Is it time to buy equities? Top-down macro ideas.

Sentiment and seasonality triggers buy signals for US equities. Germany's fiscal stimulus is a game changer for European equities. Is the Japanese 10y yield peaking and is it time to sell JPY?

Each weekend, I take time to collect my thoughts and formulate macro trade ideas, then turn them into an article. This process has been invaluable in 2025, helping me stay organised and keep up with what is happening in the world. I hope you enjoy the articles, and I welcome any comments or feedback. Let’s dive in!

The US consumer is in great shape

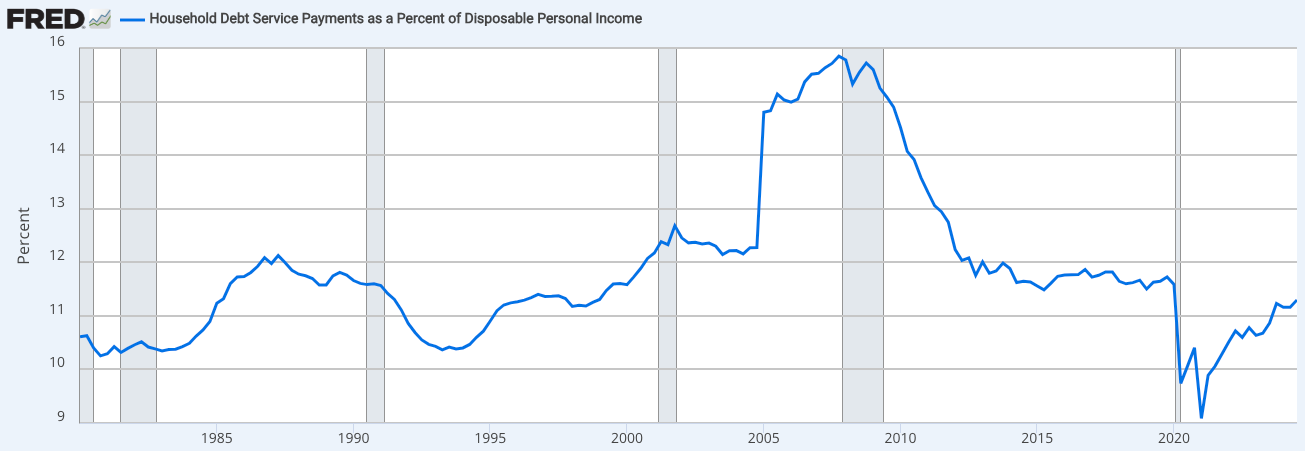

Household consumption is by far the most important driver of the US economy, accounting for 70% of GDP. Currently, household balance sheets appear healthy — as reflected by low debt service payments relative to disposable incomes (see chart below). However, there are risks to consumption. Rising uncertainty around tariffs or sharp equity market sell-offs could undermine consumer confidence, potentially weakening spending.

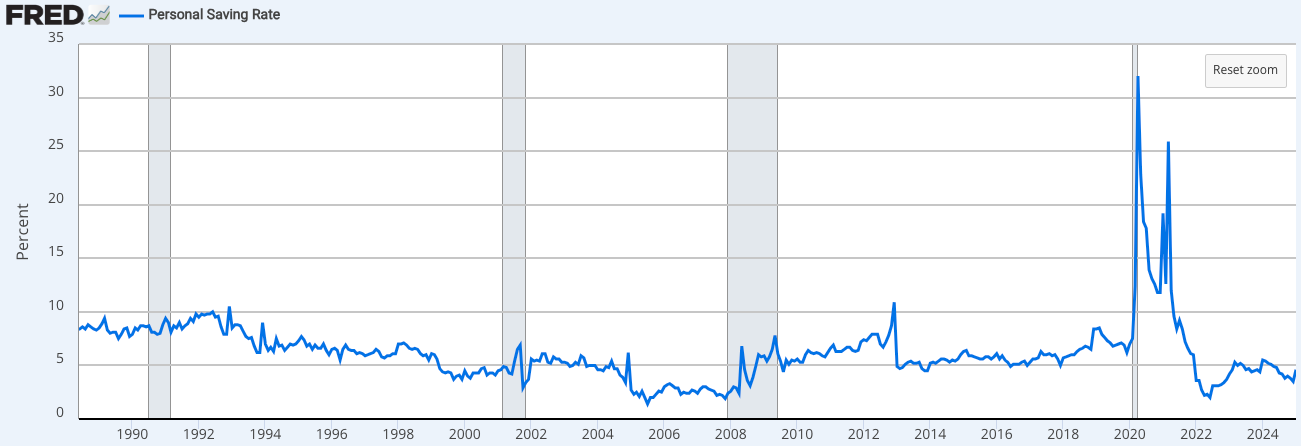

Household wealth has surged over the past three years, driven by strong gains in equities and real estate — the primary assets held by US households. This wealth effect has kept consumers in solid financial shape. It’s also evident in the declining savings rate (see chart below), as households feel less pressure to save given the increased value of their assets. Instead, they continue to spend.

