Reciprocal tariffs, NFPs and rising inflation expectations. Making sense of it all .

In this article, we take a look at 1) US growth prospects, 2) the labor market, 3) inflation, 4) the bond market, 5) FX and 6) equities and crypto.

In this article, we take a look at 1) growth prospects, 2) the labor market, 3) inflation, 4) the bond market, 5) FX and 6) equities and crypto. Let’s dive right in!

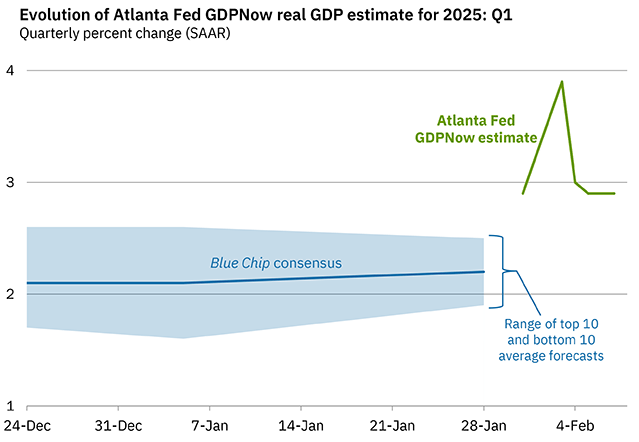

The US economy is growing at 3%. Tariffs and lower fiscal deficits are the main risks.

The Atlanta Fed GDP Nowcast is currently running at 2.9%, not reflecting any slowdown in economic momentum.

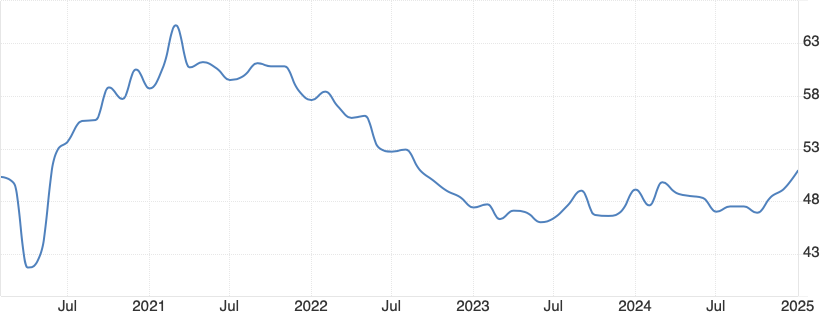

Monday’s ISM Manufacturing PMI surprised positively - 50.9 vs. 50.0 expected - with ISM new orders coming in significantly stronger, 55.1 vs. 52 expected. Wednesday’s ISM Services PMI came in below expectations - 52.8 vs. 54.2 expected - but still in expansionary territory.

The two main risks to economic growth are 1) tariffs and 2) lower fiscal deficits. Last weekend, the announcement of new tariffs—25% on imports from Canada and Mexico and 10% on imports from China—caused volatility. The tariffs on Canada and Mexico were delayed by 30 days.

I think Mexico and Canada have two options. They can either solve illegal immigration and drug trafficking issues, or they can get hit with high tariffs. The first option is much cheaper. They will probably negotiate a deal with Trump that is not causing too much economic trouble.

On Friday, Trump said he will announce reciprocal tariffs next week. For example, the EU imposes a 10% tariff on US cars. If the US would impose a 10% tariff on European cars, it could cause real problems for car manufacturers. The EU already offered to cut tariffs on US car imports to 2.5% to avoid a trade war with Trump. Other countries will likely do the same and negotiate lower tariffs with the US.

Tariffs impact global trade and, in turn, economic growth, negatively. There’s a reason most countries have moved away from protectionism. While tariffs remain a threat to future growth expectations, they will likely end up lower than what Trump proposed during his campaign.

With regards to government spending, Trump’s goal is to cut fiscal deficits from 6.4% to 3% in the next four years. Simultaneously, the Trump administration is targeting 3% GDP growth. This will be challenging. A 3% increase in GDP is equivalent to 870bn USD. To reach the fiscal deficit target, the administration has to cut the fiscal deficit by 250bn USD a year for the next four years (=1tn USD in total).

Consumption, investment and net exports have to increase by 1.12tn USD a year to reach the 3% GDP growth target and offset the reduction in the fiscal deficit. Consumption is roughly 20tn USD. If consumption increases by 3% a year, it adds 600bn USD to the GDP. If investments increase by 5% a year, it adds 150bn USD to the GDP. The remainder, 370bn USD, would have to come from an improvement of the trade deficit. The below formula breaks down how the GDP is calculated (simplified).

