Trump, Tariffs, and Terminal Rates: A Playbook for Pressuring the Fed

How Trump is challenging the Federal Reserve’s independence, why yield curve steepening may be next, and what keeps equity markets resilient.

Hi everyone,

This week’s article will be a bit shorter than usual - I’m away on a weekend trip and couldn’t carve out time for the full five-section deep dive. Today’s piece will focus on:

Chart of the Week

Fixed Income: Trump is bullying the Federal Reserve

Equities: What will happen on July 9th?

FX: The US dollar cannot catch a bid

Where is the next trade?

As always, if you find these write-ups helpful, I’d really appreciate it if you shared them, forwarded them to a friend, or posted them on X. It keeps me motivated to keep doing the work and putting these out regularly. Let’s jump in!

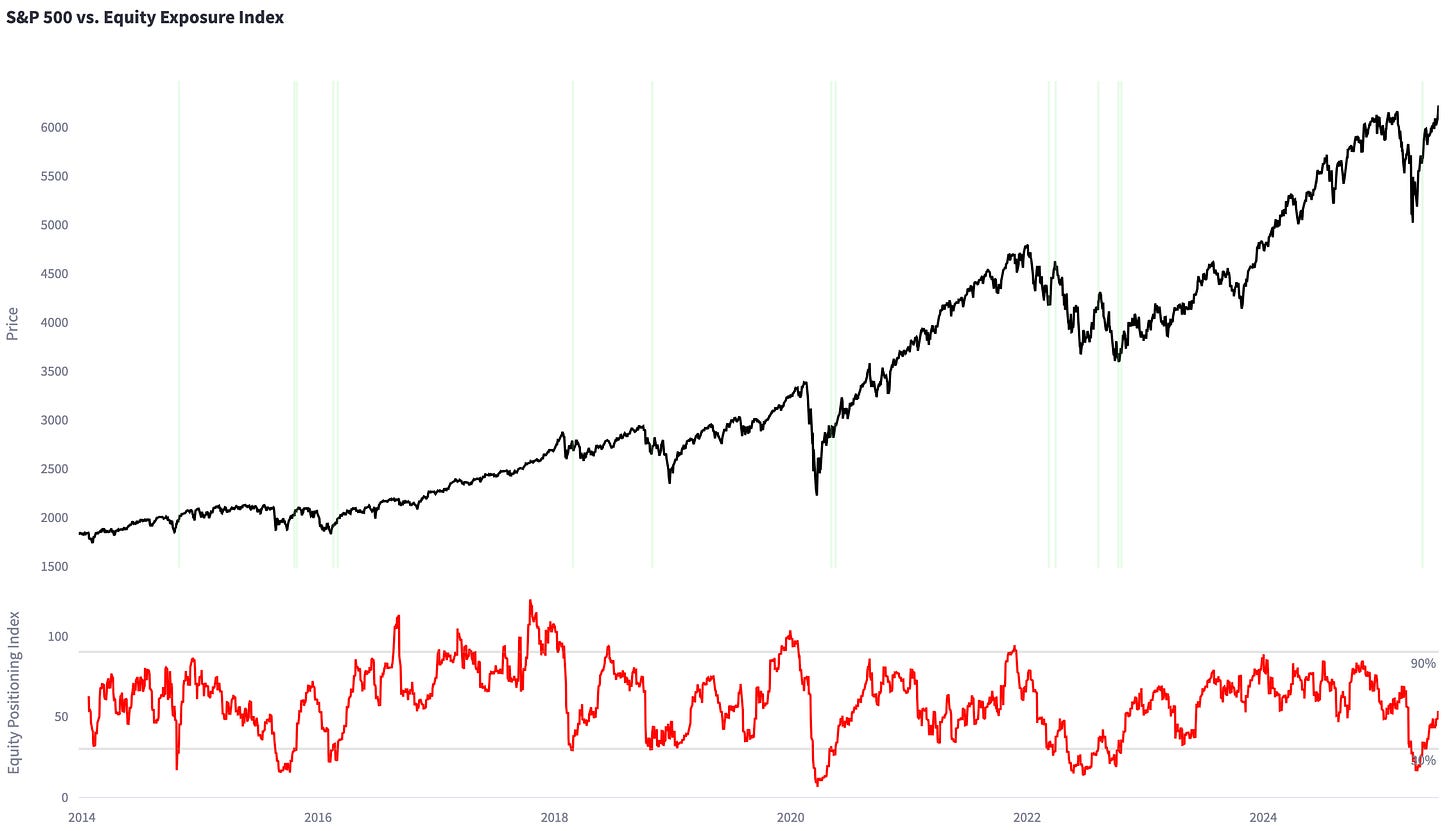

Chart of the Week: Back To Neutral Equity Positioning

I calculated an “Equity Positioning Index”, which combines equity futures positioning, the NAAIM index, and vol-targeting equity allocations. Based on the three factors, equity positioning is “neutral”. But flows in the near-term, such as buying from underperforming active managers that chase the benchmark higher, buybacks and buying from retail, will likely continue to be supportive for equities. I remain long S&P500 futures.

Fixed Income: Trump Is Bullying the Federal Reserve

The big story in markets is Trump bullying the Federal Reserve into cutting rates. Trump already said that he has 3-4 candidates in mind to become Jerome Powell’s successor. Interviews have begun. And Trump is not hiding what he is looking for in candidates: "I'm going to put somebody that wants to cut rates.”

Trump does not seem to realise that he is playing with fire. The United States is the most financialized economy in the world. The US government debt market is the most liquid bond market in the world. The U.S. cannot behave like an emerging market - where central banks serve political leaders rather than operate independently.