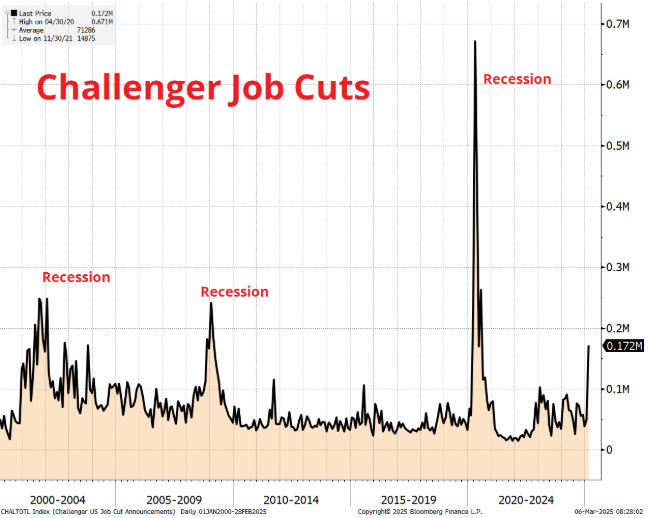

A significant equity market sell-off — say a 15-20% drawdown in the S&P 500 — would likely hit consumption. Households would feel less wealthy, prompting a higher savings rate and lower spending. In my view, this is one of the key risks to the economic expansion. Add to that the prospect of job losses due to DOGE, tariffs, or AI — or even a heightened perceived risk of unemployment — and consumption could weaken further. The latest Challenger job cut announcements already point in that direction.

But let’s not get ahead of ourselves. The economy is deeply interconnected, and knock-on effects matter. If equities were to sell off and recession fears intensified, bond yields would likely fall, reflecting weaker growth and lower inflation expectations. Lower long-end yields would drive down mortgage rates, potentially supporting a recovery in the housing market. In other words, an equity market sell-off could also trigger an easing of financial conditions — partially offsetting the economic damage.

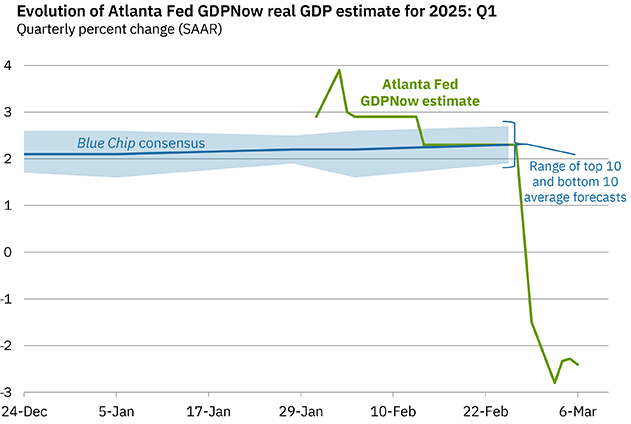

Ongoing uncertainty around tariffs, global trade, the Ukraine-Russia conflict, and a potential peak in AI capital expenditures is weighing on investor and consumer sentiment. The latest Atlanta Fed GDPNow forecast stands at -2.4%. Other economic data is also softening — Monday’s ISM Manufacturing PMI missed expectations at 50.3 vs. 50.8. The more forward-looking ISM new orders component came in sharply lower at 48.6 vs. 54.6 expected.

I have a few questions when thinking about the US economy and equity markets. How much of the above is already priced into equities? How much can the US economy weaken if 1) the US consumer is healthy, 2) economies internationally strengthen and 3) the White House wants lower 10y yields and oil prices? Maybe what we see is more of a rotation out of US equities and into Europe and/or China. If so, when would the rotation come to an end? And that leads us to …

US equities - yay or nay?

