S&P 500 earnings outlook, real money vs. bond vigilantes, and when macro fails.

Earnings are weakening, retail won’t stop buying the dip, and real money is going to war with bond vigilantes. When macro fails, what’s left - and where is the next trade?

Hi everyone,

I was away over the Easter break and didn’t get a chance to publish over the weekend. Time has been a bit limited lately, so this write-up is a little shorter than usual - but I still wanted to share market thoughts I’ve been tracking.

These write-ups take a lot of time and effort to put together, so if you find them helpful, I’d really appreciate it if you shared them, forwarded them to a friend, or posted them on X. It keeps me motivated to keep doing the work and putting these pieces out regularly. Having said that, let’s dive right in!

The earnings outlook is weakening, but retail BTFD

My view on the US stock market hasn’t changed much. There’s still no meaningful progress on trade deals that could reduce uncertainty or reverse the slowdown in growth. With negotiations ongoing with more than 70 countries, a resolution is likely months away - meaning tariffs will remain in place for the foreseeable future.

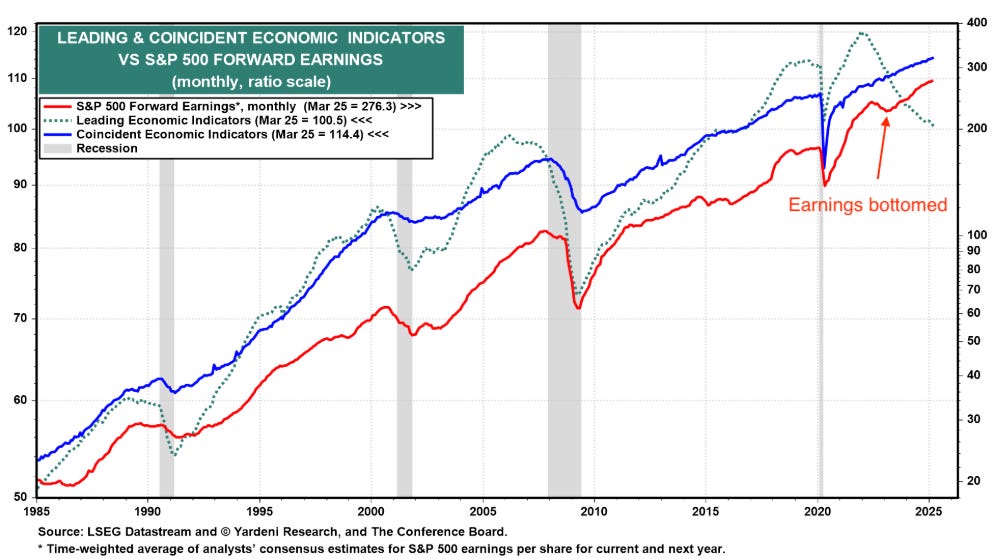

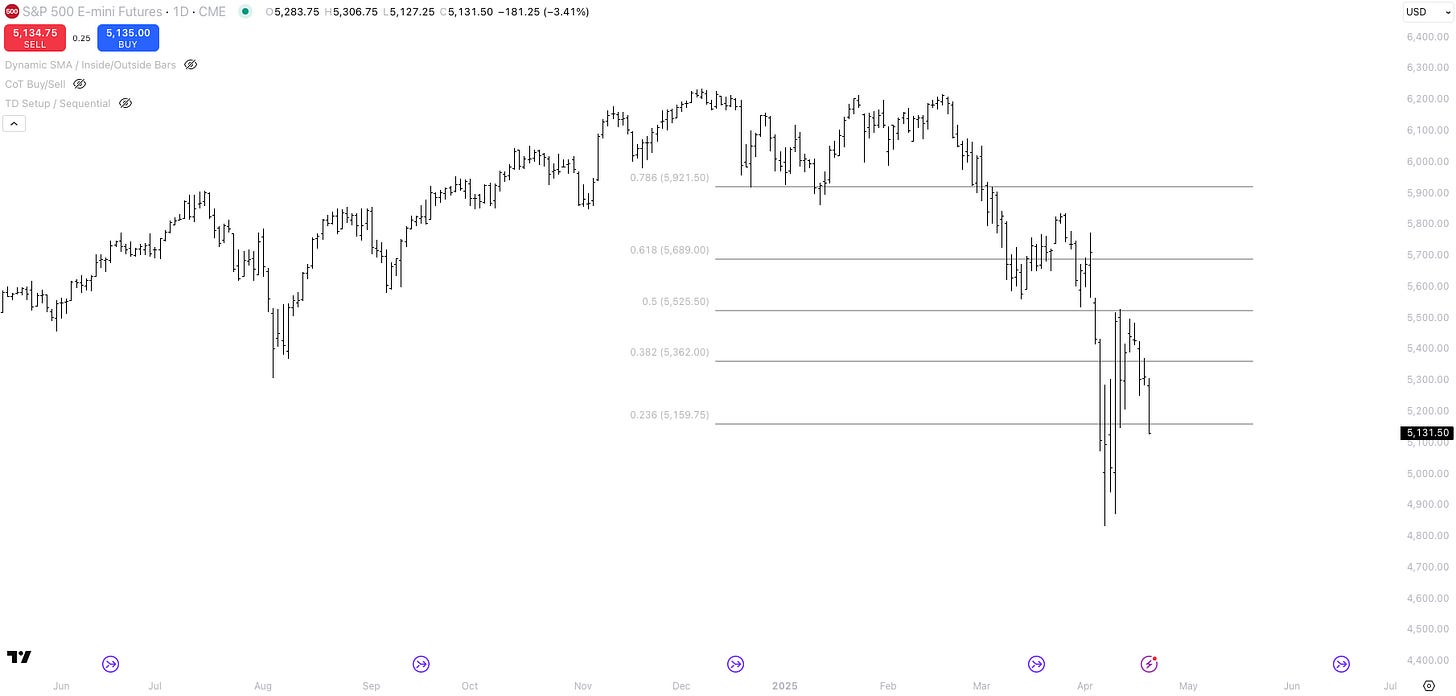

I was wrong in my call that the pain trade in equities was higher. I expected a squeeze, but instead, the S&P 500 ended last week lower. It looks like investors are starting to price in the reality: tariffs will weigh on earnings. Take a look at the chart below: earnings are revised lower.

Until we see signs that earnings expectations are bottoming - or even improving - it will be hard for the S&P 500 to reclaim new highs. The broader trend in GDP growth also supports the view that earnings growth is likely to slow from here.

The macro backdrop is also reflected in corporate debt issuance. Companies are borrowing less, signalling weaker investment appetite. That reduced credit creation is another headwind for growth.