There is a reason why central banks are independent: to avoid conflicts of interest. If the government can set interest rates at 0% to fund excessive fiscal spending, the government would be essentially buying votes without having to deal with the consequences, such as 1) inflation, 2) worse credit ratings or 3) higher long-term interest rates.

Trump believes rates should be closer to 1%, and with the Fed Chair position up for grabs, some FOMC members may already be angling for the job. Don’t be surprised if a few of them start sounding more dovish in public - it could be less about the data and more about their career prospects. Say tariffs aren’t inflationary, downplay upside risks - and maybe, you’re in line for the top job.

As a result, the internal dynamics of the FOMC could shift. Powell may lose influence long before he formally exits. And whoever is perceived as most likely to succeed him may see their views gain weight in the near term.

The Federal Reserve losing its independence speaks for STIR to reprice lower. The terminal rate (SOFR December 2028) is still pricing 3.45% - much higher than Trump’s preferred 1%. Last week’s idea of betting on the terminal rate moving lower by getting long SOFR December 2028 futures is off to a great start.

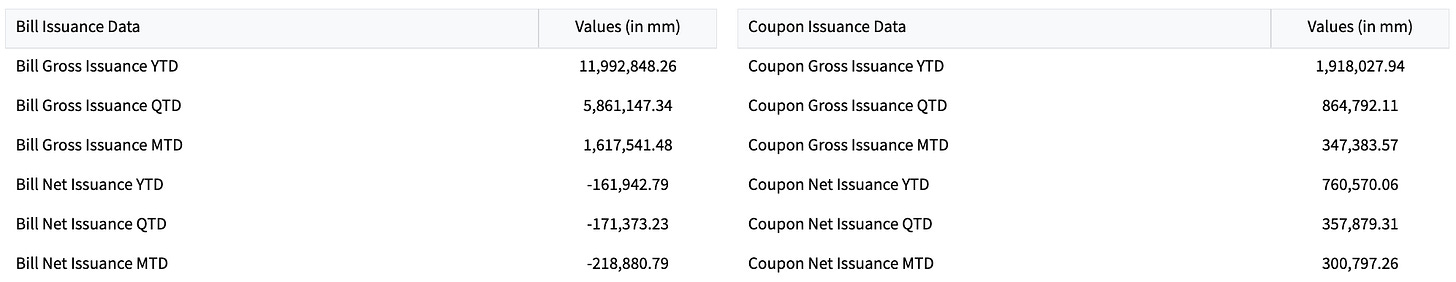

Trump also made a very interesting comment about the Treasury’s issuance schedule. He said that he instructed the Treasury not to issue debt with a maturity above 9 months. I am not sure this claim is trustworthy because it would result in the cancellation of 3.3tn USD in coupon auctions. Year-to-date, the US Treasury’s net issuance of bills is -162bn USD and of coupons 760bn USD.

If the Treasury pivots toward issuing mostly bills, the effects would resemble quantitative easing The buyer of long-dated US debt (“coupons”) has to buy something else, e.g., IG credit. The seller of IG credit might now buy HY credit. The seller of HY credit might now buy equities, etc. Everyone will move further out the risk curve.

