The Great Decoupling: Is US Dollar Sentiment Too Bearish?

Rising Yields, Falling Dollar - When Correlations Break and Opportunity Emerges

Hi everyone,

This article is structured in five parts:

Chart of the Week

The Economy

Views on Markets and Trade Ideas

Positioning Update

Closing Thoughts / Outlook

These write-ups take a lot of time and effort to put together, so if you find them helpful, I’d really appreciate it if you shared them, forwarded them to a friend, or posted them on X. It keeps me motivated to keep doing the work and putting these pieces out regularly. Having said that, let’s dive right in!

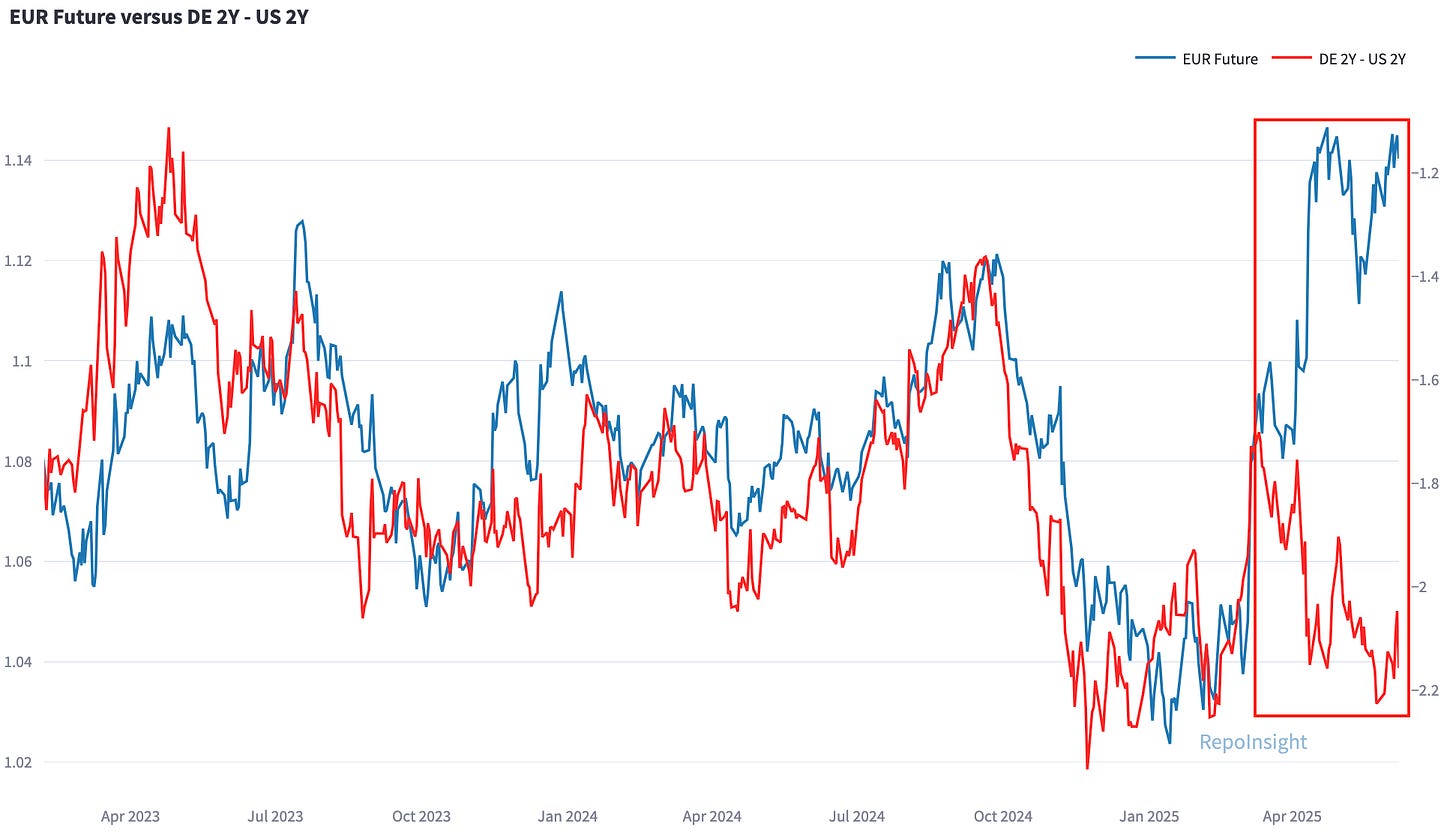

1. Chart of the Week: The Great Decoupling

Rising US yields typically support the US dollar. But when fiscal concerns dominate, higher yields can coincide with a weaker dollar - breaking historical correlations. That’s exactly what we’ve seen recently. Sentiment and positioning are skewed bearish the US dollar. But with yield differentials unlikely to weaken further, the dollar could be poised for a rebound. Add in the potential for positive US economic surprises, and the risk-reward for USD longs looks attractive again. I am waiting for an entry signal.