Companies are pulling back on investment and facing potential headwinds from tariffs - both of which can trigger consumer anxiety about job security. If people start fearing for their jobs, consumer sentiment deteriorates - which in turn weighs on GDP (and S&P500 earnings).

Despite this macro backdrop, retail traders continue to buy the dip. In fact, last week saw the largest-ever inflow into leveraged long ETFs.

What if the macro story is wrong?

The macro outlook is not great - but I want to add a word of caution: relying too heavily on the macro story can be dangerous.

The market is the collective intelligence of all investors. Earnings revisions and GDP charts are not inside information. If you're looking at the same macro charts as everyone else, chances are that information is already priced in.

Remember the famous Morgan Stanley earnings model from the 2022 bear market? It was built using various economic surveys and predicted a sharp drop in S&P 500 earnings. The below chart went viral between January and March 2023.

Source: Morgan Stanley Earnings Model on X

But the model overfit the data. Survey data, in particular, turned out to be unreliable - and the expected earnings collapse never came. Bottom-up analysts, on the other hand, were right. Earnings stabilized and eventually reaccelerated.

Anyone who positioned based on Morgan Stanley’s macro model missed the S&P 500 lows - and likely stayed on the sidelines during the rebound.

The takeaway? Don’t underestimate the market’s collective wisdom. Sometimes every macro indicator looks bearish, but the market is already looking through the noise. All the bad news might already be in the price.

Macro is incredibly useful for identifying risks - but you also need a process to get you back into the market. Often, tape reading or technicals are the cleaner, more reliable tools. Just keep that in mind when consuming macro narratives - I was pondering over this idea on the weekend.

