ECB Hikes in 2026, AI’s 1% Contribution to Q1 U.S. GDP, and America’s Fiscal Headwinds

How AI impacted Q1 GDP numbers, America's fiscal problem, the structural bear case for the US dollar, and more.

Hi everyone,

I was quite busy this weekend, which is why I am posting this article on a Monday. Let me know if you like the new structure: 1) chart of the week, 2) the economy, 3) views on markets, 4) positioning update, and 5) outlook. If you have any other feedback or would be interested in a specific topic, feel free to reach out in the comments below. Having said that, let’s dive right in!

These write-ups take a lot of time and effort to put together, so if you find them helpful, I’d really appreciate it if you shared them, forwarded them to a friend, or posted them on X. It keeps me motivated to keep doing the work and putting these pieces out regularly. Having said that, let’s dive right in!

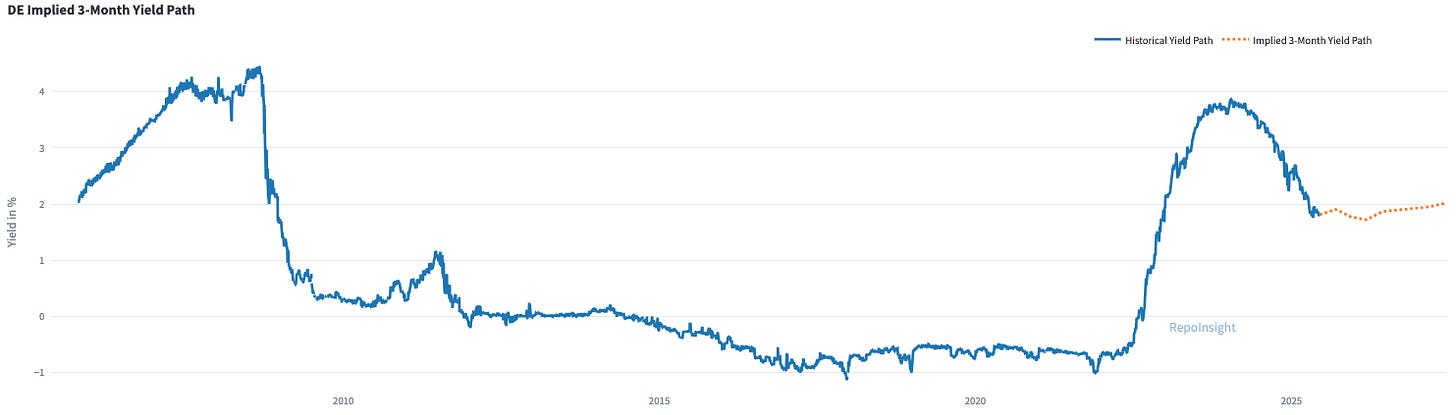

1. Chart of the Week: A Eurozone Hike in 2026?

Investor sentiment around the Eurozone’s economic outlook has brightened. Euribor futures are now pricing in 9.5bps of rate hikes in 2026, and the German yield curve implies the 3-month rate will trend higher from here (see chart). The European Commission expects Euro Area GDP growth of 1.4% and inflation at 1.7% in 2026. Unlike the U.S. - where inflation remains sticky - Eurozone inflation has hovered around the 2% target for months.

But Europe still faces significant structural challenges. It’s a slow-moving, heavily regulated market, often unfriendly to business. In this context, the bar for the ECB to hike in 2026 is quite high. A few weaker-than-expected data prints could easily prompt markets to reprice for cuts rather than hikes. To me, it looks like an asymmetric trade to bet on 9.5bps of hikes in 2026 getting priced out of the Euribor curve.