2. Macro Pulse: Slowing… But Ripe for Upside Surprises

Before diving into asset markets, a quick scan of recent economic data:

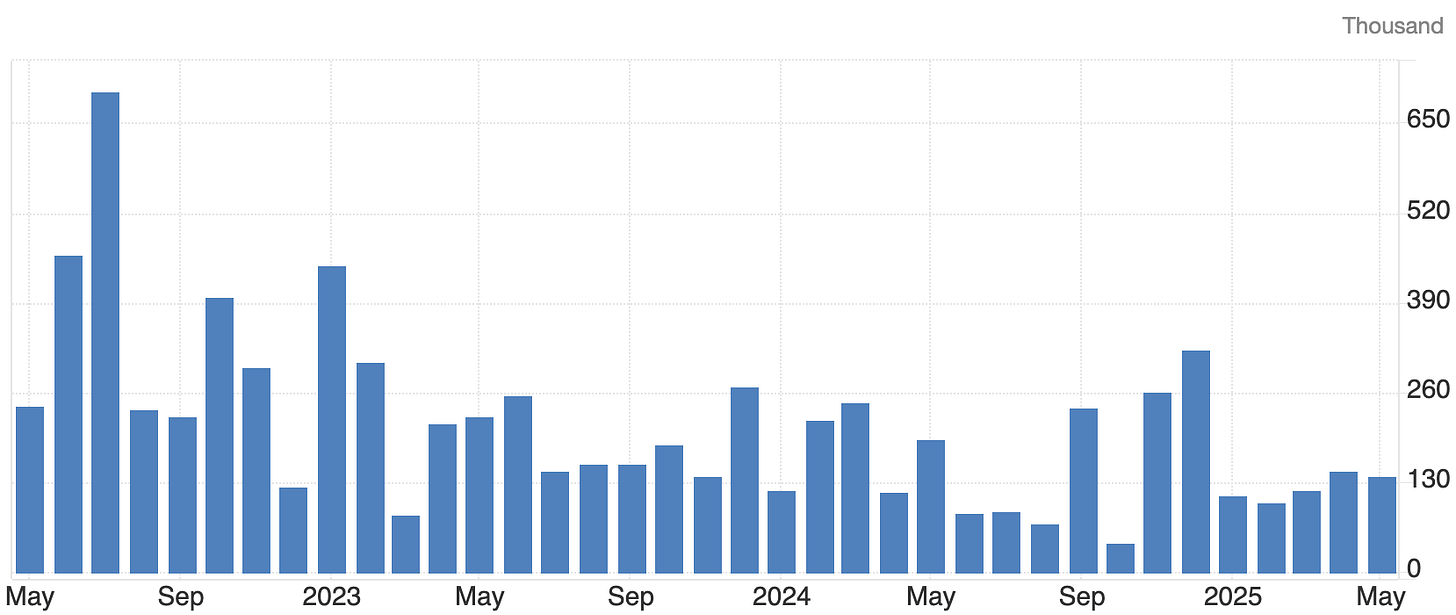

ADP Payrolls came in soft at 37k vs. 114k expected - fuelling slowdown fears early in the week.

But Friday’s NFP reversed that narrative: 139k jobs vs. 126k expected (see below), with private payrolls beating at 140k vs. 120k.

The labor market is cooling - but not cracking. A key reason: reduced immigration has slowed labor force growth. With fewer people entering the workforce, fewer jobs are needed to keep the unemployment rate stable.

