Hikes in Europe, Shorts in Small Caps - Hunting for the Next Big Reversal

Stagflation signals from ISM and claims data meet rising credit creation. Euro strength is biting exports, and speculators are crowded into Russell 2000 shorts.

Hey,

Quick update this week - work has been keeping me busy.

Thoughts on Macro

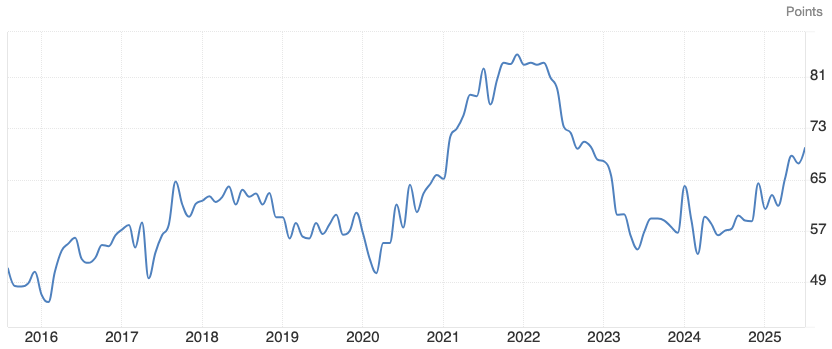

This week’s ISM Services Prices index pointed to persistent inflationary pressures, printing 69.9 versus 66.5 expected.

Continuing claims also came in higher than expected, reinforcing the stagflationary tone.

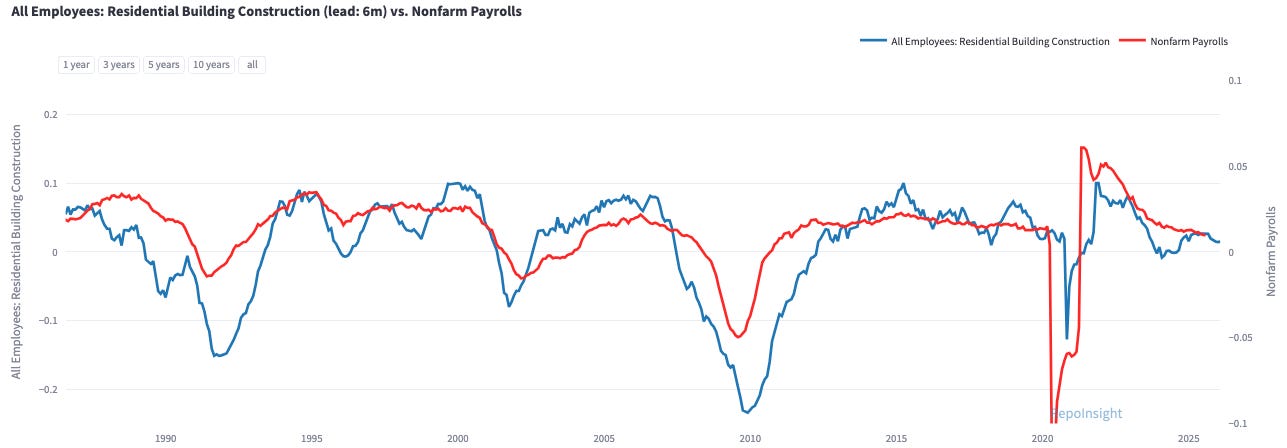

Last week, I noted that cyclical sectors like manufacturing and construction are showing signs of strain. These areas typically account for the bulk of job losses during slowdowns. The chart below compares residential building construction (blue) with NFPs (red).

On trade policy, US tariff revenue is running at roughly $30bn/month. If Lutnick is serious about hitting $50bn/month, tariff rates will have to rise further - not a great sign. Are potential tariffs on India simply the next round in this escalation?

