Last week’s economic data and Trump’s new meme coin. My views pre inauguration

This week was packed with events. Trump launched his new meme coin and financial markets interpreted the last CPI release as disinflationary. This article details my views pre inauguration.

Every investor is waiting for Monday - Trump’s inauguration. Before that event, I wanted to summarise my views across asset classes. My views are based on 1) price action, 2) recent economic data releases and 3) how I personally view the world. This is only my perspective, and you can decide what you want to do with it. If my opinion changes next week, I will write another article with updates. If you don’t want to miss it, make sure you subscribe - it is 100% free. Having said that, let’s dive right in!

Bonds - Did the short-end bottom post US inflation print?

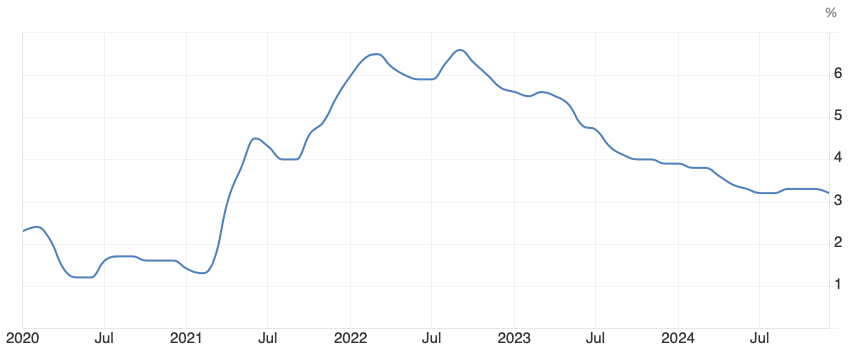

Last week, headline CPI in the US came in as expected at 2.9%, while core CPI surprised slightly to the downside, printing 3.2% (vs. 3.3% expected). December’s seasonal adjustments are the largest of all months, which makes it is difficult to interpret the data. Core CPI is still above the 2% inflation target and the progress on inflation in the past few months has not been great, but the re-acceleration many macro folks have predicted has not materialised (see chart below). Without a new supply shock, we might see core inflation sustainably above 2%, but not re-accelerating.