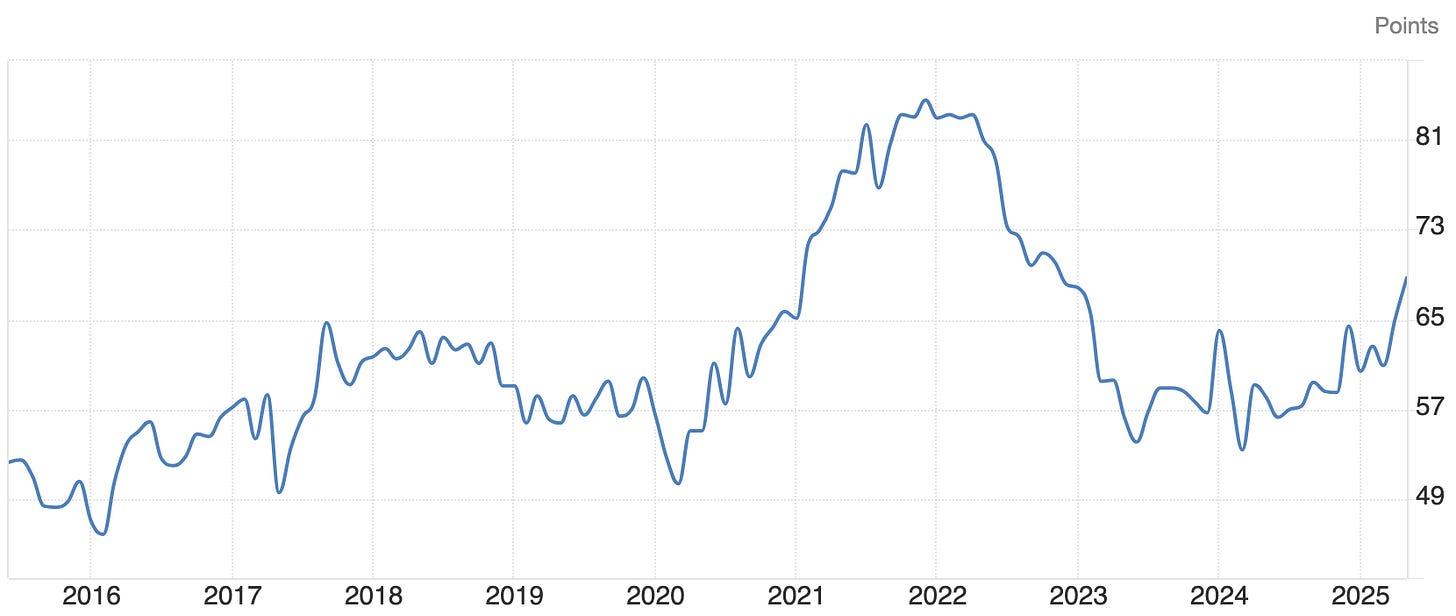

ISM Services data painted a stagflationary picture:

Headline: 49.9 vs. 52 expected (soft)

New Orders: 46.4 vs. 51.6 (very weak)

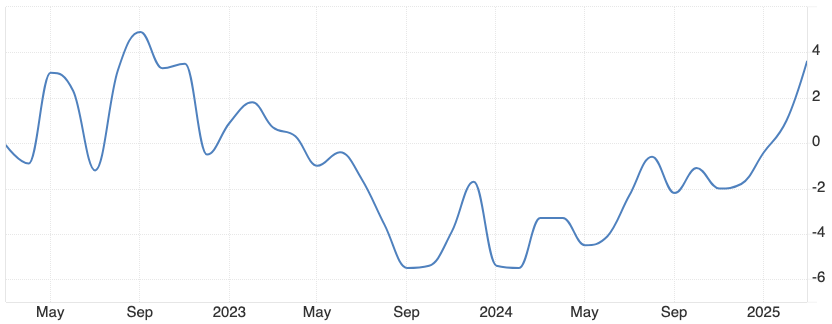

Prices Paid (see chart below): 68.7 vs. 65.1 (hot)

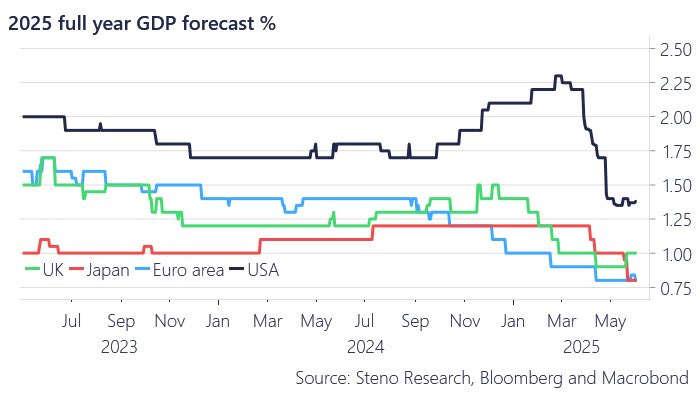

The ISM Services data suggests a slowdown. But most of the hard data is still consistent with ~1–2% GDP growth, not a contraction. Meanwhile, consensus growth forecasts for developed markets are now much lower:

