"Money Printing" is Misunderstood: How QE/QT actually affects the economy and inflation

"Money printing" is completely misunderstood by the broader public. In this article, I explain how QE/QT actually works and how it impacts economic growth and inflation.

"Money printing" is completely misunderstood by the broader public. “We will get hyper-inflation because the Federal Reserve is printing all this money”. Most people in the media with these kinds of opinions have no clue what they are talking about. They do not understand the financial system and what money actually is. In this article, I explain how QE/QT actually works and how it impacts economic growth and inflation. Let’s dive right in!

The mechanics of QE and QT and why QE does not increase the “real money supply”

If quantitative easing (QE) creates so much money, why hasn’t it been more effective at stimulating economic growth in the past decade? Why doesn't QE lead to (hyper-)inflation? And why is the US economy not in a recession despite quantitative tightening (QT) for months? In order to understand these questions, we first have to take a look at the dynamics of how QE/QT affect the financial system and the economy.

The best way to think about QE/QT is as an “asset swap on the balance sheet of the banking sector”. Let us take a look at an example. A bank has 100 mortgages and 100 US Treasuries on the asset side of the balance sheet. On the liability side, the bank has 200 deposits. I created this simplified overview to understand the dynamics at play.

When the Federal Reserve conducts QE, it buys US Treasuries (and mortgage-backed securities, which we will ignore in this example). What happens on the balance sheet of the bank, or more general the banking sector, as a result of that? The Fed buys US Treasuries and pays with bank reserves. The balance sheet of the banking sector did not expand, but it now has (more) bank reserves on the balance sheet and fewer US Treasuries.

The important point to understand is that the deposits remain unchanged. Deposits represent “real money” that can be spent on goods and services by people like you and me. Reserves are “money for banks”, which is used to facilitate transactions among banks. It is money that does not leave the financial system and hence does not directly stimulate the economy or lead to surges in inflation.

Why is the Federal Reserve conducting QE to supply the banking sector with reserves? Before the financial crisis, there were rarely any bank reserves in the system. This changed mainly due to new regulation. For example, nowadays banks’ actions are driven by the liquidity coverage ratio (LCR). This ratio forces banks to hold enough high quality liquid assets (HQLA) on the balance sheet to cover potential liquidity outflows in a 30-day stress period. As a result, the demand for bank reserves has risen since the GFC as reserves can be posted as eligible assets in the LCR calculation.

There is no direct channel how QE/QT impacts the “real money” circulating in the economy, and hence consumer price inflation and economic activity (I am not talking about asset price inflation, which is impacted by QE/QT). However, there is an indirect channel through which QE/QT impacts consumer price inflation.

The indirect channel through which QE stimulates real economic activity

Essentially, QE allows the US government to borrow more money as they do not have to fear that nobody wants to buy their debt. The Federal Reserve creates artificial demand for US Treasuries. Fiscal deficits create “real money”. When the US government takes on new debt and it sends out stimulus checks, this creates real demand for goods and services and increases the “real money supply”, which is circulating in the economy. In other words, fiscal deficits increase the private sectors’, i.e., households and corporates, net worth (without attached liabilities).

QE allows the US government to run larger fiscal deficits. Hence, indirectly, by allowing the US Treasury to borrow more, QE can lead to inflation and “prints money”. But ultimately, the amount of money printed for the real economy is a function of how large of a deficit the US government runs - not how much QE the Federal Reserve conducts. And an important side note: Even if QE would not exist, the US government could probably run fiscal deficits for quite some time as the private sector is likely able to absorb a few percentage points of GDP in net issuance each year.

Washington runs the show: they decide on the fiscal deficit

The impact of QE on inflation and the “real money supply” in the economy is mainly driven by how large the fiscal deficit is- and that is driven by decisions of politicians. If there would be massive QE, but the US government is running a fiscal surplus, then the “real money supply” circulating the economy would not increase. Potentially, the wealth effect (QE leads to asset price inflation) would have an effect on economic activity and inflation because spending increases when people feel like they have more money. But that is also only an indirect mechanism and no direct impact of QE on inflation or GDP growth.