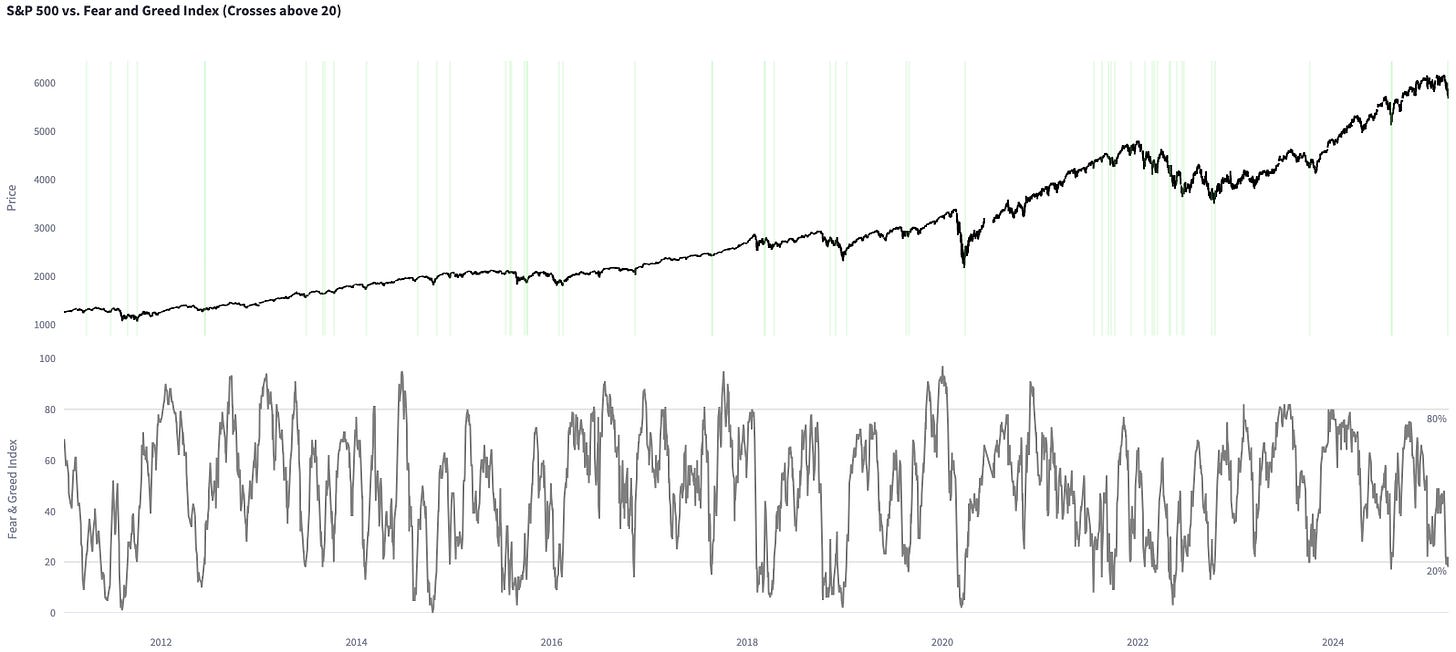

On Wednesday, Goldman Sachs' trading desk noted that Tuesday saw the third-highest put volume in SPY history and a record-high in QQQ put volumes. Both indices have traded lower since. Sentiment indicators are now approaching buy signals — as evidenced by CNN’s Fear & Greed index (see chart below).

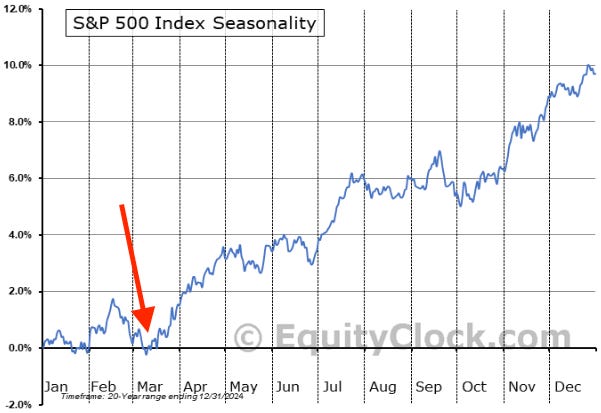

The S&P 500 is also approaching a seasonal buy point. In the US, individual income taxes are due on April 15th. Ahead of this deadline, households often sell equities or pause new investments to cover tax payments — creating short-term pressure on stocks. Once the tax deadline passes, this selling pressure typically eases.