Eurozone, UK, Japan: 0.75–1.0%

US: 1.25–1.5%

Source: Andreas Steno on X

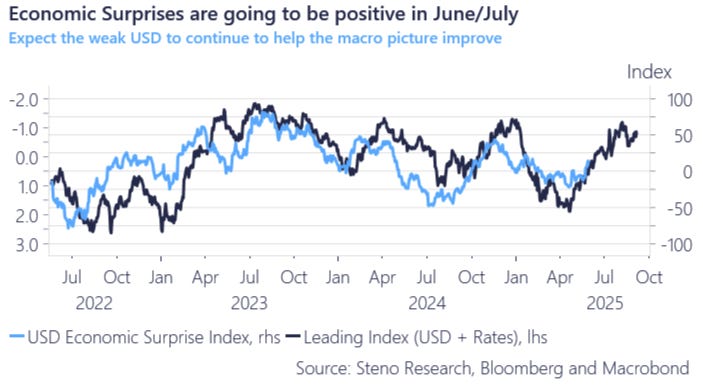

With expectations depressed, the bar for upside surprises is low(er) - and historically, a weaker dollar has often preceded just that. A weaker US dollar means financial conditions are easing and positive economic surprises are more likely to follow.

Source: Andreas Steno on X

3. Risk Assets Rundown: Dollar Strength & the Flattening Risk

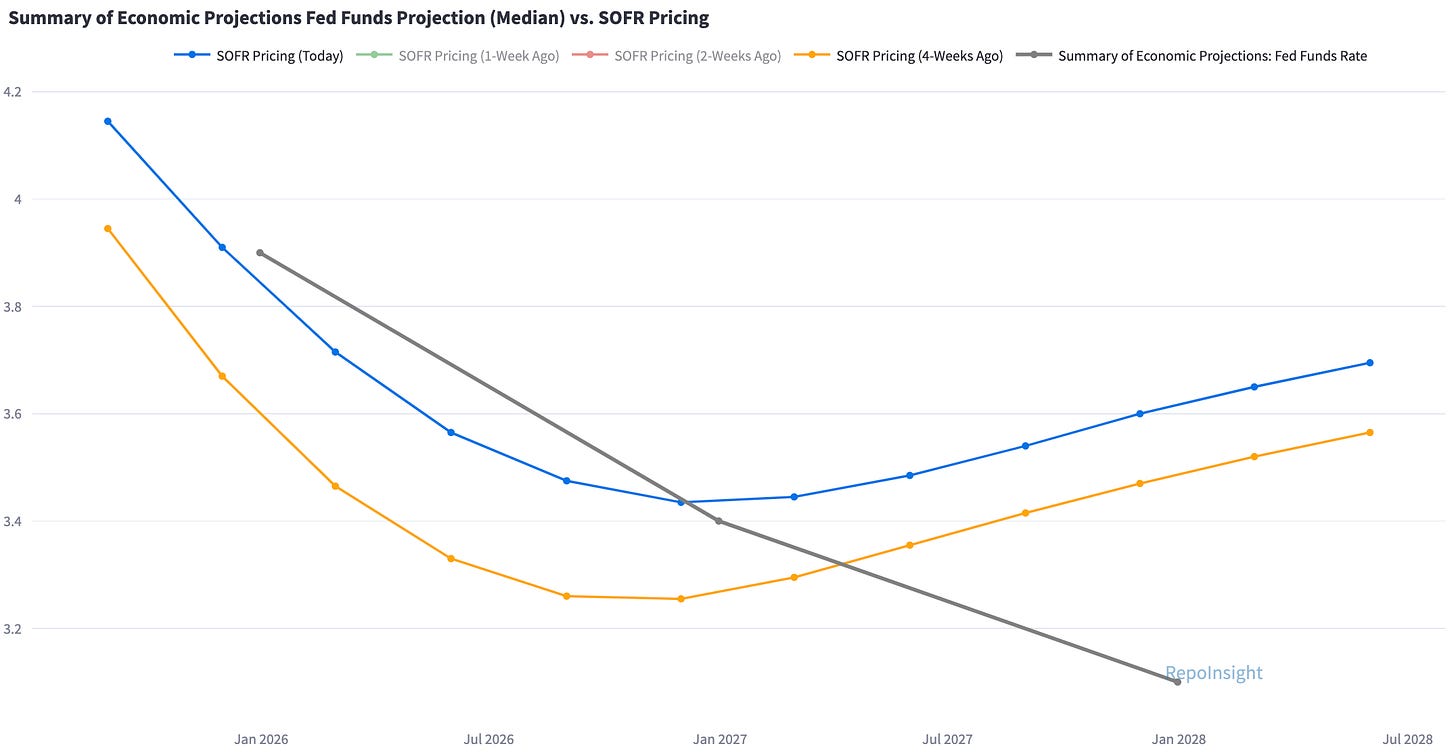