2. Macro Pulse: Tariffs, Oil, and AI

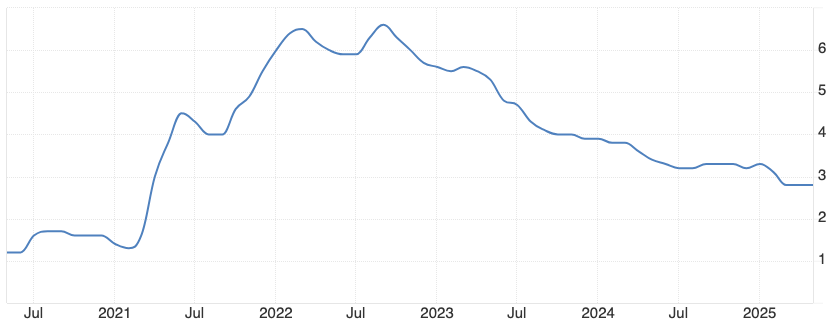

The latest CPI release - the first to reflect the early effects of Trump’s new tariffs - came in slightly below expectations. Core CPI rose 2.9% versus 3.0% expected (see chart below), while headline CPI met the forecast at 2.4%. I suspect much of the surprise came from firms front-loading inventories ahead of tariff implementation, which temporarily dampens pricing pressure. That effect won’t last; once it fades, tariffs should become inflationary.

Markets have adapted to the tariff talk. U.S.-China trade talks remain constructive but lack tangible progress, while Bloomberg reports the U.S. and Mexico are close to a deal that would lift Trump’s 50% steel tariffs within agreed quotas. Analysts expect the tariffs could reduce corporate earnings by about 0.5%. As I’ve argued before, the economy can likely absorb a blended tariff rate of 10–15%. Growth may slow modestly, but inflation could drift higher.

The Iran-Israel conflict poses a more immediate risk to volatility. Two possible escalation scenarios are worth watching: (1) Iran could suspend its crude exports - roughly 1.4–1.5 million barrels per day - or (2) attempt to block the Strait of Hormuz, through which 17 million barrels of oil flow daily. The latter scenario is unlikely, as it would be self-damaging for Iran and its allies.

Even if Iran cuts exports, OPEC+ has over 5 million barrels per day in estimated spare capacity, enough to offset the loss. While these figures are imprecise, the surplus limits the upside risk. Bloomberg Economics estimates that $100 Brent oil would add 0.6% to headline CPI, pushing it to around 3.2% by June. I doubt the oil price will increase to $100 as fast money positioning has become much less skewed to the short side, but it still is a scenario worth considering.

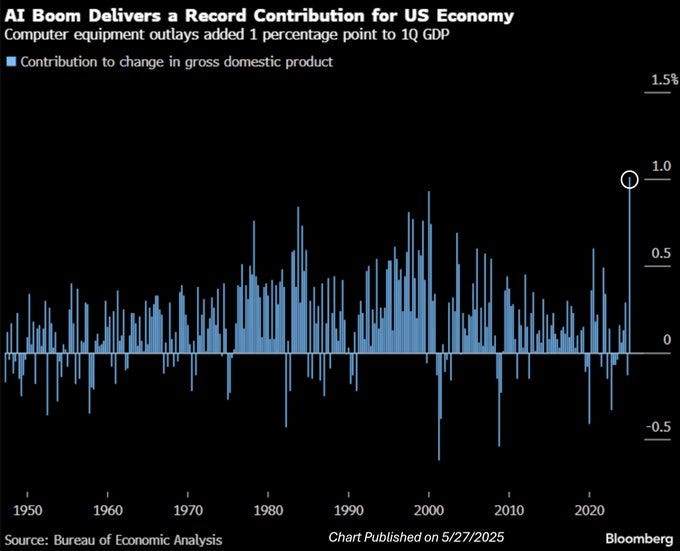

And lastly, I wanted to take a look at the impact of AI on economic growth. The below chart shows that spending on data centers and infrastructure has already been a significant tailwind to U.S. GDP growth in Q1. Computer equipment outlays added 1% (!) to Q1 U.S. GDP numbers. The economic impact is real - even before productivity gains start showing up in corporate margins.

3. Risk Assets Rundown: Are Bond Vigilantes Back?

Last Friday, markets de-risked following the escalation between Israel and Iran. The S&P 500 fell 1.13% on the day. But interestingly, U.S. Treasuries - a safe haven asset - failed to catch a bid. Instead, yields moved higher across the curve: 2-year yields rose 3.8bps to 3.95%, 10-year yields climbed 4.4bps to 4.41%, and 30-year yields increased 5.5bps to 4.90%.

