Liquidity, growth and inflation.

Fed Minutes. Scott Bessent. DOGE's impact on the labor market. Commodities rallying. Homebuilders selling off. Making sense of it all.

The first part of this article deals with Fed Minutes, Scott Bessent’s comments, PMIs, the DOGE initiatives and their impact on NFPs, and China. If you want to skip to my views on markets, I recommend you only read the last paragraph “Putting it all together”. Enjoy!

Liquidity - Fed Minutes and Scott Bessent

Fed Minutes: “(...) many participants expressed the view that it would be appropriate to structure purchases in a way that moved the maturity composition of the SOMA portfolio closer to that of the outstanding stock of Treasury debt (...)”

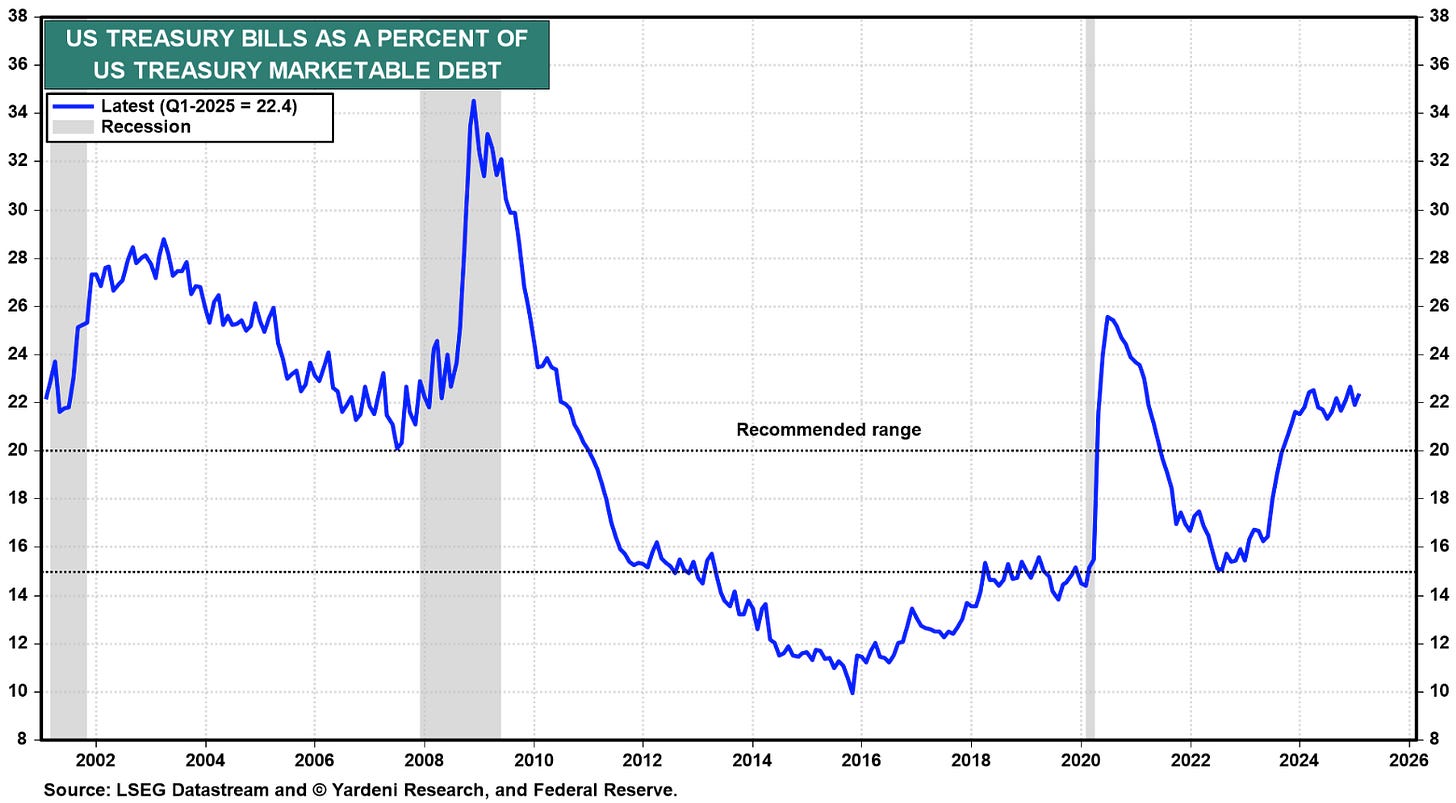

Fed Minutes revealed the Fed wants to buy fewer coupons and more bills. Currently, 5% of the Fed's holdings in the System Open Market Account (SOMA) are bills. In contrast, 22% of the outstanding US debt are bills (see chart below). If the Fed wants to match the US debt composition, it means they will reduce their coupon purchases and instead buy bills. Why is the Fed looking to do so? One reason is that the Fed is paying IORB/RRP, which are O/N rates, and it is earning interest on its SOMA holdings. In an environment in which the yield curve is inverted, i.e., O/N rates are higher than long-term yields, which means the Federal Reserve incurs a loss. Some people think the Federal Reserve losing money hurts its credibility.