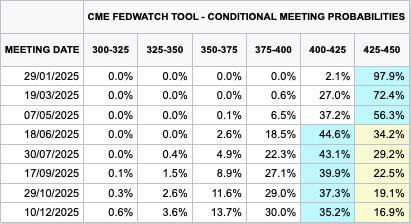

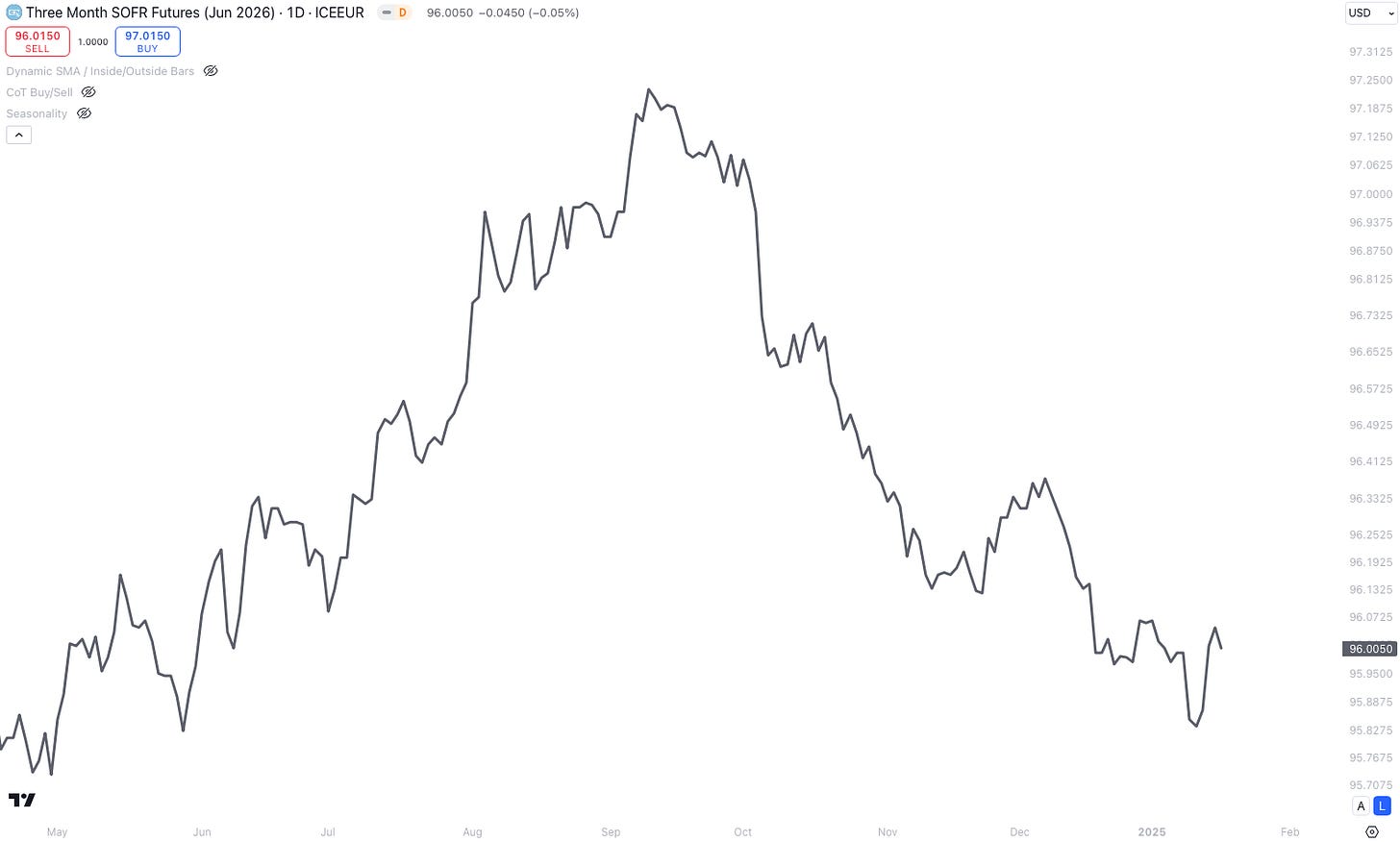

The market interpreted the numbers as disinflationary with the 10-year US Treasury yield dropping from 4.81% to 4.62% last week. The 2-year Treasury future rebounded to levels pre (booming) NFP report (see chart below). This could suggest that inflation prints are back in the driving seat when it comes to rate cut decisions. And since the last inflation print was on the dovish side, the bond market reacted favourably.

The disinflationary print supports the narrative that the Federal Reserve may pivot dovishly - especially when considering that the bar for data to come in dovish is lower after the December SEP. The market is currently pricing only one cut for all of 2025.

The bond market pricing might be a little too hawkish/optimistic - however you want to call it. While the US consumer is still in good shape, housing likely cannot handle mortgage rates at 7% with backlogs of homebuilder already starting to show signs of weakness.

Where is the trade? In my opinion, the short-end looks attractive here. The best way to trade it is probably to either buy SOFR futures outright, e.g., March or June 2026, or trade it with options.

Across the Atlantic: UK and German economic data

I know, most people are interested in the US, but we actually saw some interesting data out of Europe this week. In the UK, inflation numbers surprised to the downside. Headline CPI printed at 2.5% (vs. 2.6% expected), while core CPI came in at 3.2% (vs. 3.4% expected). The UK‘s GDP numbers on Friday also came in weaker than expected (-0.1% m/m, vs. 0.2% m/m expected).

So far, there are no signs in the economic data or in the price action to suggest GBP has bottomed. The Bank of England also dovishly suggested this week that higher long-term yields do the work for them and they can cut earlier. That does not sound bullish GBP to me. A dovish central bank while inflation is above target and the economy is contracting. Bad cocktail for the currency.

Germany’s economic picture is just as troubling. The GDP release confirmed a second consecutive year of contraction, with German GDP shrinking by -0.2% in 2024 after a -0.3% decline in 2023. The Eurozone is falling behind. I do not expect any politician in power to be able to pass the required reforms to stage an economic turnaround in Germany or Europe, e.g., de-regulation, lower taxes, and so on.

Technology is as advanced as it has ever been. But that does not mean today‘s world is less competitive. To the contrary, the speed of innovation is also as high as it has ever been. Technological advancements are exponential, which implies that competition is more fierce now. If you fall behind, such as the Eurozone right now, it becomes increasingly difficult to catch up. Their Euro is not showing any signs of strength right now (see chart below).