STIR pricing seems to be slightly dovish. Inflation is likely to stabilise or even re-accelerate from here, the unemployment rate is at historic lows and the economy is expected to grow at 1-1.5% p.a in 2025. Markets are still pricing 2 cuts in 2025, while the Fed’s March SEP projects a slower path.

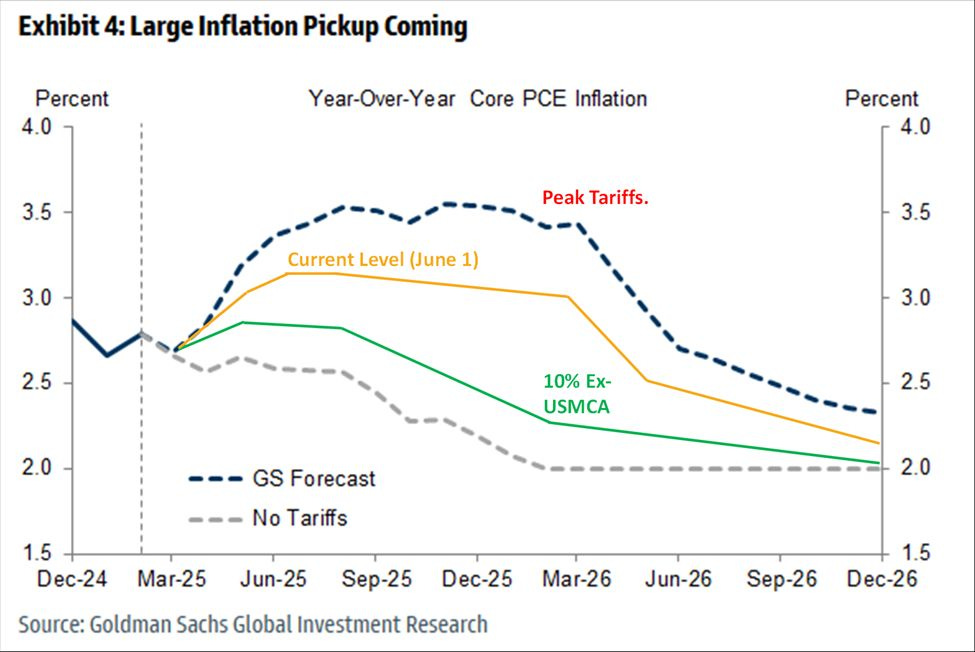

In light of ISM Services Prices Paid coming in higher than expected and tariff risks looming, a “no cuts” scenario in 2025 is becoming more likely. The below chart shows Goldman Sachs’ core PCE forecast, which projects a significant re-acceleration in core PCE from here.