3% GDP growth over the next four years can only materialise if investment in the US increases and trade deficits decrease. I think risks are tilted to the downside, i.e., GDP growth is more likely to come in below 3% a year. This the multi-year perspective. In the near-term, which is more relevant to us as traders, growth is solid and there are no signs of a rapid deceleration.

The labor market is gradually cooling

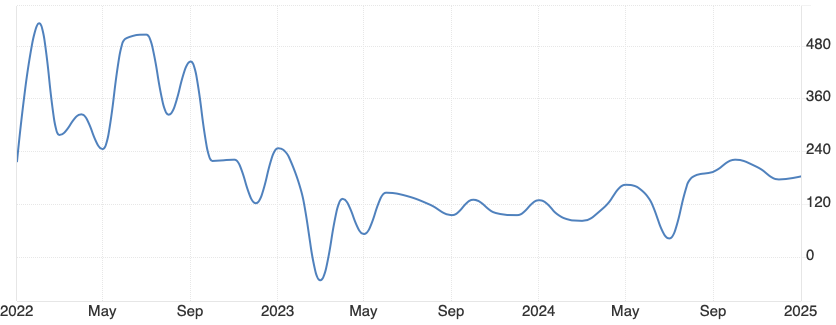

The labor market looks robust, but it is gradually cooling. Tuesday’s US job openings came in weaker than expected with construction jobs openings at the lowest levels since covid.

Wednesday’s ADP employment came in higher than expected, 183k vs. 150k expected.

Friday’s NFPs were slightly lower than expected, 143k vs. 175k expected. Private payrolls disappointed, 111k vs. 158k expected. The unemployment rate came in at 4.0%. As Warren Pies pointed out on X, excluding government/healthcare/education jobs, the US economy only added 14k jobs, which seems softish.

The NFP report could have been influenced by Trump’s stricter immigration policies. Average hourly earnings were up 4.1% YoY (expected: 3.8%, prior: 3.9%). A lower unemployment rate, a higher labor participation rate and higher wage growth points to labor supply becoming more scarce.

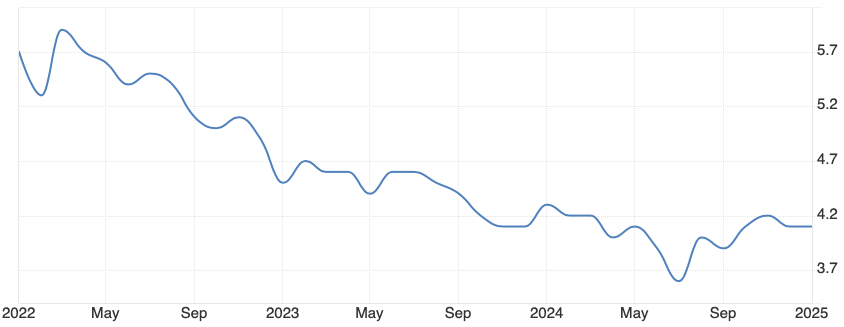

The short-end (US 2y future below) sold off after the NFP report, i.e., the market priced fewer cuts. The reason for the selloff were revisions to the November and December NFP numbers. When taking into account the revisions, the 3-month average for NFPs is 237k, which reflects a solid labor market. In short: the US labor market is strong, but there are signs of gradual cooling.

Inflation expectations on the rise? Don’t overreact.

On Friday, University of Michigan 1-year inflation expectations jumped from 3.3% to 4.3%, which surprised the market hawkishly. I do not put much weight on inflation expectations. This survey is particularly noisy. Just take a look at November 2023, when inflation expectations jumped to 4.5%. One month later, they fell to 3.1%.

ISM Services Prices Paid fell this week. The data came in at 60.4 vs 65.1 expected. With shelter inflation, which is roughly 40% of core inflation and close to 60% of core services inflation, likely to fall over the next 12 months, I am cautiously optimistic about the path of inflation in 2025.