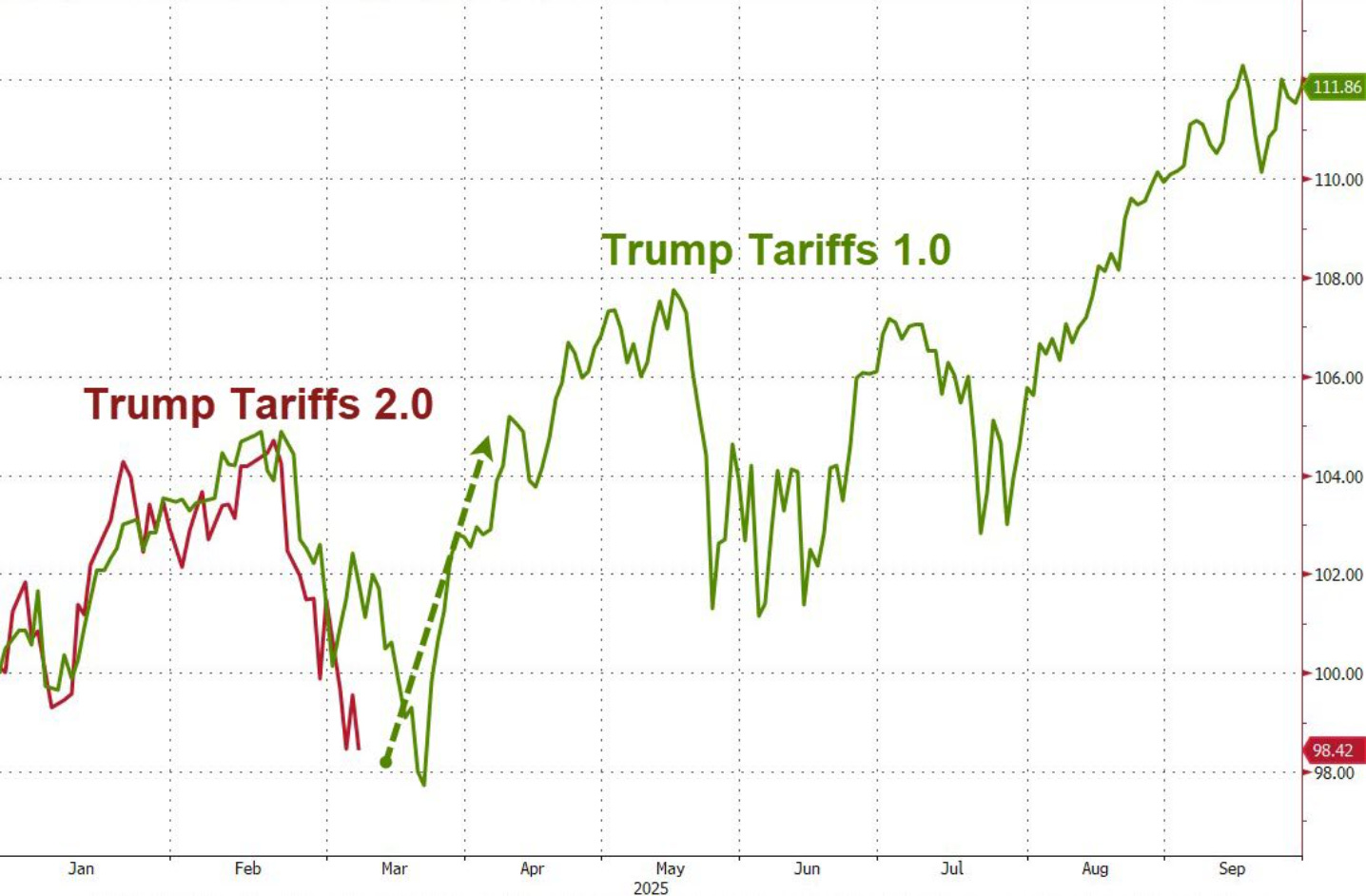

A similar pattern played out during Trump’s first term. The S&P 500 initially rallied — arguably overshooting — before selling off and returning to reality. If history is any guide, this could now be the time to buy the S&P 500.

I am not an AI expert, but Nvidia’s forward PE looks historically cheap. Would you have expected that? I did not. Analysts are generally accurate at projecting earnings in the next 12 months. If the AI capex cycle has already peaked and some AI projects will be reduced in size, long-term earnings expectations for NVIDIA might still be too high. But this chart offers perspective — particularly against the common bearish argument about high valuations.

Trump said he does not look at the stock market. Treasury Secretary Bessent confirmed this by saying “there is no Trump put”. The administration is accepting short-term pain for long-term progress. But Trump certainly does not want to be remembered as the president that lead the US economy into recession. If the S&P 500 avoids a true bear market (a >20% drawdown), when will the dip be worth buying? Will it be a prolonged slump (end of 2023) or a quick sell-off with a rebound (mid-2024)?