If the Treasury decides to issue more bills and less coupons, financial conditions would ease. Coupon issuance means the private sector has to absorb duration - or “interest rate risk”. If there is less duration to absorb, the demand or availability for leverage increases. That means risk assets increase in price, which ultimately results in goods inflation.

Next week, we will find out whether Trump was serious about his statement regarding the Treasury’s issuance calendar. If the Treasury reduces coupon auction sizes, it will be interesting to see how the bond market reacts. My best guess is that 30y yields would rise because growth & inflation reprice higher. That would be the ultimate catalyst for yield curve steepening.

Equities: What Will Happen on July 9th?

Let’s focus on equities. There are a few factors that are making me (more) nervous:

The July 9th tariff deadline

Trump challenging the Federal Reserve’s independence

High(er) equity valuations

Back to neutral equity positioning

Despite the above, equities have traded remarkably well last week. Earnings expectations have risen to new highs and the S&P500 reached a new all-time high this week (see below). Maybe it is a good sign that equities continue to trade so well despite all the bearish headlines.

There are also several factors that continue to be supportive for equities:

The OBBB advanced in the Senate. Increased fiscal spending is bullish risk assets.

Trump is bullying the Federal Reserve into interest rate cuts.

AI is booming - NVIDIA has reached a new all-time high this week.

The SLR reform is coming, which will be positive risk assets.

Flows will likely remain supportive, in particular from retail and buybacks.

The European/German economy could re-accelerate in 2026 due to fiscal stimulus.

I remain long S&P500 futures. But in contrast to my long-term investment account, in which I am long equities at all times, I might cut my exposure sooner than expected.

FX: The US Dollar Cannot Catch A Bid

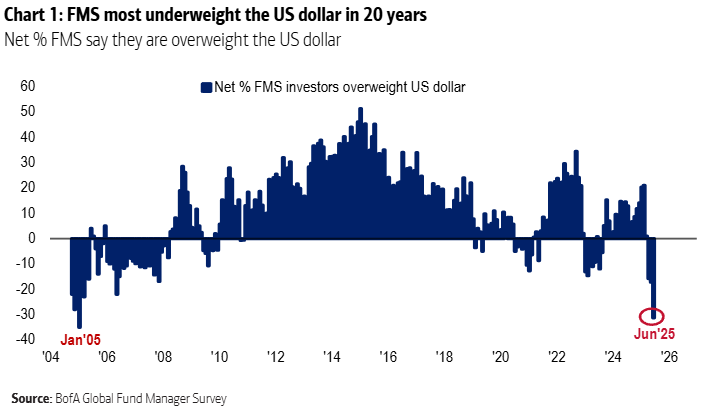

The “US dollar reversal trade” is frustrating. I converted the US dollars in my EUR-denominated trading account back into Euros on Wednesday. It’s annoying that I am cannot buy USD vs JPY - that was my main trade idea in the last two months. Currently, my only options are to convert EUR cash into USD cash or buy the US dollar index. So far, getting long USD cash has lost me roughly 1.5% (YTD: 7.3%).

The best catalyst to get long US dollars would be weak economic data such as a recessionary labor market report, but the US dollar closes up on the day. But as long as we don’t get such price action, I will remain on the sidelines. US dollar positioning remains crowded short - not only based on the CoT data, but also according to BofA’s fund manager survey.

Where Is the Next Trade?

In fixed income, my main view is that terminal rate pricing will move lower as Trump is bullying the Federal Reserve into cutting rates while the US economy is slowing down. One way to play this is to get long SOFR Dec 2028 futures.

In the currency space, I am looking to get long USD versus either CAD or CHF. The Canadian economy is doing poorly and the SNB has already lowered rates to 0%. Positioning is much more long CAD and CHF than it was just a few weeks ago.

I am also looking at silver and platinum. Both metals have rallied a lot in the past few weeks and positioning is getting crowded long. Short silver or platinum could be a good hedge for long S&P500 contracts. The 30-day correlation between the S&P500 and silver is 0.7 and between the S&P500 and platinum is 0.88.

I hope you enjoyed this article. This is not investment advise and all views are my own. I write these articles because they help me to stay disciplined and transform my thoughts into actionable trade ideas. I always appreciate your feedback, likes and comments!