What is the effect on financial markets? Long-term debt, e.g., 10y US Treasuries, are riskier and more volatile than bills. If the Fed is not buying them - or it reduces the quantity it buys each month - the private sector has to buy them. That means the private sector has to absorb more duration or "risk". If the demand for long-term debt falls, its price falls, i.e., the yield on long-term debt increases. Term premia measure the excess return investors demand for holding long-term debt vs. short-term debt. Fed Minutes imply that term premia should increase, because the demand for long-term debt falls.

Fed Minutes: “Regarding the potential for significant swings in reserves over coming months related to debt ceiling dynamics, various participants noted that it may be appropriate to consider pausing or slowing balance sheet runoff until the resolution of this event.”

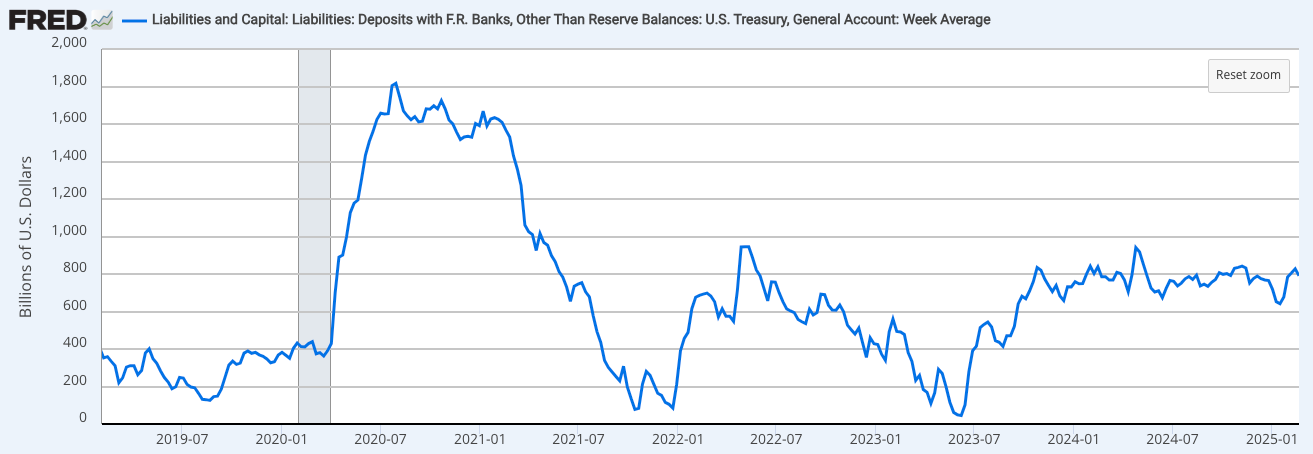

In contrast to the potentially liquidity-negative change in the Fed’s bond purchases, the Fed potentially stopping QT in the next FOMC meetings is certainly positive for the liquidity environment. The Federal Reserve is worried about the coming TGA rundown. The Treasury General Account (TGA) is the US Treasury's bank account at the Fed. Without a debt ceiling resolution, it will run down over the coming months, from roughly 800bn USD to close to 0bn USD (with the x date some time in August).

The TGA is built up mainly with debt issuance. Someone else, e.g., banks and MMFs, are buying the debt, i.e., they are spending bank reserves. If the US Treasury issues debt, but it does not immediately spend the cash, it withdraws reserves from the financial system. When the TGA is run down, reserves go back into the financial system, which is liquidity positive. This will be the case without a resolution of the debt ceiling. The US Treasury is not allowed to issue additional debt, hence it has to use its cash buffer and run down the TGA.

