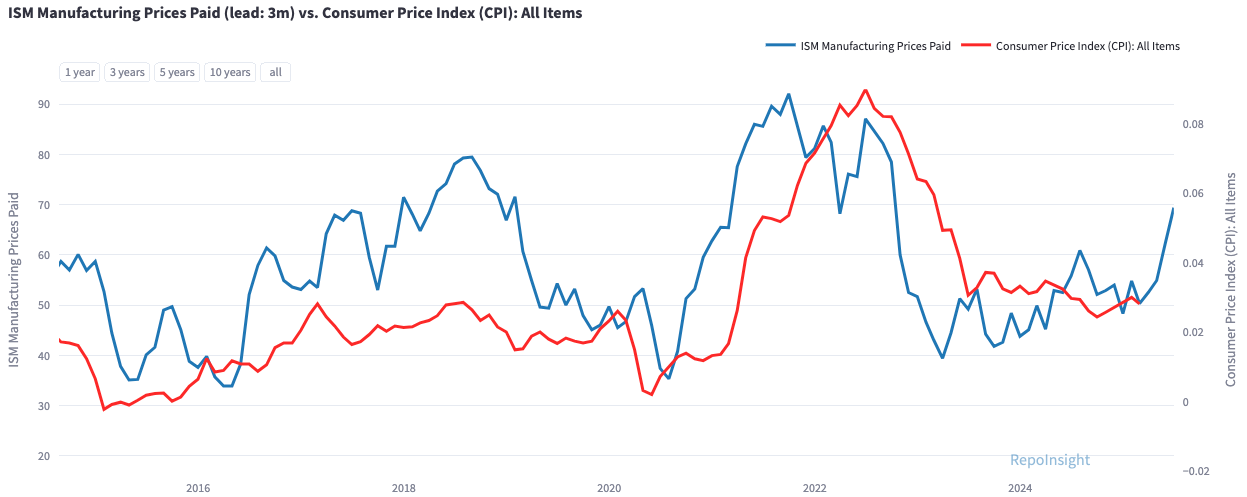

While the labor market signals strength, inflation survey data has come in hotter. For example, Tuesday’s ISM Mfg. Prices Paid came in significantly higher, 69.4 vs. 64.6 expected. While this does not guarantee inflation will surge, it sharply underscores the risk of re-acceleration ahead.

The economy has changed post-covid. Companies know they can increase prices by more than 2.0%/year now. If the Federal Reserve cuts rates too fast and inflation re-accelerates, it will be difficult to contain it. And in the process, the Federal Reserve’s credibility would be seriously undermined.

Powell said on Friday: “Our obligation is to keep longer-term inflation expectations well anchored and to make certain that a one-time increase in the price level does not become an ongoing inflation problem.”

If the US economy remains somewhat steady, but inflation stabilises or re-accelerates from here, SOFR December 2025 futures are a short. Not because I think four cuts could not materialise - they could - but I do not think five or six cuts will materialise. The risk-reward to bet on only two or three cuts in 2025 looks favourable.

