How to Invest in 2025

AI, Trump's administration, shelter inflation, the US dollar selling off, high equity market valuations, elevated earnings expectations and bullish crypto news. Making sense of it all.

In this article, I outline my thinking about FX, interest rates, equities and crypto. I am writing these pieces primarily to synthesise my own views and trading ideas. It is 100% free - make sure to subscribe so you do not miss the next one!

Bonds and FX: Is the US dollar rally over?

The world of bonds and foreign exchange has been anything but static. This week could have been a significant turning point for the US dollar. Let’s dive into some of the themes.

US 2-Year Futures: A Turning Point?

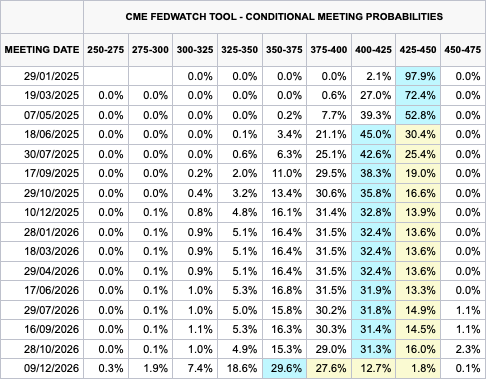

The US 2-year future is a good approximation of what is happening at the short-end of the US yield curve. You can also look at SOFR futures to specific dates, but for simplicity I will focus on the 2-year future. As of January 25th, there is only one cut priced into the yield curve for all of 2025.

Next week’s FOMC could be the catalyst for the bond market. If Powell speaks dovishly, it might lead to it pricing in more cuts again. Thus far, there has been no technical confirmation of an end to the selloff, nor a clear change in trend (see chart below). If Powell is dovish next week and the path of short-term interest rates is re-priced, the US dollar will not like it.

Trump’s Perspective on Inflation and Shelter Inflation Cooling

Donald Trump understands that energy prices impact inflation. He told reporters in the Oval Office: "I'd like to see oil prices come down, and when the energy comes down, that's going to knock out a lot of the inflation. That's going to automatically bring the interest rates down." In fact, he said „with oil prices going down, I will demand that interest rates drop immediately (…)“. It seems like bond vigilantes are not only fighting the Federal Reserve anymore, but also a dovish White House that wants lower interest rates.