Commodities: Silver shines bright

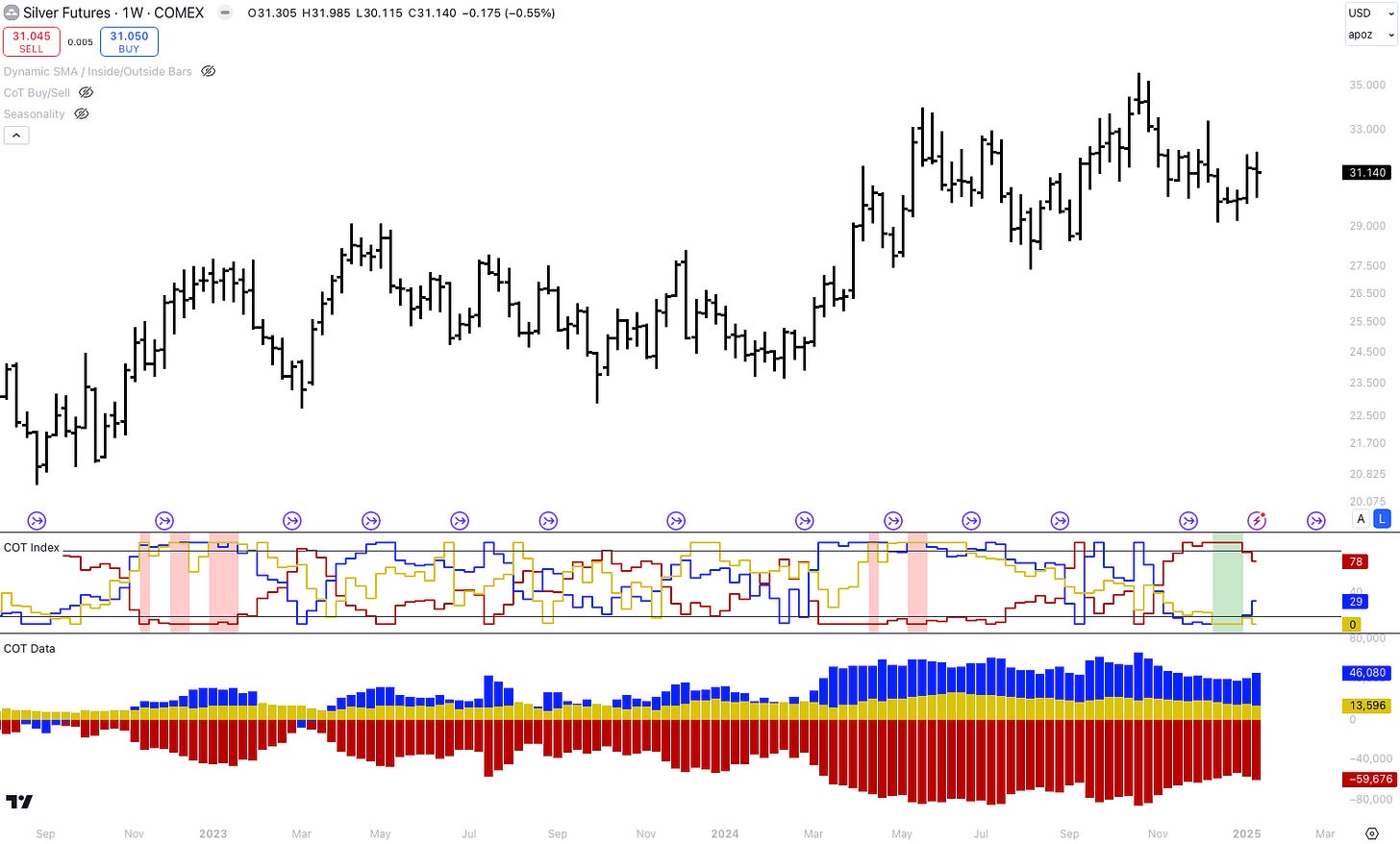

Among commodities, I am currently most interested in silver for the following three reasons.

Macro tailwinds: As an inflation hedge and beneficiary of lower interest rates, silver aligns well with the disinflationary narrative. Plus, there is speculation about central banks, e.g., the Russian central bank, buying silver.

Positioning dynamics: According to the CoT data, speculators are less long now. If silver’s rally sustains, CTAs will likely jump on the trend. The chart below shows the silver price and the CoT positioning.

Secular/physical demand: Artificial intelligence needs a lot of energy. This likely means solar energy will need to expand. Silver is a critical input for solar energy, which could lead to a rise in demand of physical silver.

Despite a stronger US dollar, silver traded strongly the past week. I think it is worth thinking about holding silver as part of a diversified portfolio. The macro, positioning, and secular trends make it a compelling bet.

Equities and the Fed: A Tug of War

In 2025, it will likely be a tug of war between slower growth and rate cuts. Slow growth with elevated expectations is bad for equities. Rate cuts tend to be good for equities. My base case is that the US economy will not slide into a recession in 2025, which is why I am still positive for equities.

An environment of slowing growth and the Federal Reserve easing usually leads to positive outcomes for equities. Of course, these assumptions only hold true if the inflation genie is not escaping the bottle. If inflation re-accelerates, it will be negative for equities as the Federal Reserve would have to reiterate its hawkish stance.