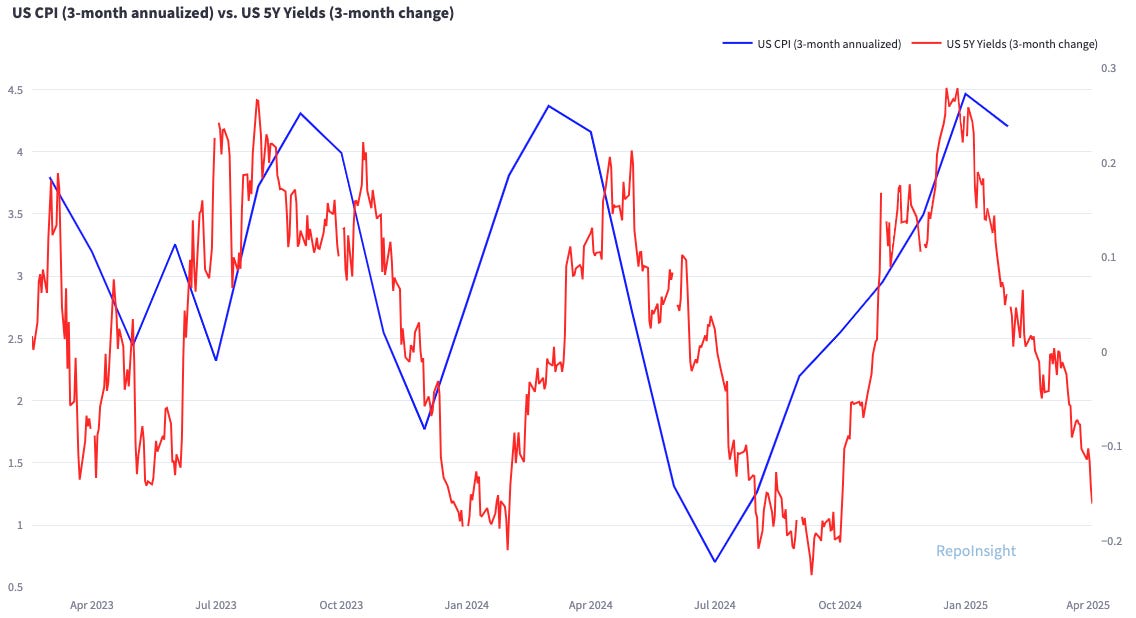

The belly of the curve (5Y sector) is pricing a significant slowdown of the economy and no risk of a re-acceleration of inflation. Just take a look at the following chart, which shows the US CPI 3-month annualised versus the 3-month change in US 5y yields. If we get one or two hot inflation reports, US rates will probably sell off.

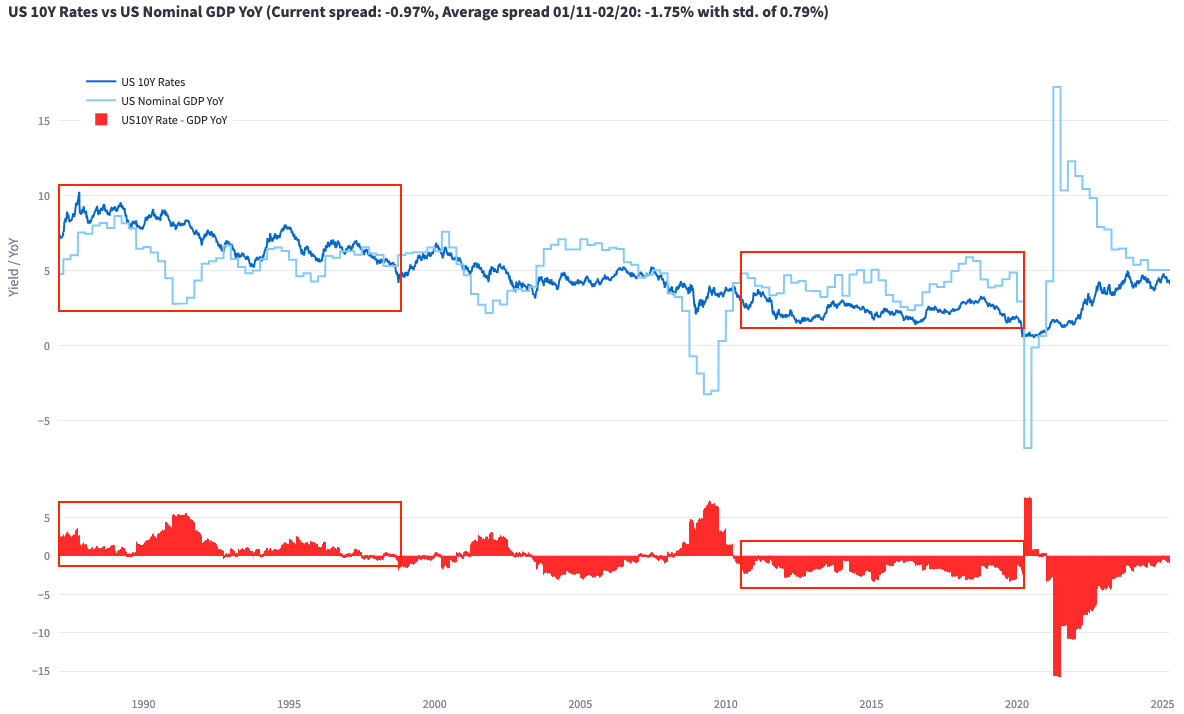

From January 2011 to February 2020, the US 10y yield traded on average 1.75% below nominal GDP growth. If nominal GDP growth slows to 3.0%, this would imply a significantly lower US 10y yield. However, we are not in a QE and zero interest rate environment anymore. The Federal Reserve is a net seller of US Treasuries and the Fed funds rate is at 4.33%. In the pre-2000 era, the US 10y yield traded above nominal GDP growth most of the time (see chart below).