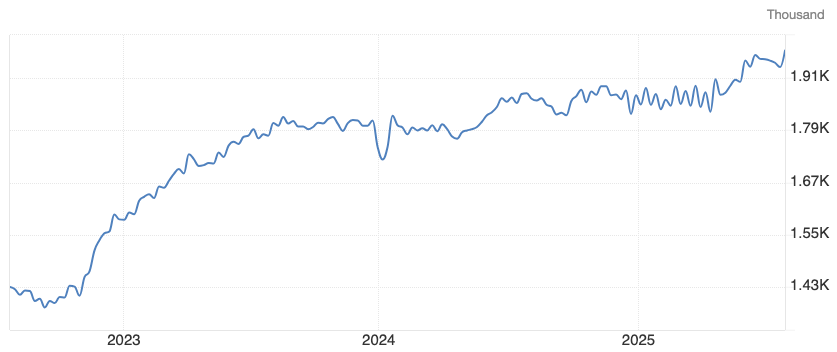

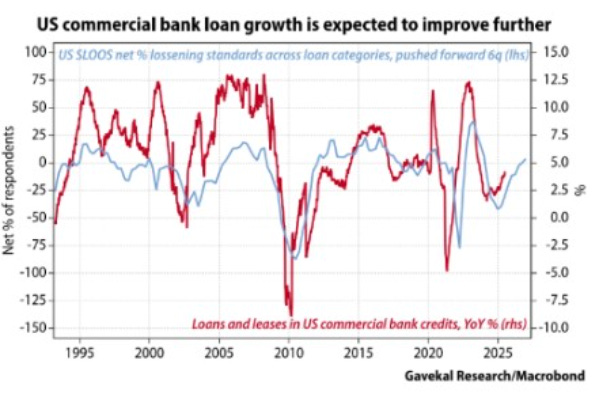

On the policy front, it’s looking increasingly likely that Waller is the frontrunner to replace Powell in May 2026, given his inclination to cut rates. Survey data already hints at an acceleration in credit creation lower rates would add fuel to that trend. That’s one macro positive worth flagging.

Thoughts on Markets

Two of the most widely held views right now are:

The US dollar will weaken as the Fed cuts rates and Trump threatens the Fed’s independence.

The equity rally will carry into year-end, though August and September could bring volatility given weak seasonality.

Sometimes the consensus is right. But I can’t understand the rush into the Euro. Yes, Germany is throwing money at its economy - but that doesn’t fix structural problems like a steadily weakening industrial base. German cars could be far more competitive globally if the Euro were weaker.

A stronger Euro is deflationary for the Eurozone - imports get cheaper. Meanwhile, US tariffs are also deflationary for Europe. They’ll hurt the European economy, while US consumers end up paying more for European goods.

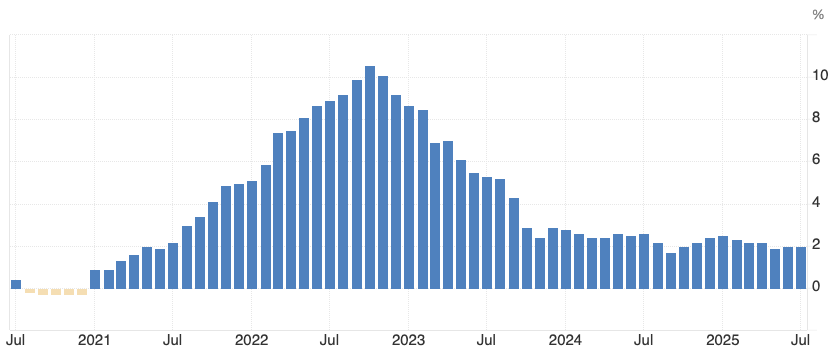

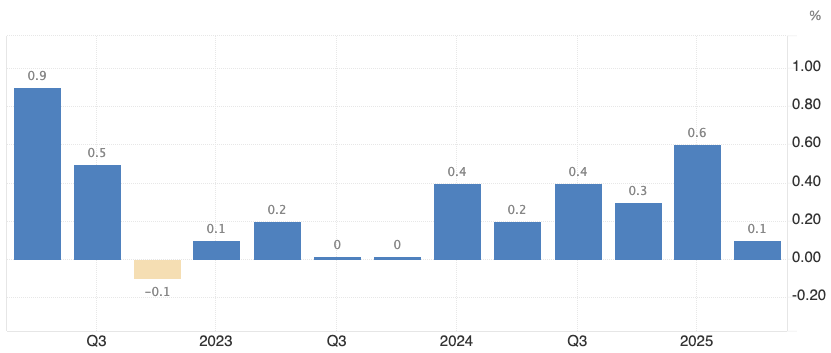

Eurozone inflation is sitting exactly at the ECB’s 2% target.

Euro Area GDP growth is basically flat.