Once the debt ceiling is increased, the US Treasury will issue debt to restock the TGA. A large chunk of the debt issuance will likely be bills. Why could that be a problem for funding markets? Investors in bills, e.g., money market funds, place cash in the repo market and other funding markets. If they pull back from investments in repo or other short-term funding instruments and instead park the cash in bills, they withdraw reserves from funding markets. Even if QT continues to run at the same pace, the rapid withdrawal of reserves from the system due to the TGA build up could cause problems for funding markets.

Fed Minutes: “Several participants (...) expressed support for the Desk's future consideration of possible ways to improve the efficacy of the SRF.”

The Fed wants to improve the Standing Repo Facility (SRF). The SRF allows banks to post USTs to the Fed and source liquidity against it (at the upper bound of the Fed funds range). The facility is supposed to cap money market rates. If there is urgent liquidity stress, money market rates might spike by 1000%. In this scenario, banks can go to the Federal Reserve and access the SRF. However, the problem with the SRF is that it is a bilateral facility. Why is this a problem?

Accounting rules state that repo transactions can be netted if they have the same counterparty. If a bank trades via a central clearing house, all repo transactions can be netted (because the bank’s counterparty for all transactions is the clearing house). If the bank trades bilaterally with the Fed, the transaction creates balance sheet. Banks are leverage ratio constrained. They cannot increase their balance sheet as much as they want. That means even if repo rates are above the upper bound of the Fed funds range (the "SRF rate"), they might still fund themselves in the repo market.

If the Fed modifies the SRF, for example the SRF becomes a centrally cleared facility, banks can still access the SRF at the upper bound of the Fed funds range, but they would not have the same balance sheet problems that a bilateral facility creates. Also keep in mind that the Fed might reduce the Supplementary Leverage Ratio (SLR). If that were to happen, banks are not as sheet constrained anymore and might be more willing to use the SRF (even if it wasn’t centrally cleared). Both developments would be liquidity positive.

Scott Bessent on boosting the share of long-term Treasuries: “That’s a long way off, and we’re going to see what the market wants”

In addition to the Fed Minutes, Treasury Secretary Scott Bessent said in an interview with Bloomberg that the increase in long-term debt issuance sizes is ways off. Bessent recognised that if the Fed wants to change the composition of the SOMA holdings and the US Treasury sells more long-term debt at the same time, there will be two major sellers that could push long-term yields higher. However, Bessent and the administration want to see lower 10y yields. Increasing coupon issuance sizes would go against that. His confirmation that auction sizes will not be increased in the near future is liquidity positive.

In summary: The Fed might 1) invest in longer-term debt rather than bills, which is liquidity negative, but 2) stop QT earlier than expected, which is liquidity positive and 3) instead of re-introducing QE modify the SRF to supply reserves if needed. 4) Scott Bessent confirming that an increase in long-term debt issuance sizes is not happening anytime soon is also liquidity positive.

Growth & Inflation - Where are we now?

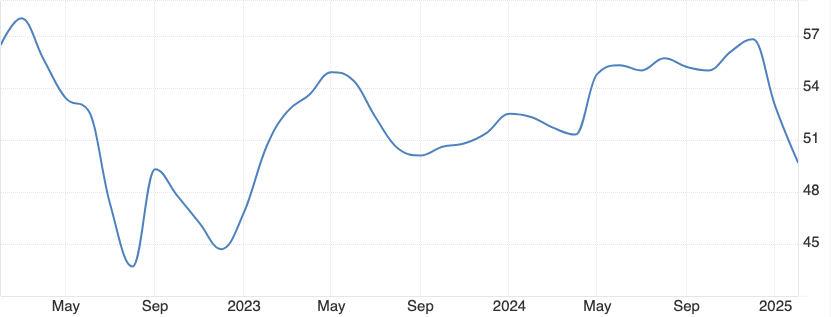

The Atlanta Fed GDP Nowcast is at 2.3%, which is a bit weaker than a few weeks ago. Economic uncertainty comes mainly from the impact of the DOGE initiatives, a reduction of the federal deficit and tariffs on GDP growth. The Flash Services PMI came in weaker on Friday, 49.7 vs 53 expected (see chart below). This is one of the first signs of weaker economic growth and could be related to the lagged effects of more restrictive financial conditions, i.e., higher yields and a stronger US dollar since September 2024.