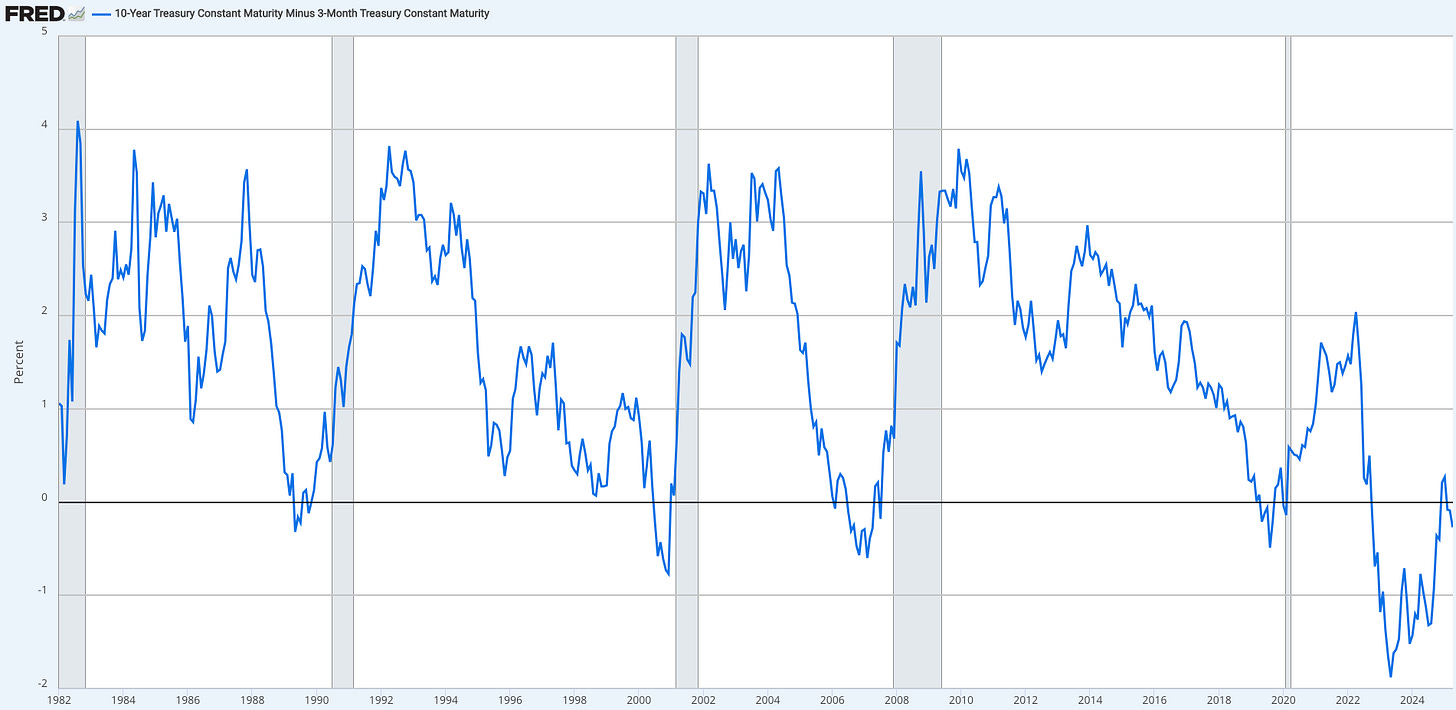

Since 1982, the average spread between 10y yield and 3-month yield was 1.57%. Even if the Federal Reserve cuts interest rates four times in 2025 and the 3-month yield falls from 4.27% to 3.20%, the implied US 10y yield would be above 4.50% (now: 4.00%). Even if you think the spread is lower now, e.g., 0.5-1.0%, US 10y yields look fairly valued, but not like a screaming buy.

The risk-reward to go long US 10y is not great. You would be betting on complete economic carnage and a recession. Right now, my base case is that the US economy will be able to avoid a recession in 2025. On Friday, the US 10y yield fell to 3.86%, but reversed most of the move intraday and closed at 4.0%.

I hope you enjoyed this article. This is not investment advise and all views are my own. I write these articles because they help me to stay disciplined and transform my thoughts into actionable trade ideas. I always appreciate your feedback, likes and comments.

In my trading account, I will stay on the sidelines. I am up a little under 4.0% YTD, which I am very happy with. I will probably try to play a bounce in equities, but I do not see any signs of this sell off ending yet.

Have a good one!

Thanks for sharing Mr. Repo, amazing clarity as always!

Great post! Let me know if I can ever invite you on my podcast to talk macro: https://www.youtube.com/@lessnoisemoresignalpodcast