Face off: real money vs. bond vigilantes

If consumer sentiment continues to weaken - and with it, U.S. consumption and growth - can inflationary pressures really accelerate in a meaningful way? Slowing demand typically tempers price increases. So even if tariffs are inflationary in theory, the actual impact may be limited in a weakening economic environment.

It’s also worth considering the breakdown of U.S. consumption. Roughly 68% of consumption is services, and only 32% is goods. Of that 32%, about 80% of goods are produced domestically, while 20% are imported. That means imported goods - which would be impacted by tariffs - make up only 6.4% of total consumption.

Within that 6.4%, Mexico, Canada, and China account for close to 42% of imports. So even if tariffs raise the price of these goods, the direct impact on overall inflation - goods and services - may be smaller than many fear.

Many U.S. businesses have already front-loaded imports to get ahead of tariff hikes. If consumer demand continues to slow, these businesses may struggle to clear inventory. In the short term, that could help contain inflationary pressures, as excess supply meets weakening demand. Tariffs might prove inflationary over time, but the near-term effect could be more muted than expected.

So far, the U.S. bond market isn’t pricing in the possibility of a meaningful slowdown in growth and inflation over the next 6 to 12 months. 30y US yields are still hovering around 4.90%. If nominal GDP growth slows to 3% and inflation rises only temporarily - and by less than markets currently fear - then long-end yields are likely too high. I’m not married to this view, but it’s a scenario worth keeping on the radar.

Now imagine you’re the CIO of a $100 billion pension fund. You likely hold a sizable allocation in public and private equities - say, 30–50% - with additional exposure to real estate, credit, and alternatives. But you also have ultra-long-term liabilities stretching 30 years or more. You are forced to extend the duration of the portfolio.

If you believe that:

the swap spread unwind has largely run its course,

inflation is headed back toward 2%,

a U.S. recession is a real risk, and

bonds might eventually regain their negative correlation with equities, then 30-year yields around 5% start to look attractive.

To me, the 5.00%–5.20% range is the danger zone - this is where the narrative really gets tested. Will real money investors (pensions, insurers, asset managers) step in to support the long end? Or will bond vigilantes- such as fast money macro funds - continue to push yields higher? I remain on the sidelines for now.

Where is the next trade?

In my trading portfolio, I’m remaining patient. I initiated a small long position in crude oil last Wednesday, as a tactical play on a potential risk-on rally. Positioning in crude is looking increasingly crowded to the short side, largely driven by the OPEC+ supply increase narrative. If those shorts start to unwind, the move higher could be sharp - making the setup feel asymmetrically skewed in my favor. I'm risking just under 0.5% of the portfolio, with a stop on a close below Wednesday’s low.

I liked that oil rose on Wednesday despite a sharp equity selloff. Inventory data also came in slightly above expectations, yet the price held up. That said, the main driver of the bounce seemed to be the U.S. imposing new sanctions on Chinese importers of Iranian oil. For that reason, I’m not in love with the setup - I generally prefer when an asset rallies despite bearish news. In this case, there was a bullish catalyst helping the move.

At some point, I’ll likely want to get long equities - but not just yet. From a macro perspective, if earnings roll over and valuations mean-revert, the S&P 500 could still trade down toward 4,500. Higher credit spreads alongside rising long-end yields don’t help the case either. That said, sentiment remains deeply bearish (AAII, Fear & Greed Index), and positioning is beginning to unwind (NAAIM). I’m staying on the sidelines for now, waiting for a cleaner entry.

The Japanese yen continues to grind higher. The macro narrative is clear: domestic inflation is ticking up, yet rates remain low. That divergence, coupled with JPY’s role as a safe haven, has drawn in buyers - now leading to stretched long positioning. I am waiting for JPY to fail on bullish news and remain on the sidelines for now.

Trading involves a whole lot of randomness. Sometimes there’s clarity, and sometimes it’s just noise. In those periods, cash is a position - there’s no need to force trades when the setup isn’t there. I’ve mostly been in wait-and-see mode, keeping my risk tight and my bias flexible.

I hope you enjoyed this article. This is not investment advise and all views are my own. I write these articles because they help me to stay disciplined and transform my thoughts into actionable trade ideas. I always appreciate your feedback, likes and comments!

It’s a good point on the size of goods imports, though there’s also goods that underly service businesses that aren’t included there?