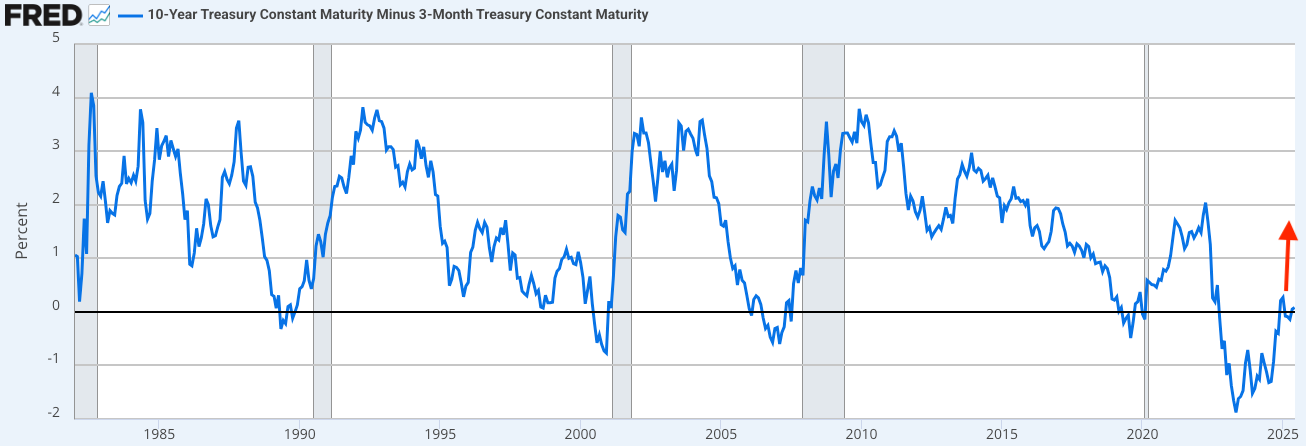

On the Long-End: Where to for 10-30Y Yields? In my opinion, this is a much more difficult question to figure out. Fiscal deficits and consistently higher inflation call for higher 10-30 year yields. With the Federal Reserve less likely to cut interest rates and the 3m10y spread depressed in a historical context (see below), it feels like the 10-year yield should be higher than 4.50%.

Last week’s price action was not encouraging with a US bonds selling off after Friday’s better than expected NFP numbers.

Yield curve steepener trades have worked well in recent months (see below 5y30y), but I think the pain trade in fixed income could be “bear flattening”, i.e., higher yields across the curve but front-end yields rise more than long-end yields. Should the short-end reprice higher, e.g., zero or one cut in 2025, but the long-end remains pinned as real money (pensions, insurers) buy ~5% yields, the trade could work out.