When it comes to inflation, we currently see two interesting developments. Firstly, commodity inflation is back. The below chart shows the CRB commodity index, which is close to new all-time highs. This will likely affect the headline inflation number more than the core inflation numbers.

Secondly, there is the shelter inflation component, which will likely decline over the next months. It represents 40% of the core inflation numbers. With 30y mortgage rates still close to 7%, I do not see the housing market accelerating from here. Homebuilders backlogs have come down, while construction employment is still at record highs. Margin pressure could lead to layoffs, which would result in lower NFP prints. This development supports continued deceleration in core inflation numbers. If equity markets are the best economist out there, is XHB (US homebuilders) starting to price in this scenario?

DOGE’s impact on Nonfarm Payrolls and the Unemployment Rate

As of today, DOGE-led efforts have resulted in an estimated 10,000 to 15,000 federal layoffs since January 20, 2025. Additionally, 75,000 workers have opted into a voluntary “deferred resignation” program, set to exit by September 30, 2025, but these are not yet reflected as layoffs in payroll data. The federal civilian workforce totals about 2.1 million (excluding postal workers, who number around 600,000), meaning the current cuts represent roughly 0.5% to 0.7% of federal jobs. Note, this does not include Friday’s announcement from the Pentagon to fire between 5-8% of its civilian workforce, with the first round of layoffs targeting 5,400 probationary workers.

Government employment, including federal, state, and local levels, accounts for about 15% of total nonfarm payrolls (22-23 million out of roughly 158 million in recent BLS reports). If DOGE accelerates cuts, targeting 200,000 to 250,000 federal jobs in the first six months, this would equate to 33,000 to 42,000 layoffs per month from January to June. The US economy needs to create 150.000 to 160.000 jobs per month to keep the unemployment rate stable. The 3-month moving average of NFPs is 237.000.

If DOGE causes a 20,000–40,000 drop and all else equal, it would be noticeable but not catastrophic. Each 1% rise in unemployment equates to about 1.5 million jobs lost economy-wide. Losing 200,000 federal jobs (0.13% of 158 million) might nudge the rate up by 0.1%–0.2% if unabsorbed, but state/local hiring or private reemployment could mitigate this.

China - Tech Turnaround and Stimulative PBOC

Chinese equity markets have had a great start to this year. The Hang Seng Index is up 19.6% year-to-date. Xi Jinping meeting tech leaders such as Jack Ma this week and saying it is the "right time for private enterprises and private entrepreneurs to fully display their talents" is a good sign. The Communist “common prosperity” era is likely over with the CCP realising they need free enterprise to innovate and compete with the United States. If you trust in historical correlations, then the collapse in Chinese 10y bond yields forecasts easy monetary policy from the People’s Bank of China in the coming months.

Putting it all together

The market seems to be thinking in the following two base cases for the next 12 to 18 months. I assign a 65% probability to scenario 1 and a 35% probability to scenario 2.

Scenario 1 - Core PCE slows from 2.8% to close to 2.0%. The unemployment rate rises from 4.0% to 4.5%. GDP growth remains around 2.0 to 2.5%.

Scenario 2 - Core PCE remains around 3.0%. The unemployment rate remains low, between 4.0 and 4.5%. GDP growth remains around 2.5 to 3.0%.

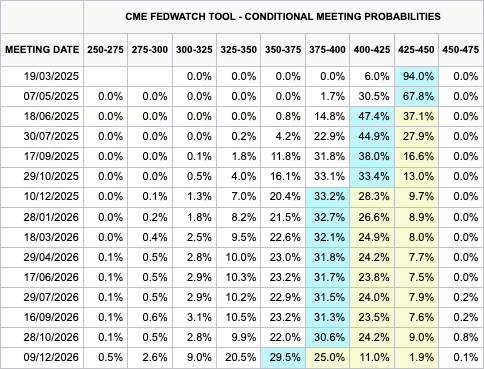

From today to October 2026, the bond market is pricing two cuts. Take a look at the CME’s FedWatch tool.