The 10y yield - The White House vs. Speculators

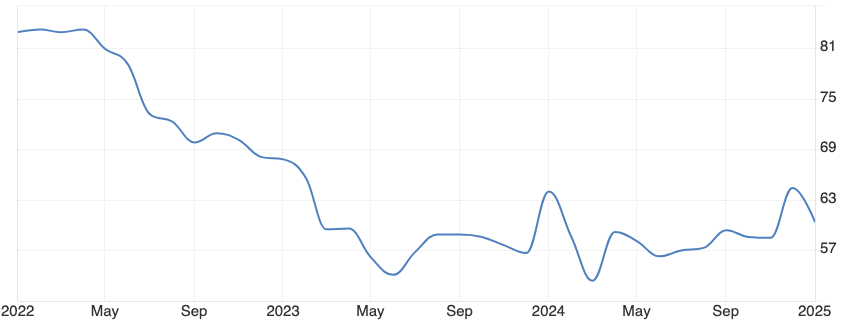

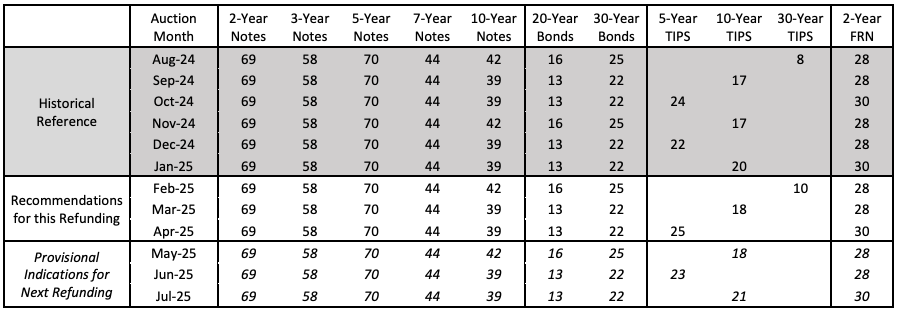

This week’s Quarterly Refunding Announcement (QRA) was a non-event. Coupon auction sizes will be kept the same in the next quarter. That means the private sector does not have to absorb more high duration issuance. On the margin, this is a positive for long-term yields.

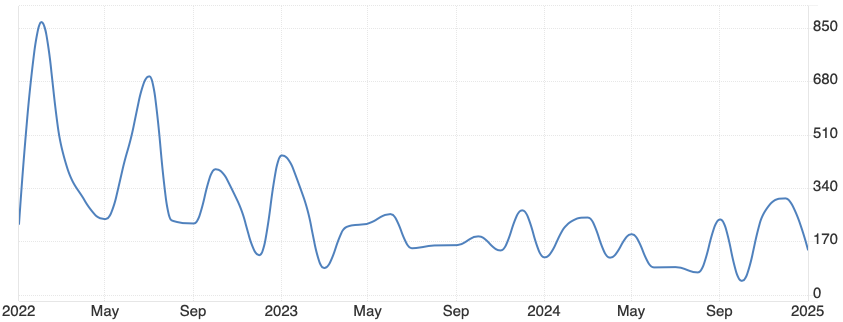

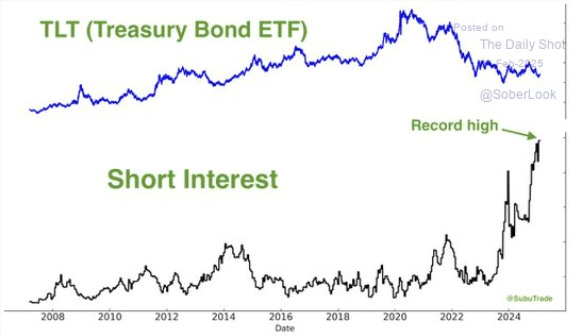

This week, US Treasury Secretary Scott Bessent told Bloomberg that the Trump administration targets the 10y yield and their goal is to bring interest rates down. We are witnessing a battle between speculators and the White House. The White House wants lower long-term yields, but speculators are betting on higher long-term yields (TLT = 20+ year). Interestingly, since the short interest increased to record levels, TLT stopped making new lows.

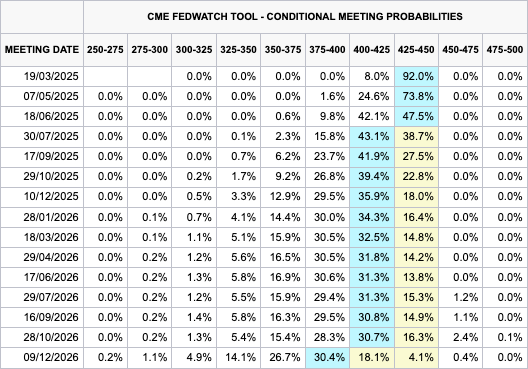

After Friday’s NFP revisions caused the short-end to sell off, the bond market is pricing only one cut in 2025. Even more interesting is that the bond market is pricing the Federal Reserve to keep interest at the same level from July 2025 to October 2026 (according to CME’s FedWatch tool).