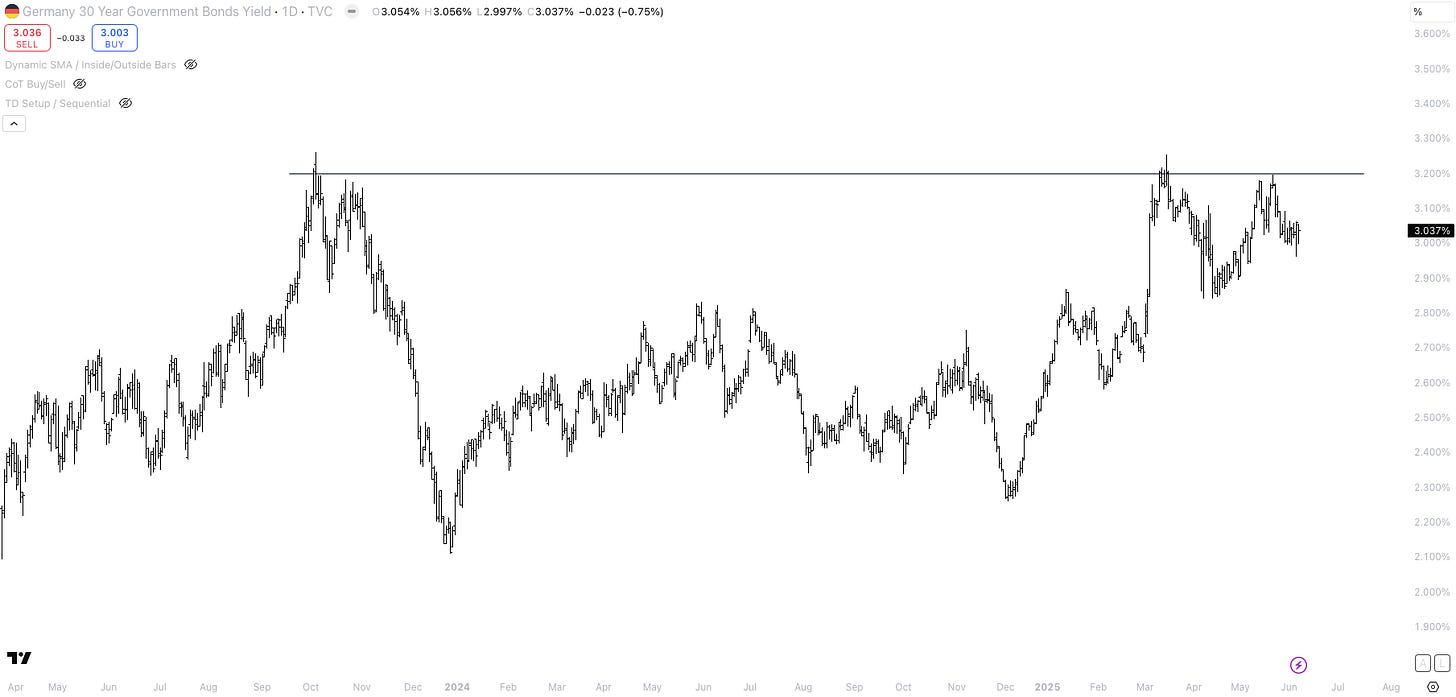

If you are looking to short the long-end (somewhere), the risk/reward in Germany could be more attractive than shorting the long-end in the United States. German 30-year yields have fallen from 3.20% (area of resistance) back to 3%.

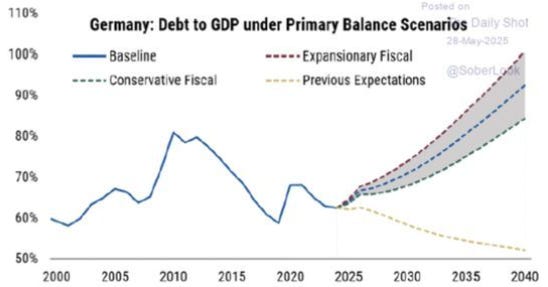

But the fiscal trajectory in Germany has changed dramatically. For the first time since the GFC, Germany will ramp up net issuance.

Add in that European industrial production might have bottomed (see chart below) and that increased fiscal stimulus will likely lead to higher economic growth and inflation, and long-term interest rates look too low.

The short-end could already be sniffing out that European interest rates will rise. Euribor futures are pricing in 12.5bps in hikes between December 2025 and December 2026.