If scenario 1 materialises, the bond market could be pricing four to five cuts instead of one cut from today to October 2026. Five cuts would bring the Fed funds range to 3.00-3.25%. If core PCE is at 2.00%, the Federal Reserve would likely interpret real interest rates at 1% as “moderately restrictive”.

If scenario 2 materialises, the bond market would likely price out the cut. However, the bar for rate hikes is high. Fed funds at 4.25-4.50% with core PCE at 3.00% would equal real rates at >1.00%, which the Federal Reserve likely deems as “restrictive”.

Friday’s weak PMIs led to the US 2y future rallying. It feels like the 2y future reacts sensitive to data that supports the bullish narrative. I still believe the risk-reward to be long US 2y futures is attractive.

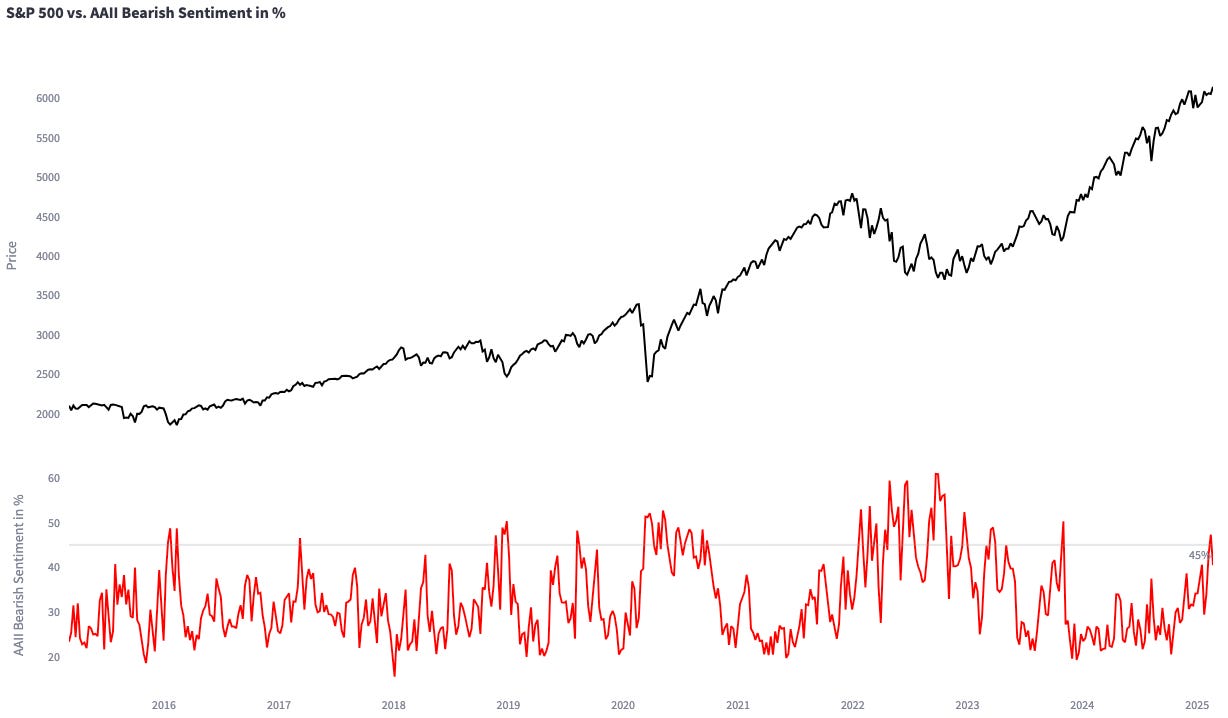

US equities have been struggling year-to-date, but I remain constructive over the course of the next 12 months. Valuations and earnings expectations are elevated, but we need a catalyst for equities to sell off meaningfully. Without a catalyst, it is difficult for me to see significant selling pressure with retail sentiment this bearish (see chart below).

I am still long GBPUSD, but my conviction in the trade is not as strong anymore. The main thesis, which is more restrictive financial conditions since September 2024 will feed into the real economy and result in weaker economic data in the coming weeks, has played out. There might still be some room in the trade (see chart below, which shows that weaker economic data should lead to more US dollar weakness and lower 10y yields), but the “easy money” has been made.

With the threat of reciprocal tariffs on the horizon, currencies such as EUR, CAD & MXN have started to struggle last week. If Trump hits “the world” with high tariffs on April 1st, the US dollar will rally. But considering that the United Kingdom and the United States get along comparably well right now, I believe GBP is still the best bet to short the US dollar.