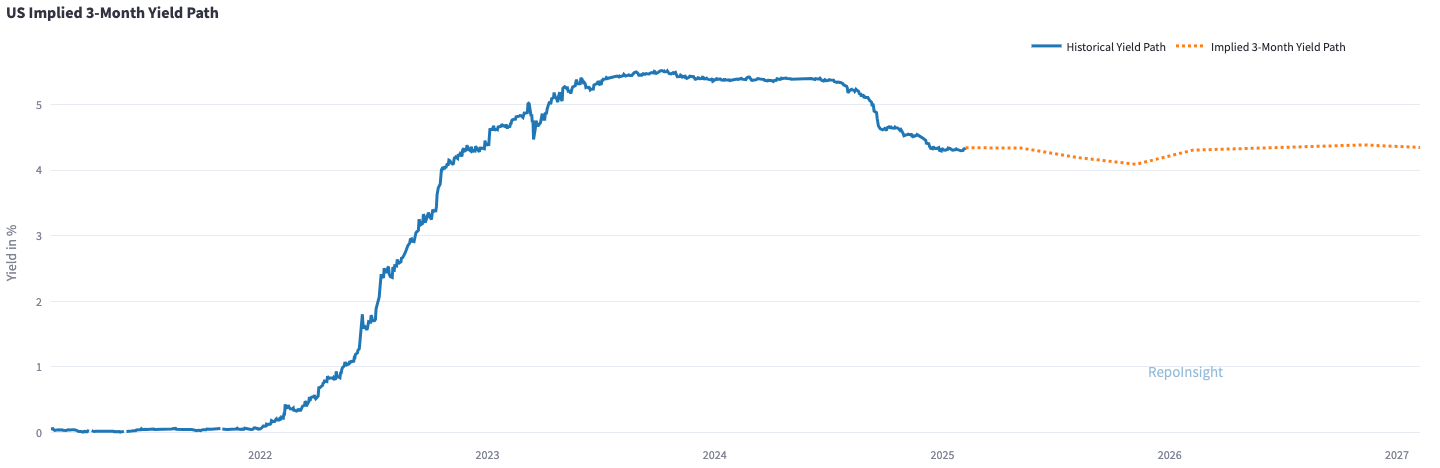

The implied path for US 3-month yields shows that the bond market is pricing a high(er) terminal rate. And for good reasons: the US economy is growing at 3%, the unemployment rate is at 4%, and inflation is still above 2%.

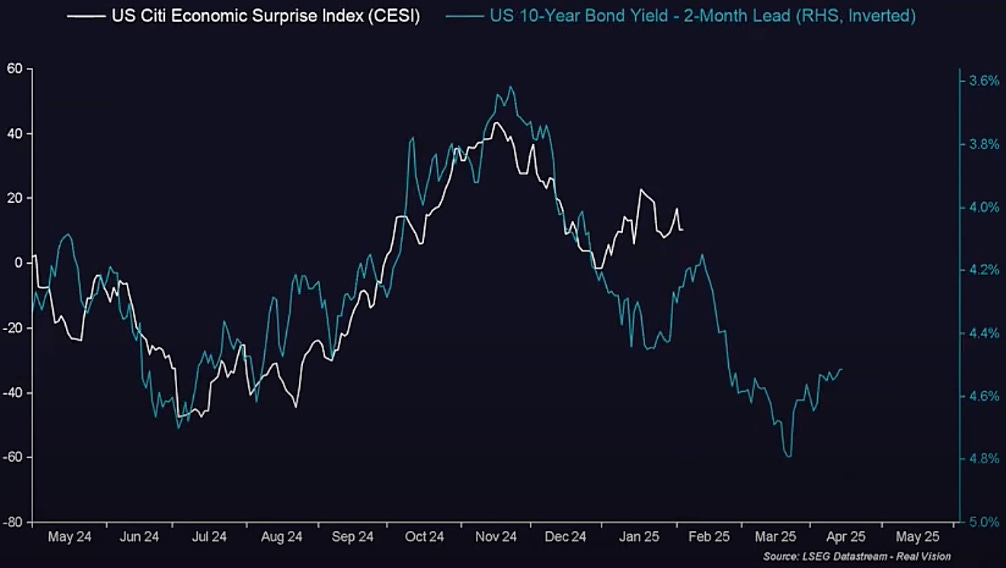

Despite strong economic data, my issue with shorting U.S. bonds is that the bar for rate hikes is high, and both the Federal Reserve and the White House favour lower yields. Stronger economic data justifies a pause - not a hike - but weaker economic data justifies cuts. Financial conditions as measured by the 10y yield and the US dollar have tightened since the Fed cut 50bps in September. Will this feed into the real economy at some point? It sure looks like it judging by the Citi Economic Surprise index vs. 10y yields.