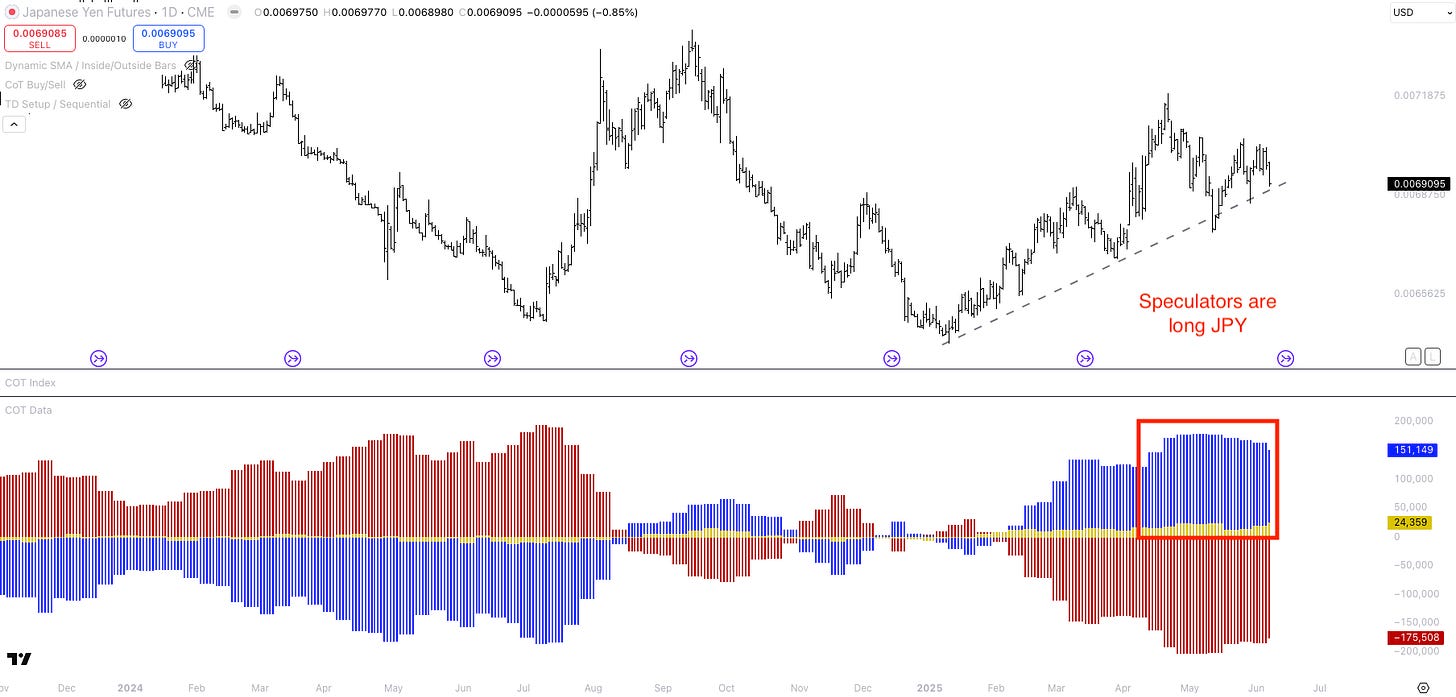

Let’s take a look at the US dollar. Since January, the EUR, GBP, CHF, and JPY are all up 7–10% vs. the dollar. Many macro investors are bearish fixed income, but it feels like they are even more bearish US dollars. This is also reflected in the positioning data, which shows speculators long Euro and Japanese Yen (see below).

I’m looking to fade this move. For non-US investors: a simple way to express this is via USD money market funds. On Interactive Brokers, this Ireland-domiciled USD MMF yielding ~4.1% p.a. could be a good alternative, symbol: 00B39VC86. In my case with a EUR-denominated trading account, should the USD appreciate by 5%, the total return could be ~7% in six months with little volatility.

And lastly, let’s talk equities. The main reason I remain long the S&P500 is that flows continue to support the market, and there’s no economic disaster on the horizon. For a sustained selloff to materialise, we’d need a steady stream of growth-negative news - and I just don’t see that right now.

Last week, I noted Morgan Stanley’s estimate of $15 billion per day in S&P 500-like product demand. As realised volatility fades as April’s turbulence drops out of most 30-60 day lookback windows, volatility-targeting funds are set to ramp up their equity exposure. That shift means flows from systematic strategies will stay supportive. Add in retail demand and buybacks, and the bid remains firm.

4. Trade Tracker: Long SPX & USD

On Monday - contrary to the investment case I laid out above - I converted my US dollars back into Euros. The position, on which I already took partial profits, ran against me. In total, I lost very little, close to ~0.3%.

But I am thinking about opening the long US dollar position again. I laid out my thinking above: 1) bearish sentiment/positioning, 2) decoupling of yields and the US dollar, and 3) the potential for the US economy to surprise positively.

Year-to-date, the trading account is up 7.4%. I am still long the S&P500, which is my only position right now. I might convert some of my Euros back into US dollars next week and invest it into a USD money market fund.

I am also looking at the metals complex, most notably silver (see below). Fundamentally, I am bullish silver (AI & solar will lead to a silver shortage), but in the short-term the rally could be over-extended and positioning is getting crowded long.

5. Closing Thoughts: Inflation and Tariffs

Next week will be interesting. China and the United States will continue trade talks in London, which could lead to big headlines. On Wednesday, we will get US CPI data. The two big dates to keep in mind are July 4th, the Big Beautiful Bill target date for the House, and July 9th, the end of the tariff pause.

I hope you enjoyed this article. This is not investment advise and all views are my own. I write these articles because they help me to stay disciplined and transform my thoughts into actionable trade ideas. I always appreciate your feedback, likes and comments!

Thank you, Mr. Repo, for sharing your thoughts and giving us some quick look into your framework.

I had a doubt regarding your long USD idea. Since I've been following you for a couple months now, my sense is that this is a shorter term idea, and that you tend to move your book fairly often, would that be a fair assesment?

If that's the case, what do you think on a more structural or even cyclical basis regarding the USD?

As of now, at least for euro investor (and please correct me if I'm wrong), long DE 10yrs yield better than long US 10yrs FX hedged. If the tariffs do put a floor or rising pressure to US CPI, and also deflationary pressure in EU, couldn't the mentioned differential keep on widening in favor of DE 10yrs? (if ECB and FED keep going in different directions, with the former cutting and the latter staying).

In addition, BBB passes into law, and longer bonds have a hard time to catch a bid.

Wouldn't that scenario, coupled with a decade + of huge long USD buildup in developed countries (Japan, EU, CAD, UK) that have remained unhedged (or at least not fully hedged) provoke a sort of stampede of people hedging their long USD and, therefore, lowering the greenback?

Might be off here, just curious about your thoughts.

Thank you for a great piece!

BEst,

Valentino