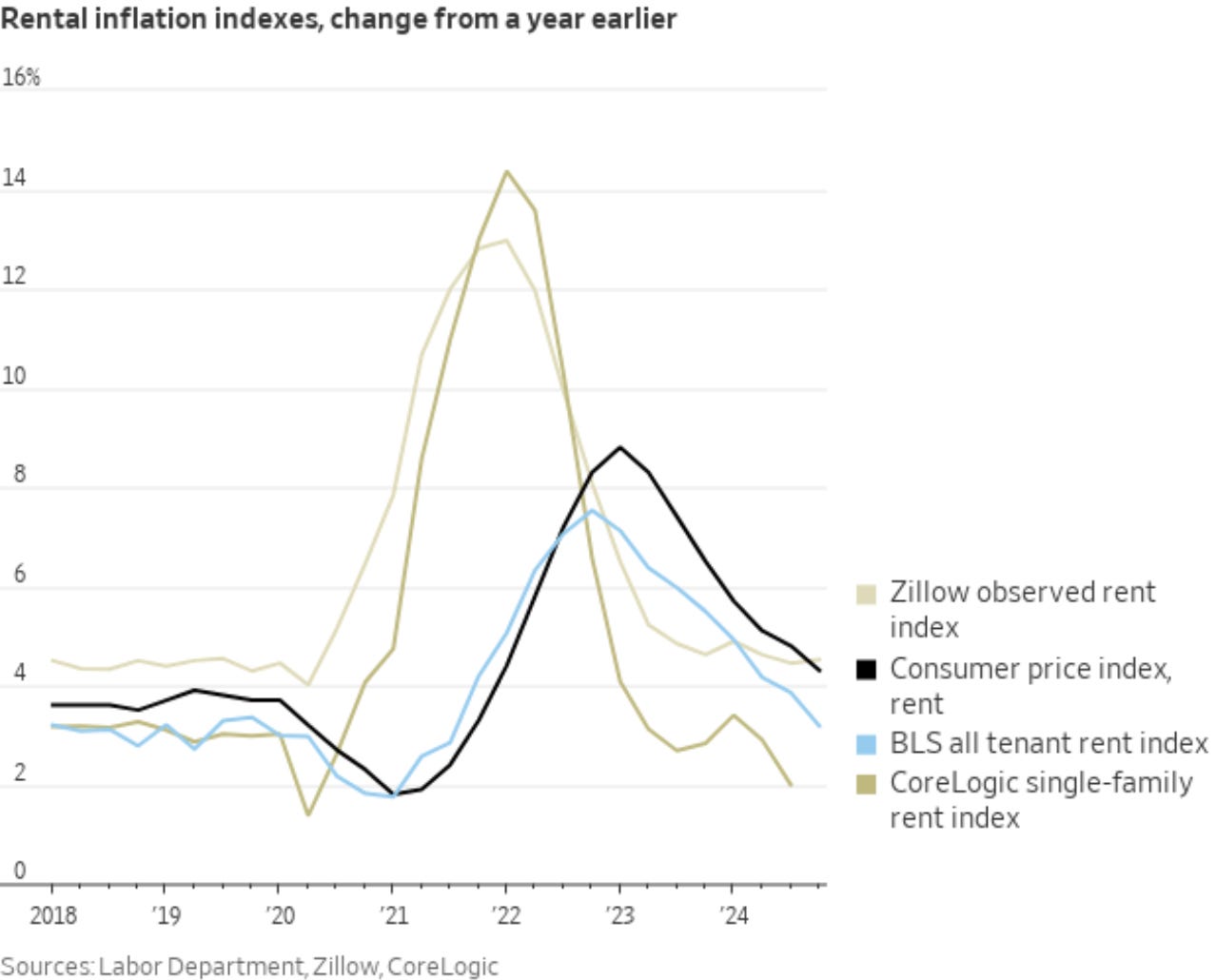

Shelter inflation, a persistent thorn in the inflation narrative, showed signs of easing. Nick Timiraos wrote on X that the Labor Department’s "all tenant rent" index rose just 3.2% year-over-year in Q4, compared to 3.9% in Q3 and 5.5% a year earlier—marking a return to pre-pandemic levels. Warren Pies noted on X that the CoreLogic Single-Family Rent Index hit a 14-year low. Both developments are disinflationary and could provide relief to services inflation.

Is Economic Data Going to Come in Weaker?

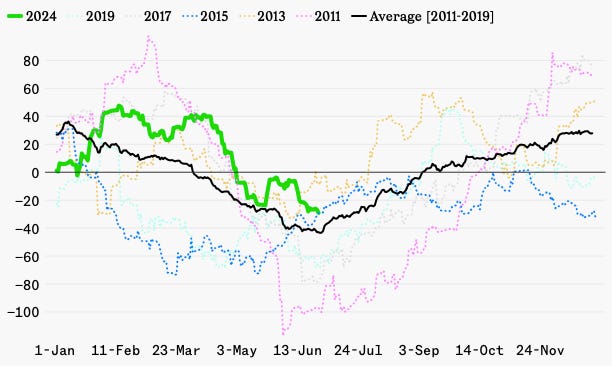

Historically, the Citi Economic Surprise Index tends to decline between now and early June, which implies that US economic data comes in weaker relative to expectations. This has implications for both US rates and the dollar. If economic data starts coming in (marginally) weaker than expected, it should also lead to the short-end pricing in more cuts - especially if simultaneously shelter inflation provides relief to services inflation. With many macro investors still anticipating that inflation will either re-accelerate or stabilise above 2%, and with positioning in the US dollar heavily skewed long, the market could find itself wrong-footed.