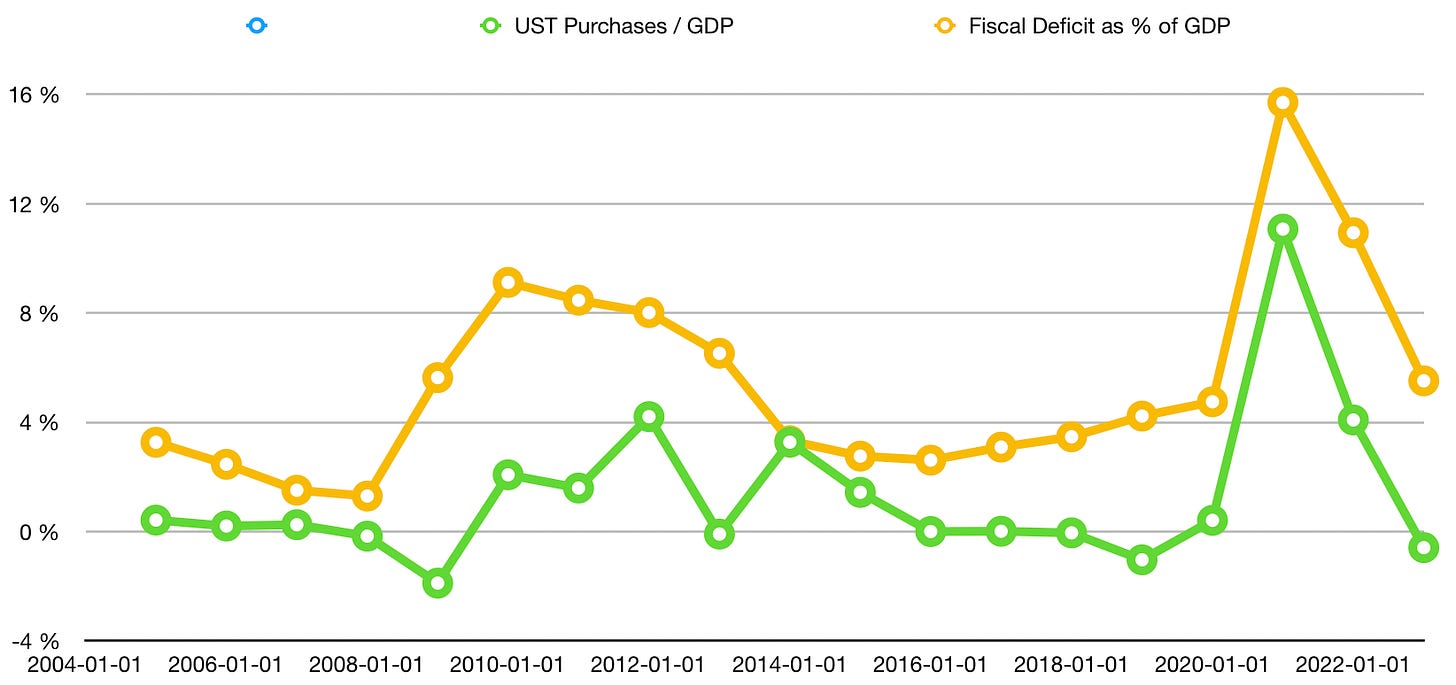

Let us take a look at the numbers. I plotted how many US Treasuries the Federal Reserve bought each year as a % of US GDP and how large the fiscal deficit of the US government was in each year as a % of US GDP. On average, from 2004 to 2022, the Federal Reserve bought US Treasuries worth 1.3% of US GDP each year. The fiscal deficit was on average 5.4% of US GDP in the same period. The difference (5.4%-1.3% = 4.1%) can be thought of as private sector demand for US Treasuries. In other words, most of the fiscal deficit of the US government was financed by the private sector - not the Federal Reserve.

I personally do not think the QE is a great way to stimulate the economy - and I think the Federal Reserve knows this. QE is mainly a mechanism through which the Federal Reserve supplies bank reserves to the financial system. Bank reserves are needed in the financial system because of new regulation introduced after the GFC. From 2003 to 2024, commercial bank assets in the US grew by 6% per year. If this trend continues, it would also imply that the demand for HQLA assets from banks to comply with the LCR regulation increases by roughly 6% per year.

This means that the Federal Reserve will most likely continue to expand its balance sheet in the coming years - not only to allow the US government to run fiscal deficits, but also in order to supply the banking sector with bank reserves. Balance sheet expansion is therefore not a “huge issue, which will destroy the US economy and the financial system”, but it is a function of regulation introduced after the GFC to make the financial system safer.

The second factor that drives the “real money supply”: bank lending

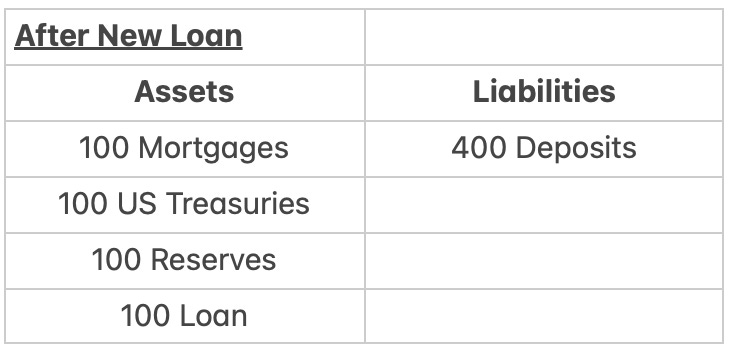

We established that fiscal deficits stimulate economic activity. QE only impacts the real economy indirectly by allowing the US government to borrow more money or through wealth effects, which are really difficult to measure accurately. The second big factor that impacts economic activity and inflation is bank lending. Private banks create “real money” - not the Federal Reserve. Take a look at the balance sheet of a private bank before the bank makes a new loan.