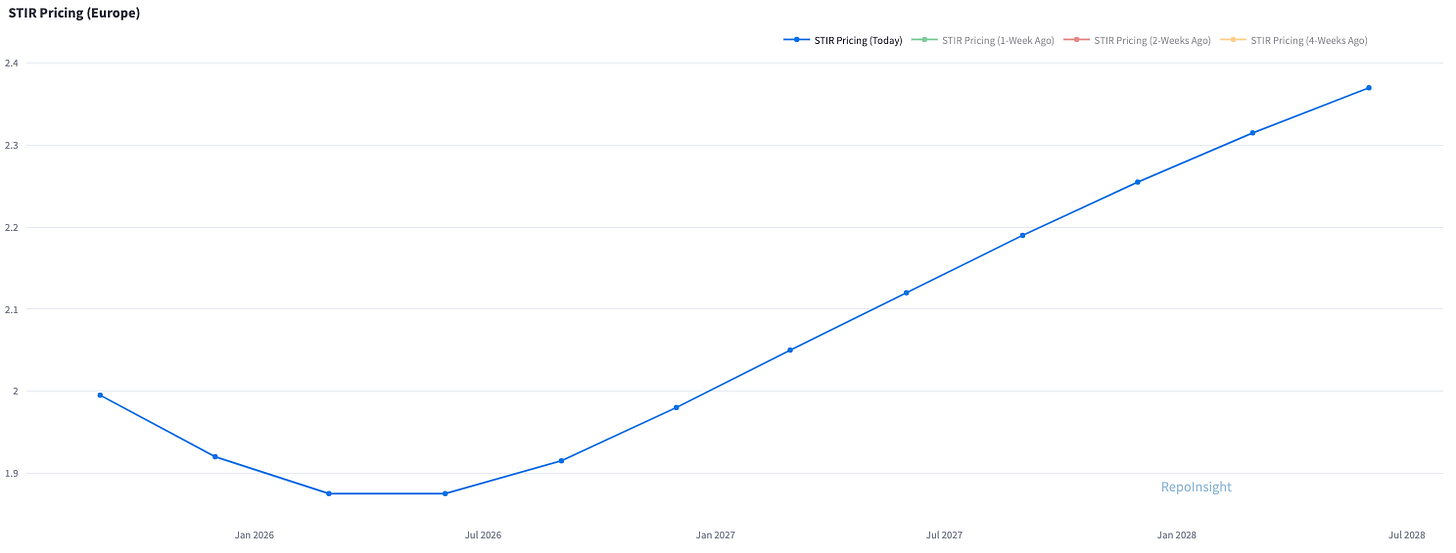

Yet, the Euribor Dec ’25–Dec ’26 spread is pricing in 6bps of hikes (!).

Christine Lagarde - the ECB president giving interviews with books on Modern Monetary Theory in the background - is going to hike in this environment? See the Euribor curve below.

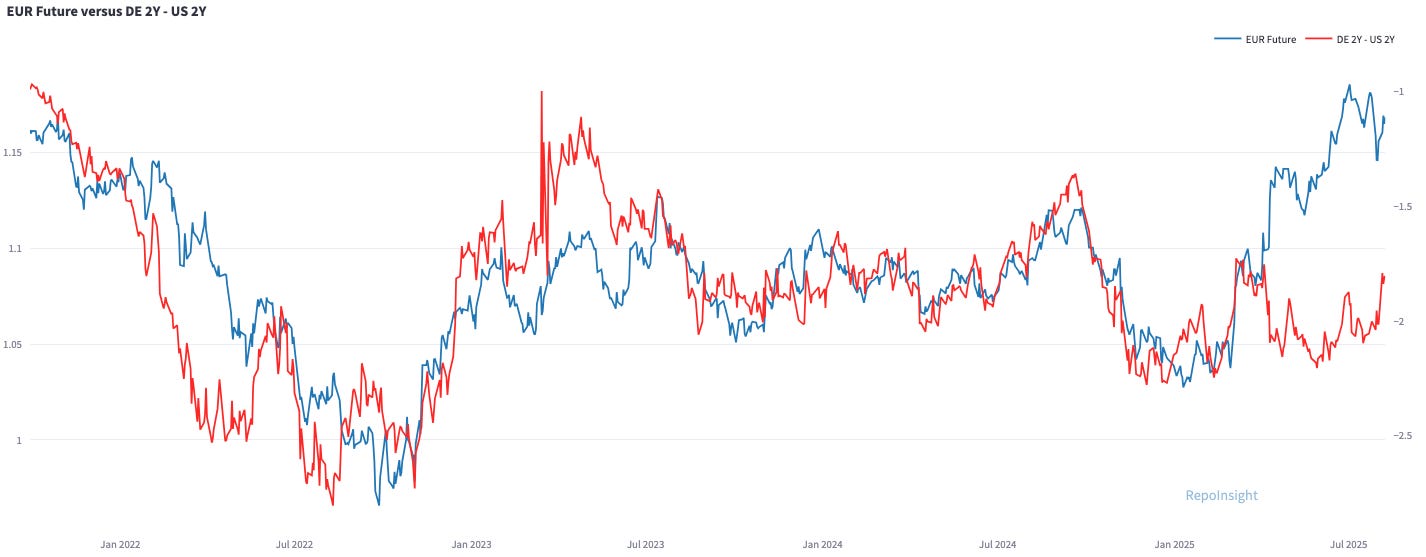

I doubt the ECB will hike next year. German 2-year yields are at 1.96%, while the Swiss National Bank has already cut to 0%. If the ECB follows with cuts to 1–1.5% over the next 12–18 months, German 2-year yields would likely fall, narrowing yield differentials and putting pressure on the euro.