I think the price action in currencies this week already pointed towards crowded positioning. For example, in Canada, weak retail sales data saw core retail sales fall by 0.7% month-over-month, far below expectations of a 0.1% increase. Nevertheless, the Canadian dollar was up on the day. Of course, the CAD story is largely dependent on whether Trump decides to put tariffs on Canada. But with Trudeau stepping down and the more business-friendly Conservative Party likely winning the next election, the Canadian dollar could stabilise at current levels, and possibly even rally.

Meanwhile, stronger PMI readings in Germany, France, and the UK drove rallies in the Euro and British Pound. If we look back ten weeks from now, the Trump inauguration could have been a classic “buy the rumour, sell the news” event. Of course, this is heavily dependent on whether there will be tariffs in the next weeks. As of now, I feel comfortable with my long GBP position that I opened on Tuesday. I think currency trades currently provide the best risk-reward for betting on a rally of the short-end and a falling US dollar.

Equities: Opportunities and Risks

I find myself conflicted about equities. High valuations relative to elevated earnings expectations pose the largest risk in 2025. However, slowing growth from moderate levels, combined with a Federal Reserve easing interest rates, creates a bullish backdrop.

A Favourable Environment with Caveats

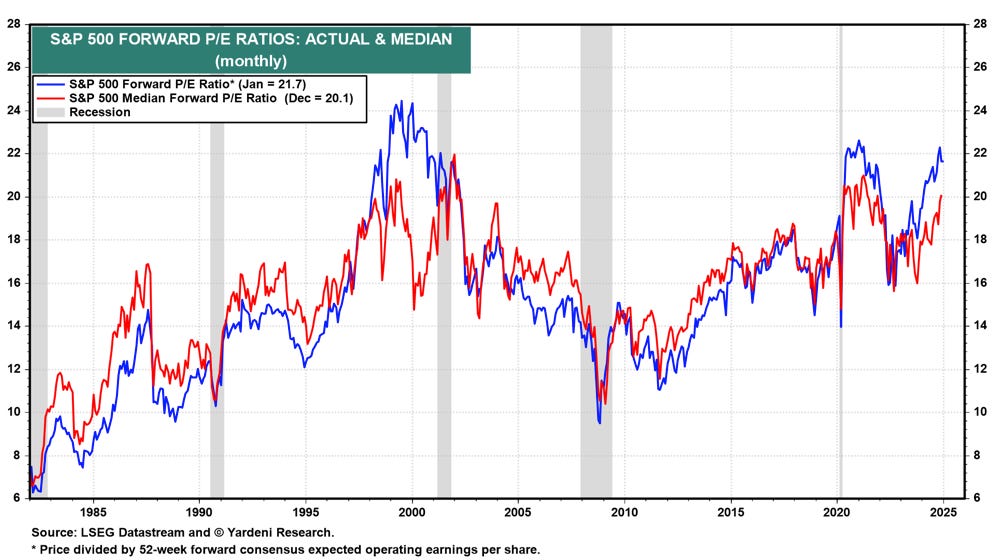

Looking back at the pre-pandemic era, equities have typically done well when growth was slowing from moderate levels and the Federal Reserve tried to stimulate the economy. It is a bit different now, as the inflation genie has escaped the bottle, and we are not yet sure if we have managed to capture it and put it back. Assuming that we have, the environment for equities is quite bullish. Risks are mainly high valuations, as measured by forward P/Es or the equity risk premium relative to 10-year Treasury yields. The chart below shows that the S&P500's forward PE.

As Bob Elliott pointed out on X this week, achieving the same growth surprise as the last two years would require GDP growth of 4-5%, an unlikely scenario. If earnings disappoint in 2025, forward PEs will look even more elevated. There are caveats though. Firstly, forward PEs look (more) elevated because tech companies account for a high percentage in the index. Arguably, their stocks deserve higher multiples. And secondly, valuations are a horrible timing tool. Equity markets could do well for another one to two years from here. The same happened from 1996 to 1999. For equities to decline, there needs to be a catalyst. High valuations are not enough.