Rates & FX - labor market and inflation

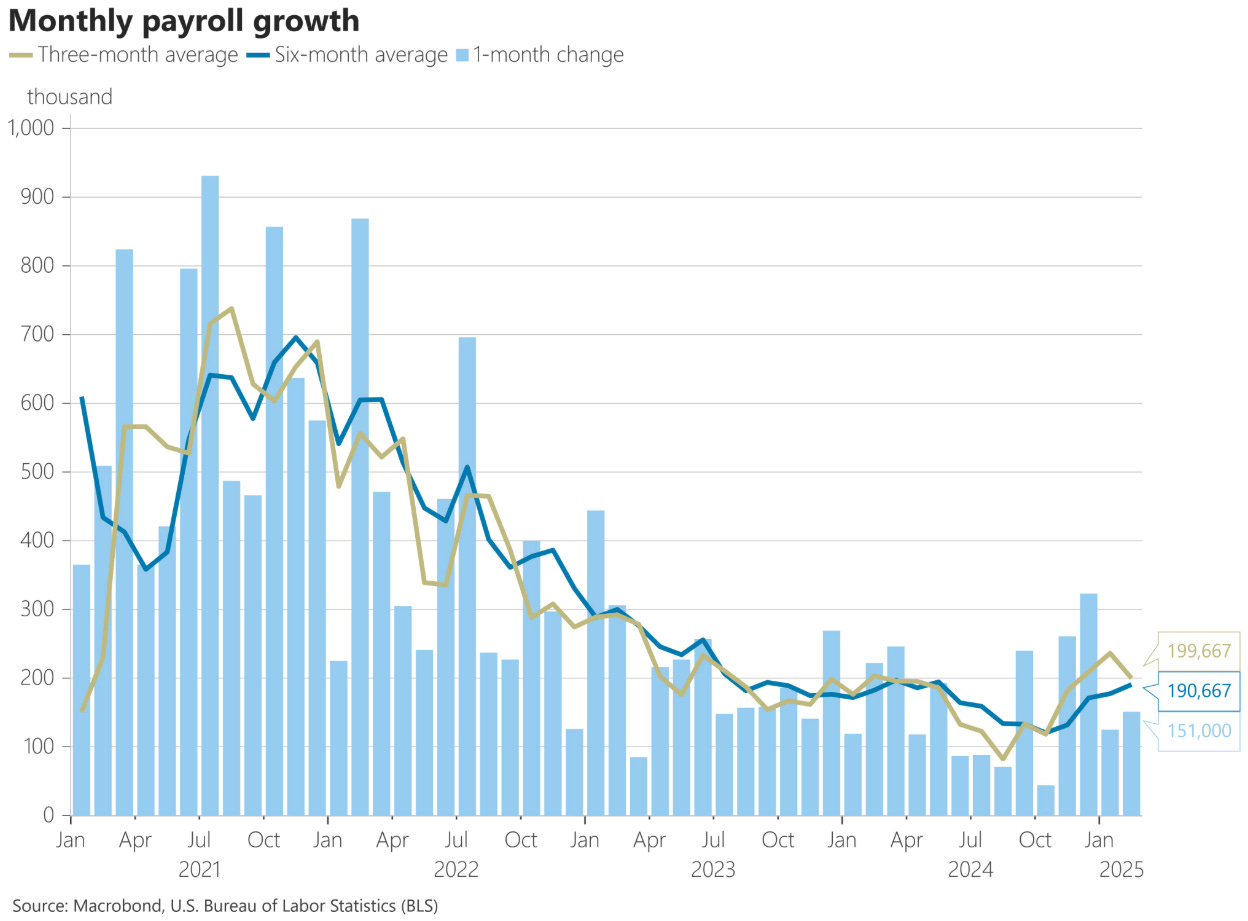

Friday’s NFPs came in slightly weaker, 151k vs. 160k expected. The unemployment rate inched up to 4.1%. The 3-month average for NFPs is at 200k now, which reflects a slowing, but still strong labor market. Residential construction payrolls, a leading indicator for the housing market and overall labor market conditions, were flat in February.

With zero immigration, the unemployment rate in the US remains stable if NFPs print between 80k and 100k each month. That means if NFPs continue to print around 150k, the labor market will tighten over time and the unemployment rate will decline. Layoffs of federal employees will likely reduce NFP prints in the next six months, but so far we do not see a rapid deceleration in the data.