The Fed will also cut rates, but STIR markets are already pricing five cuts over the next 13 months - despite the risk that US inflation re-accelerates.

One plausible scenario: Europe surprises to the downside, the US surprises to the upside, the ECB turns dovish, and the Fed stays hawkish or meets expectations. With speculators already long euros, that would be fertile ground for a reversal - meaning a weaker Euro.

I am still long US dollars in my EUR-denominated account. I will close the position if the high on July 28th or the below trend lines is exceeded on a closing basis.

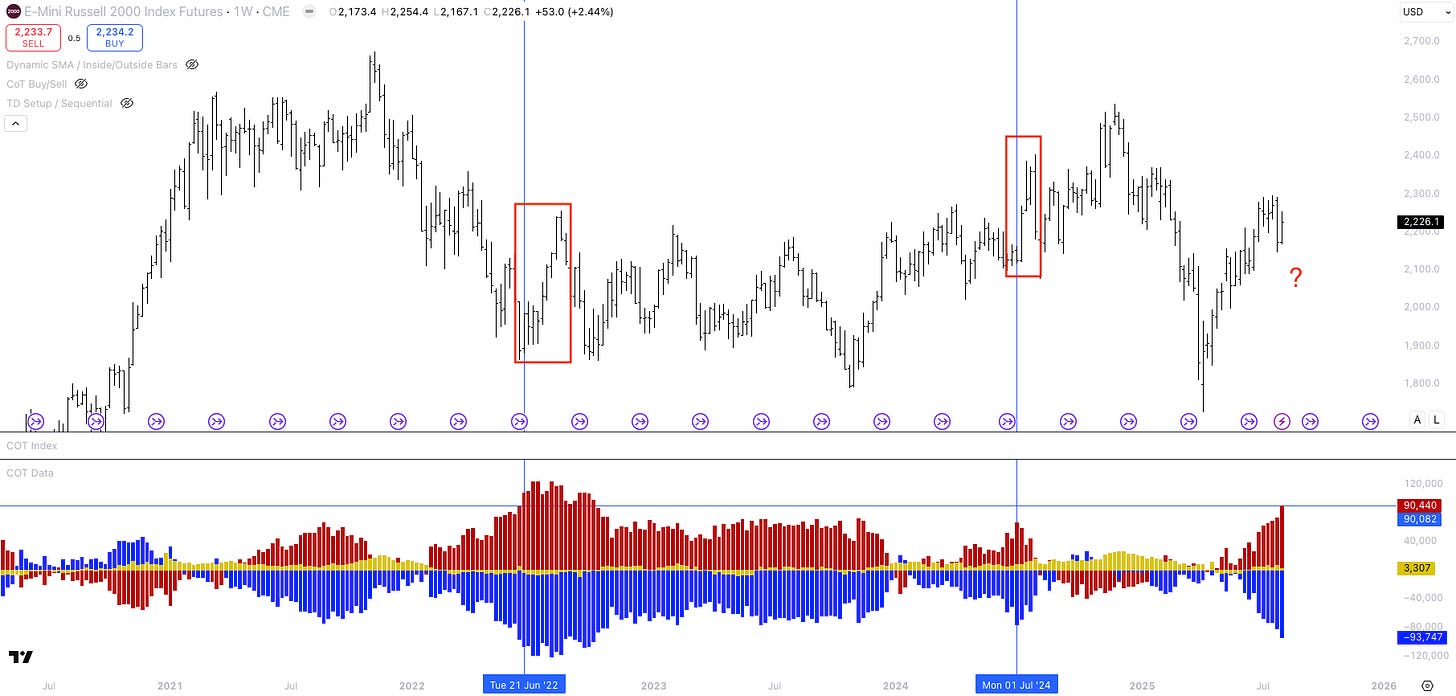

I currently have no equity exposure in my trading account, but the “Mag-7 eats the world” and “long Nasdaq” narratives are everywhere. Meanwhile, short positioning in the Russell 2000 has been building.

My guess: long/short equity funds are crowded long in tech and short in small caps - a trade that’s worked for years. As a PM, you’re not getting fired for losing money there.

The risk? When positioning gets this one-sided, unwinds can be sharp. If Russell 2000 shorts start covering, we could see a quick pop higher.

The past three months have been frustrating - my trading account has gone sideways, and I’ve been wrong on the Euro. I’m still up 6.0% YTD, but that’s a 2.1% drawdown from the peak. For now, I’m staying on the sidelines, holding only my short Euro position (long USD cash in my EUR-denominated account).

Do you think one should short long-duration bonds if next week's CPI is higher than market expectations?