Timing Market Peaks

Predicting equity market peaks is a notoriously difficult task. My personal approach to de-risking equity exposure is when two factors confluence: 1) there are significant macro forces on the horizon, which could lead to a large decline (>10%) and 2) prices already display weakness. Signs of weakness could be bullish news but equities do not go up. It could also be purely technical with breadth deteriorating. Topping is a process and I do not have the expectation to sell the highest tick.

There is a reason why equities go up

Everyone likes to predict bear markets. But there are very good reasons for why equities go up. The US is entering one of its most business-friendly periods in years. The following announcements were made only this week:

The Stargate Artificial Intelligence Project was announced. Cumulatively, we are talking about USD 500bn in AI investments in the US over the next four years.

Mark Zuckerberg said Meta is building an AI datacenter with 1.3 million GPUs. The datacenter will have almost the size of Manhattan.

Trump said he will ask Crown Prince Mohammed bin Salman to invest USD 1tn in the US economy.

Innovation around AI is accelerating, not decelerating. The impact on the economy and earnings is real. The massive investments made in the US economy are real. US exceptionalism is real. There is no place except the US where such an innovative, entrepreneurial, big-thinking and risk-loving mindset is paired with huge amounts of capital and the most sophisticated venture capital industry in the world. And with an administration focused on deregulation and tax cuts, the environment looks even more favourable.

What if the semiconductor sector (SOXX) breaks out to the upside in the next couple of weeks? Will equities do poorly if that happens? Probably not. AI has dominated the headlines in the past year, but the semiconductor sector has gone nowhere. Is it time for another move up in 2025?

China has disappointed in 2024, but what about 2025?

Lastly, let‘s talk about China. The Central Economic Work Conference was held in December. The Politburo, i.e., the policymaking committee of the Chinese Communist Party, called for „moderately loose monetary policy“, „even more active fiscal policy“ and „unconventional (stimulus)“. These are words they have not used since the Great Financial Crisis.