The moment the bank makes a new loan, the bank creates money. After the bank has made a new loan, the balance sheet looks like the one below. The new loan shows up on the asset side and there are new deposits on the liability side, which can be spent on goods and services in the real economy. Bank lending creates “real money” and the amount of bank lending depends on whether it is attractive for banks to lend, i.e., whether the net interest margin is sufficient and whether corporates and households are solvent enough.

According to most economic textbooks, the Federal Reserve drives bank lending through the minimum reserve ratio (MRR). Essentially, the MRR determines how many reserves a bank has to post against new loans. This ratio is meant to make the financial system safer. However, since March 26th 2020, the Federal Reserve set the MRR to 0%. Therefore, it is no longer a restriction for banks to make new loans. As long as the new loan is profitable, expected to be paid back and the bank is able to meet the regulatory requirements (LCR, NFSR, Leverage Ratio), it will make new loans.

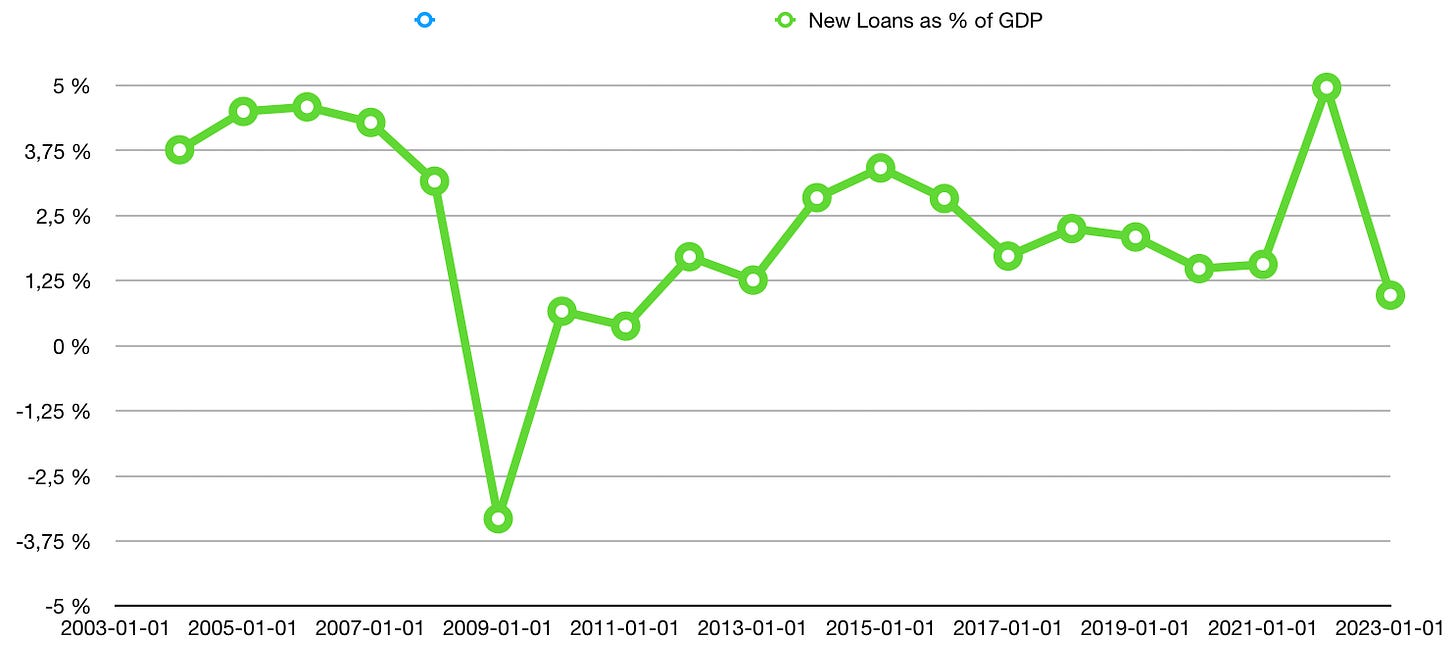

New loans - often expressed as credit impulse metrics by economists - drive real economic activity. New loans and leases as a % of US GDP were on average 2.3% from 2003 to 2023. This number show that fiscal deficits play an even more important role at stimulating economic activity than bank lending. In the past 20 years, fiscal deficits accounted for two thirds and new loans for one third of “real money creation”.

I hope this article helped you to understand the dynamics at play when the Federal Reserve is conducting QE or QT. “The Fed is printing money, the world is ending and we will have hyper-inflation” is proof of incompetence. It is not true and a sign of a poor understanding of the monetary dynamics at play and the financial system. Real money creation in an economy is determined mainly by fiscal deficits and bank lending - not by central bank actions.

If you enjoyed this article, feel free to subscribe to my Substack - it is free! I am not going to publish new articles on a weekly basis, but when I feel like I have something important to say. If you like my content, you can find more frequent posts on X/Twitter.