The asymmetric reaction function of the Federal Reserve makes me think that the short-end is a buy, not a sell. The market is expecting only two cuts from today to December 2026. Without a supply shock, I do not think inflation will accelerate. Inflation could stabilise above the 2% target, but the Federal Reserve would likely keep interest rates the same - not hike - in this scenario. We only need two disappointing data points and the bond market will price more cuts.

How to trade this view

I am trading this view via currency bets, i.e., a short US dollar position. If the bond market prices more cuts, the US dollar likely weakens. I like to express the view in FX because the long US dollar position is consensus and crowded, and my confidence in short US 2y futures is not high enough.

I am long GBP. If Trump announces tariffs for the EU, it will be interesting to see whether GBP can fight off the news. On Thursday, the Bank of England cut interest rates by 25bps. But the cut was dovish - 7 members voted for 25bps and two members for 50bps. GBP sold off, but rebounded during the day.

I also think a long AUD position could be interesting here. The position benefits from the following scenarios: 1) the US short-end is pricing more cuts which leads to US dollar weakness, 2) China is doing better and 3) commodities rally.

Take a look at the Hang Seng Index (weekly candles). Almost every macro investor with the exception of David Tepper is bearish China, but the HSI is making new highs since the beginning of 2024. If the Chinese economy does better, AUD will benefit.

Australia is the fifth largest copper producer in the world, and the country has some of the world’s biggest undeveloped copper reserves. Copper broke out to the upside last week.

Iron ore is even more important than copper for the Australian economy. Iron ore could be breaking out to the upside too.

What about equities and crypto?

My views on equities and crypto are largely unchanged. I do not understand how someone could be bearish technology over the next ten years. It is not the year 2000 when tech companies had zero revenue. Today, tech companies are the most profitable companies the world has ever seen. And AI is going to accelerate tech earnings growth.

Just take Meta Platforms as an example. Meta has 3.3 billion daily active users across Facebook, Instagram, WhatsApp and Messenger. And now it is Mark Zuckerberg’s plan to develop AI agents. Imagine companies or individuals can buy their own programmer or UX designer. The more specialised the skill, the higher the price. For some AI agents, Meta will be able to charge companies >1.000 USD a month. A completely new revenue stream.

This is just one example how companies can monetise AI. Yes, valuations and earnings expectations are elevated. But valuations are a horrible timing tool and as long as GDP is growing at 3%, the savings rate is low and consumers are spending, earnings should not contract or disappoint meaningfully. The S&P500 is less than 2.5% below its all-time high. Without a catalyst I do not think equities will decline meaningfully.

With regards to crypto, I think there are a few positive catalysts on the horizon for 2025. 1) Solana ETFs will likely be approved by the SEC this year. 2) SOL futures are going to start trading next week. 3) The end of QT sometime in Q3 2025? More liquidity is good for crypto. 4) BlackRock is planning to list their Bitcoin products in Europe, which means European funds will be able to invest in cryptocurrencies.

I quote from my previous article: “Currently, Solana has the fastest-growing developer ecosystem and surpassed Ethereum on most on-chain metrics such as trading volumes or daily active addresses. However, Solana still has only one quarter of Ethereum‘s market cap (126bn vs. 402bn). In price terms: if Solana goes to 1,000 USD, it would have Ethereum’s market cap.”

I hope you enjoyed this article. I am planning to write about my views and trade ideas more often on Substack. Subscribe, so you do not miss them - it is 100% free.

Thank you for your newsletter! I read every issue with great curiosity. Right now, I’m particularly interested in questions regarding the potential partial reintroduction of the gold standard.

How realistic is a partial reintroduction of the gold standard in the U.S. under the current administration?

- What economic and political factors support or oppose this move?

What would be the impacts of a return to the gold standard on the global economy and financial markets?

What role do countries like Russia and China, which have significantly increased their gold reserves, play in this scenario?

- How might these countries benefit from a return to the gold standard?

What signs or developments should we monitor to detect a potential return to the gold standard?

- Are there specific political or economic indicators that could signal such a change?

When could such a change realistically be implemented, and what steps would be necessary?

Dear Mr. RepoInsight,

Great article, thank you for sharing.

I pretty much agree with the US inflation picture, but just curious why not playing it via long US2y futures/options?

I really enjoyed your aussie thesis, it makes a lot of sense. I've been playing a bullish view on China and Iron Ore (and BRL stabilization) through a long in Vale Do Rio Doce ($VALE), would love to share my thesis with you if that could be of interest.

Thanks again!

Best,

Valentino