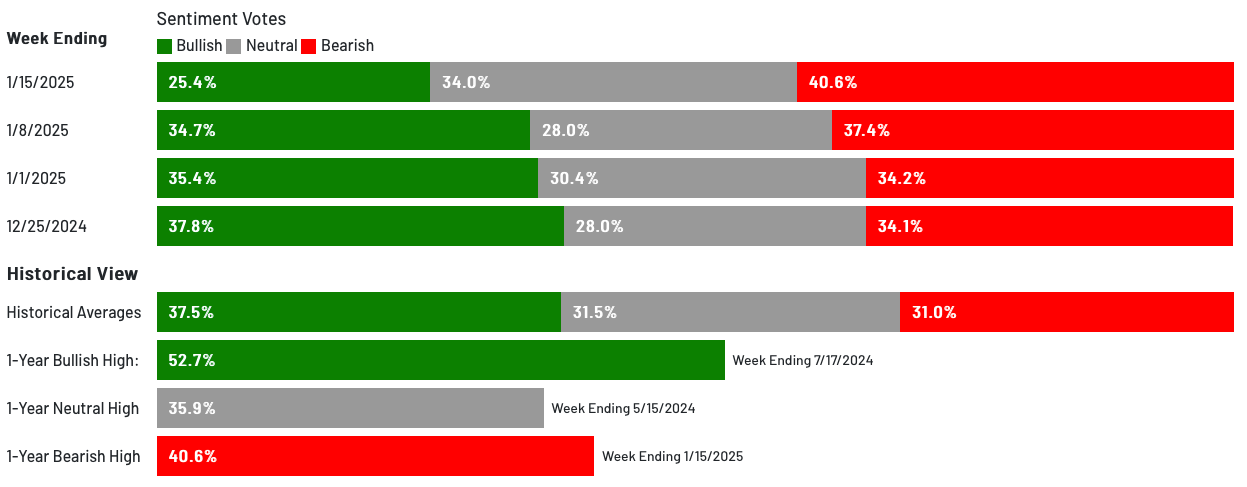

Another reason why I am still optimistic about equities is investor sentiment. It feels like a 3% decline in the S&P500 leads to bearish sentiment very quickly. This is also reflected in sentiment surveys, such as the AAII investor sentiment survey. In the latest release, retail investor‘s bearishness increased to 40.6%.

If Trump announces large tariffs on Monday, the S&P500 will likely decline. In Trump’s first term, when tariffs were announced, equities closed negative on the day. That is the risk to a long equities position right now. But do not forget, despite multiple tariff announcements in 2019, the S&P500 still did well that year (admittedly, after a bad 2018). Trump himself also does not want equity markets to do badly in his second term. He understands the wealth effect. I might update my view on equities after the inauguration, but at the moment I continue to believe that long equities will be a good position in 2025.

Crypto: the trump meme coin and its signalling effect

Trump launched his own meme coin this weekend. Wow! I am sure we will hear more about this in the coming days, but for now I think it is important to understand the signalling effect. Trump basically legitimised sourcing capital via ICOs. Under Biden’s administration, the crypto industry could not thrive to its fullest potential, mainly because of regulatory concerns. If the new president launches his new meme coin, regulatory concerns can be thrown out of the window, can’t they? Every institution can now legitimately use ICOs to source capital.

Bloomberg reported that Trump designated cryptocurrency as a “national priority”. Senator Charles Schwertner introduced a bill to create a Strategic Bitcoin Reserve for Texas. Oklahoma introduced the “Strategic Bitcoin Reserve Act” so they can hold Bitcoin as a state asset. All this happened this week. Solana’s trading volumes shot up after the Trump coin launch. In the past 24 hours, Solana’s trading volume according to coinmarketcap.com were 22+bn USD. Ethereum’s trading volume was 32+bn USD. However, Solana is only roughly one quarter of Ethereum’s market cap. Isn’t that an interesting statistic?

My simple thinking about crypto is: even if you do not understand it, if you allocate 5% of your capital to crypto and it goes bust, it will not hurt you that much. But if the sector increases by another 500+% (or even more), then it could really impact your portfolio positively. The weekly Solana chart below does not look bearish to me. I stick to Bitcoin & Solana in my personal accounts. My allocation is usually anywhere between 5-10%, but there were times when I increased it more.

Of course, the timing of this article is risky as many things can change on Monday. If Trump actually passes 100+ executive orders, there will be lots of news to digest next week. Nevertheless, I hope you enjoyed this article. In the future, I am planning to write about my views more often, maybe even track the performance. I am also going to publish more educational pieces, mostly about the financial system. Subscribe, so you do not miss them - it is 100% free.