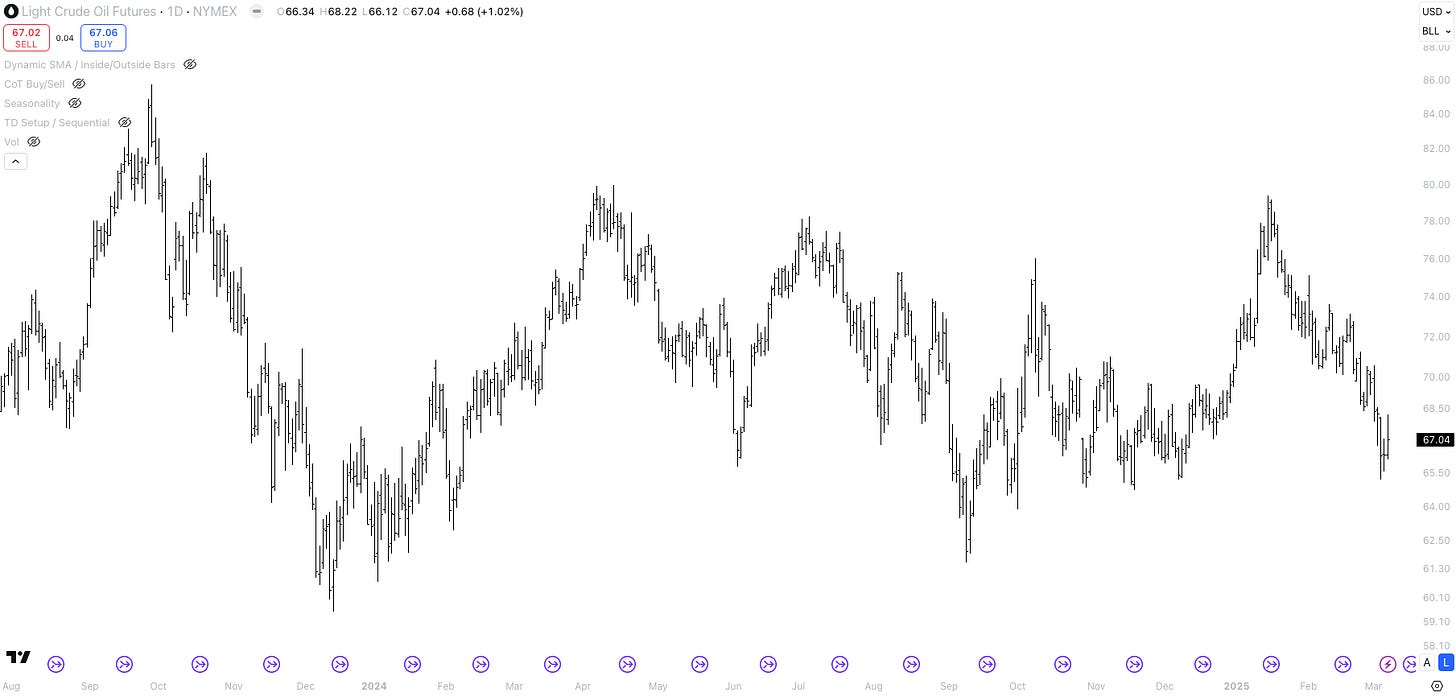

When it comes news on inflation, OPEC+ announced an increased oil output and the Fed’s Beige book was released. OPEC+ is going to raise oil output by 138,000 bpd in April, marking the first increase since 2022. The oil price sold off from close to 80 USD to 66 USD since mid January, which dampens inflationary pressures and speaks for lower US 10y yields.

The Beige book points towards companies not fully passing on the costs of tariffs on to consumers: ”Firms in multiple Districts noted difficulty passing input costs on to customers”. That means a 25% tariff will not lead to a 25% increase in the price, but for example a 10% increase. The remaining 15% will come out of the company’s bottom line. Again, tariffs are less inflationary than some might have expected.