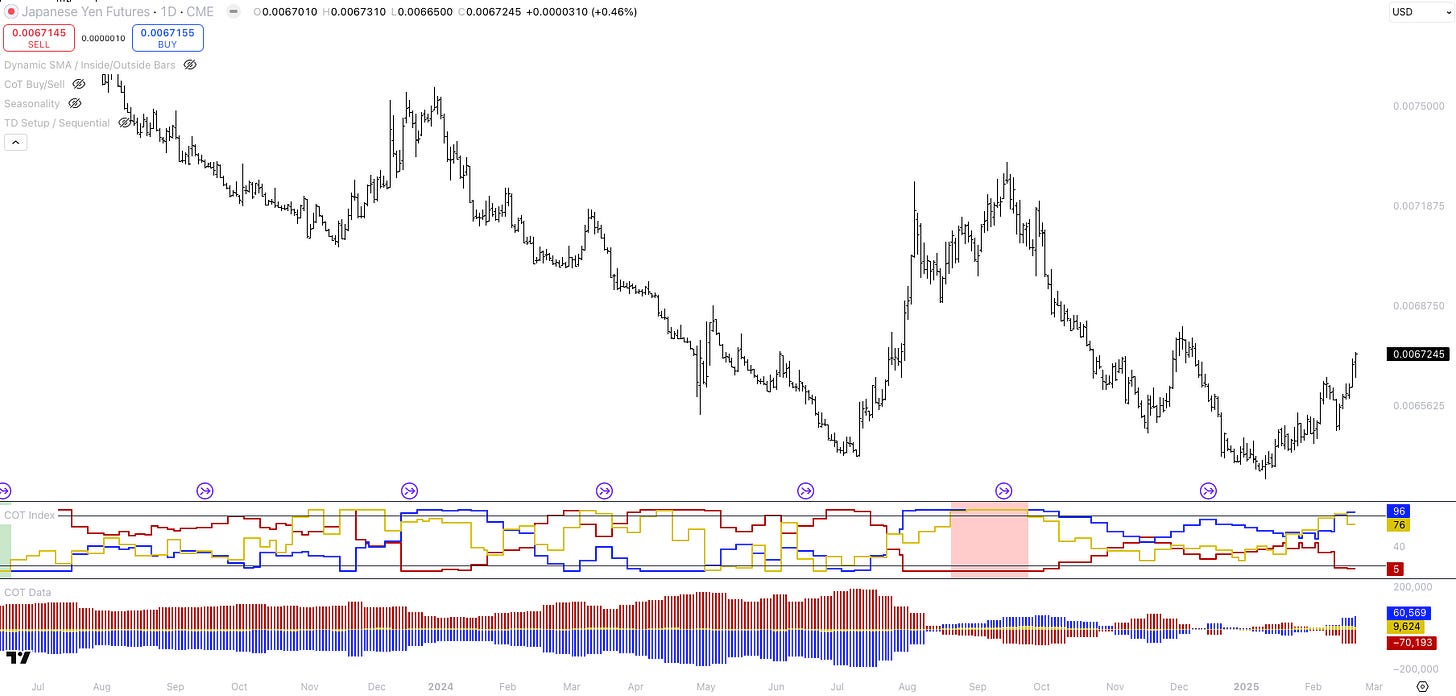

One trade idea that I am monitoring but have not put on yet is short JPY. The market has repriced Japanese monetary policy aggressively in the past months. Take a look at Japan’s 2y yield below. Whenever the market thinks “this time it’s different” or it is a “regime shift”, it is usually wrong.

I have seen multiple bullish statements about JPY on X in the past weeks. So far, macro folks have been correct about JPY strength. The bullishness is slowly reflected in the CoT positioning data. Once the positioning and sentiment becomes more extreme, I am watching for bullish news for JPY, but JPY selling off on the day. If that scenario materialises, I might open a short position.

I hope you enjoyed this article. I am planning to write about my views and trade ideas more often on Substack. Subscribe, so you do not miss them - it is 100% free.

Hi, really enjoy your publications.

One small remark, the srf is already a triparty facility (BNY Mellon clearing it). The issues with the srf are 1/stigma of using it 2/ market timing