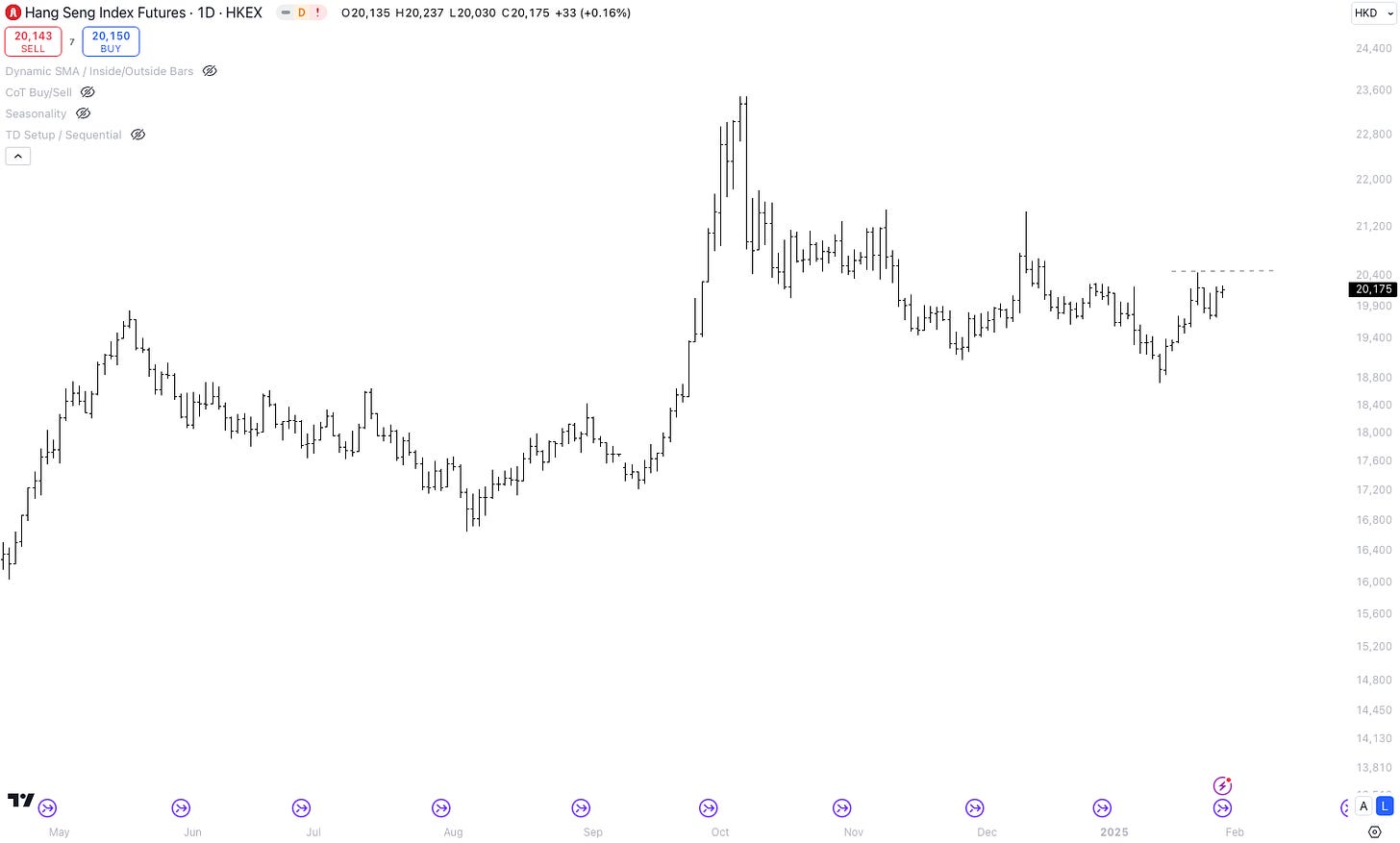

Is China just going to watch from the sidelines while Trump is pushing his pro-growth agenda? The pressure on the Chinese government to boost its economy is increasing. Some Chinese economists are expecting stimulus packages in 2025 to reach 10% of Chinese GDP. If China announces stimulus measures, it will also be beneficial for the US economy and US equities. Chinese equities are stabilising. I am waiting for price to confirm my thesis.

Crypto: Digesting Gains and Looking Ahead

The crypto market - and I am referring mainly to Bitcoin and Solana - is digesting its gains. I am personally making my decisions in the crypto world based on 1) whether I am bullish risk assets and 2) technicals. My view on risk assets in 2025 is generally bullish. I think there needs to be a catalyst for equities to decline meaningfully and as of now, I do not see a bearish catalyst.

The Strategic Bitcoin Reserve and Solana News

I read a few interesting pieces on crypto this week. Let‘s start with Trump, who said the US will be the world capital of AI and crypto. This might seem bullish, and it probably is from a regulatory perspective, but the „Strategy Bitcoin Reserve (SBR)“ is very unlikely to lead to any Bitcoin buying anytime soon. For now, Trump’s executive order only tasked a working group with evaluating stablecoins and the feasibility of an SBR in the next six months.

Two factors that could be bullish for Solana in 2025 are 1) SOL CME futures, which will go live on February 10th and 2) the approval of Solana ETFs in 2025. Currently, Solana has the fastest-growing developer ecosystem and surpassed Ethereum on most on-chain metrics such as trading volumes or daily active addresses. However, Solana still has only one quarter of Ethereum‘s market cap (126bn vs. 402bn). In price terms: if Solana goes to 1,000 USD, it would have Ethereum’s market cap. I typically trade in and out of my Solana position. In 2025, my plan is to either buy 1) pullbacks off the lows or 2) breakouts.

I hope you enjoyed this article. I am planning to write about my views and trade ideas more often on Substack. Subscribe, so you do not miss them - it is 100% free.