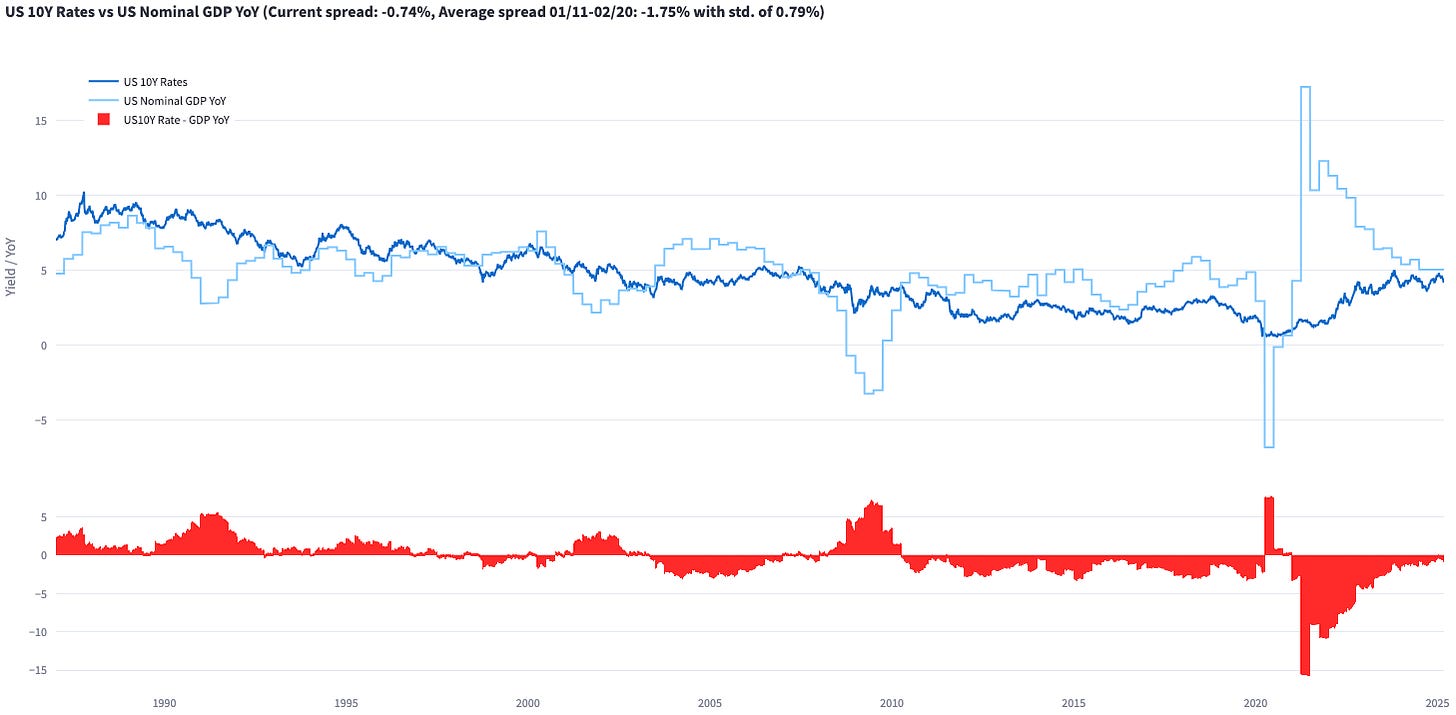

If you add 1) stricter immigration policies, 2) a reduction of the federal deficit and 3) a further decline in shelter inflation to the mix, inflation should continue to decline towards the 2% target. If the US economy continues to slow towards 4% nominal GDP growth - based on historical spreads of US 10y yields and US GDP growth - it would suggest lower US 10y yields.

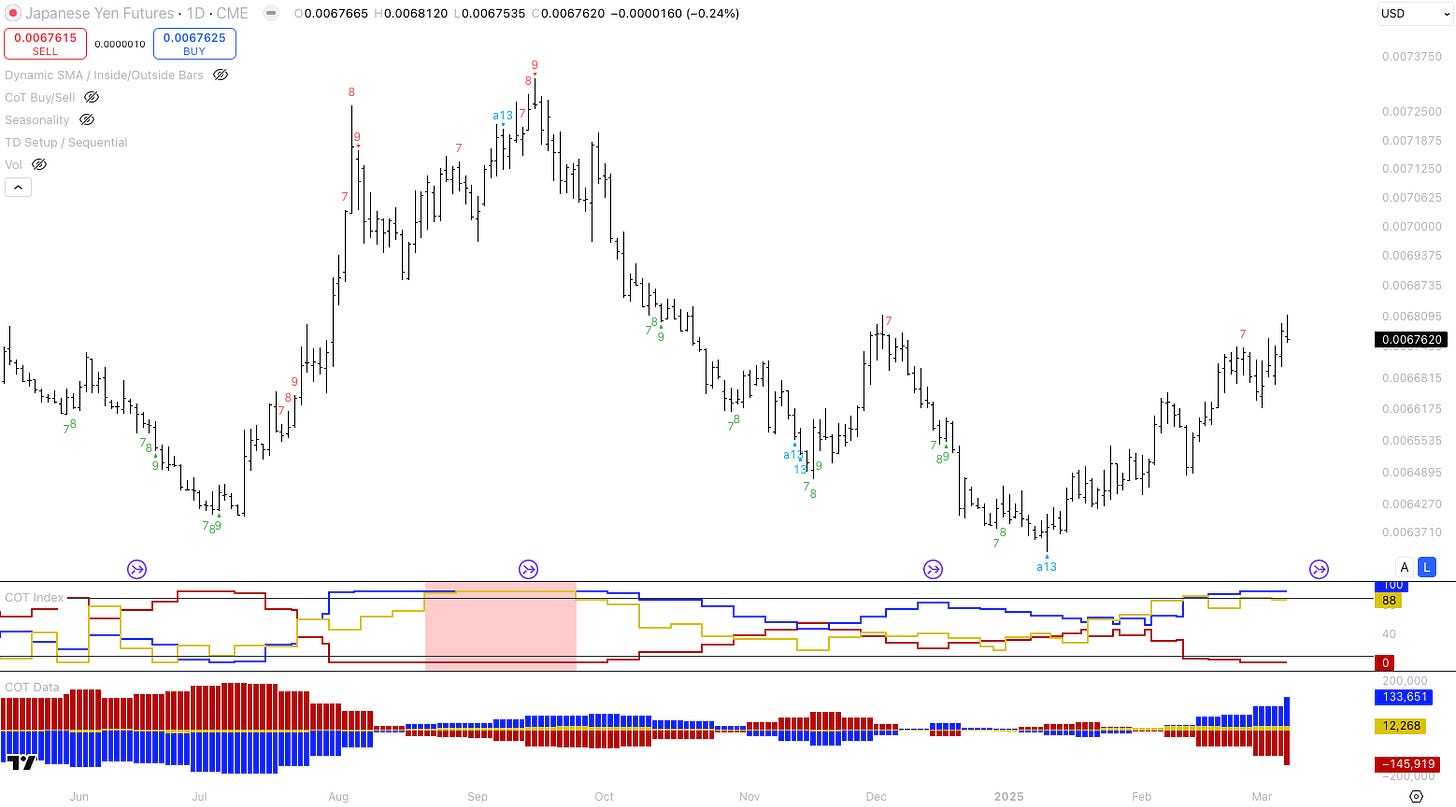

From a contrarian perspective, I think the move in the Japanese 10y yield (1.51%) could come to an end. There is too much debt in Japan and Japanese pension funds might find it more attractive to buy Japanese 10Y bonds at 1.5% than buying foreign assets and hedging the FX risk. I also get the feeling there are too many people on X saying “this time is different”, “Japan will grow faster” and “inflation will be sticky”. I am not an expert on Japan, but if that is the consensus, the risk-to-reward to fade it is usually more attractive than jumping on the trend too late.

If the Japanese 10y yield peaks, it could translate into JPY selling. Based on CoT data, JPY positioning is quite bullish right now. If we get bearish USD news or bullish JPY news, but JPY sells off on that, it could be worth trying to short JPY.

Fiscal stimulus in Germany

This week’s big news came out of Germany. The CDU & SPD want to pass a 500bn EUR infrastructure package and essentially remove defence spending from the debt brake. If the CDU & SPD can convince the Green party to vote for the proposed policies, the parliament could pass these measures in the next two weeks. This is massive. MacroAlf put it best “Imagine if the US announced a $5+ trillion fiscal injection and told you they stand ready to do “as much as it takes” on top”.

Germany and Netherlands are the only European countries with headroom for fiscal stimulus. Investors have been waiting for these kinds of measures for years if not decades. Many investors with low equity allocations in Europe could see themselves under-invested. Capital inflows will likely continue to support the Euro and European equities. Since the beginning of 2022, the Euro Stoxx 600 and the S&P500 have performed equally good.

Summary

I still have a long GBP position on, but I took profits on most of it. The easy money has been made and “long Europe (EUR & GBP)” is consensus now. I don’t think long Europe is the wrong investment thesis, but I am trying to trade turning points, not trends. I am just sticking to my process.

I am looking to add to my equity positions. I will probably add US and also European equity exposure. I do this mainly in my long-term tax-incentivised investment vehicles, which I do not want to touch in the next years. Drawdowns such as the one we are currently witnessing are usually good opportunities.

I am looking to short JPY. I think the move in Japanese 10y yields might be coming to an end and positioning in JPY is almost crowded bullish. The risk-reward to fade “this time is different” trends is usually good. I am waiting for a news failure. No news failure, no entry.

The bullish US 2y future thesis worked out great. I am neutral the short-end (US 2y futures) and US 10y, but with a bullish bias. I think the 10y yield is likely headed lower. I do not have a position on right now.

Thank you Mr. Repo, amazing reading!

A quick follow-up questions, if that's ok.

For the GDP-Now measure from Atlanta's Fed, when thinking about "core" components, do you strip out net exports? As of the latest print, they're stripping 384bps of growth, and final number is -2.4%, so roughly everything else besides net exports is still growing at 140bps. So, even if one wanted to forget about net exports (maybe given import frontloading or lower exports by stronger dollar or both) the rest of the economy is still slowing down (most concerning to me, consumer spending went from 153bps in late february's GDP Now to a meagre 30bps in the latest report). Do you think this reflects just a soft patch or also consisten with the underlying slow down?

Whith a shifting consenus to slower gdp and "sell-off" market + growing odds of 3 cuts this year (and after a succesful trade on the long side) would you tactically think about taking the other side of those cuts and fade them? I'm curious about your thoughts, given some inflation metrics still seem to be sticky, but specially since the market turned from a month ago on cuts.

Lastly, when you say you're watching for a news failure on JPY, do you mean a positive news that fails to translate into bullish momentum for the currency?

Thank you again, I really appreciate the writing!

Valentino