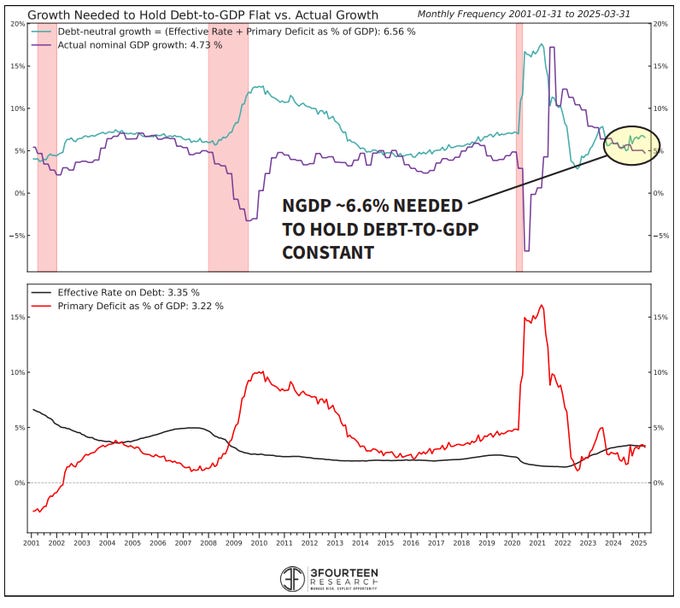

In my view, there are two key concerns weighing on U.S. fixed income: (1) the inflationary implications of tariffs and (2) the scale of fiscal deficits and the associated bond supply that must be absorbed by the private sector. Let’s focus on the latter for now.

Warren Pies estimates that the U.S. needs to grow nominal GDP by roughly 6.6% annually to stabilize its debt-to-GDP ratio. Over a 5-10 year time horizon, it is unlikely the United States will be able to achieve such growth rate.

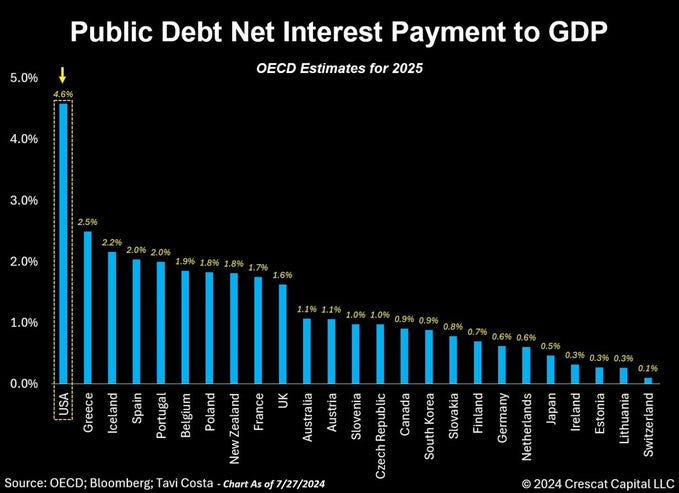

The United States is under significantly more pressure than most developed economies to generate strong growth in order to service its debt. Interest payments now account for 4.6% of GDP - more than double the level seen in many other advanced nations.

If Trump’s Big Beautiful Bill passes, fiscal deficits will stay elevated. Once the debt ceiling is lifted, the Treasury will flood the market with bills - but eventually, it will need to term out the debt. Long-dated bonds carry more interest rate risk than short-term paper, so there must be enough investors with the appetite and capacity to absorb that duration.

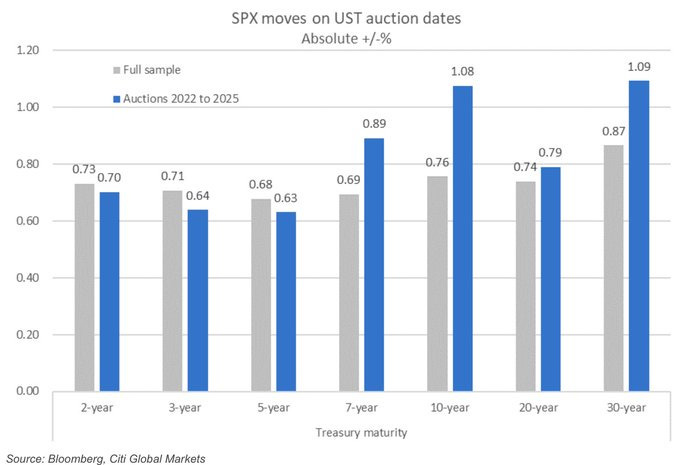

If the private sector cannot take down the supply - whether due to fiscal concerns, limited risk appetite, or leverage constraints - yields will rise. And when yields rise, there will be ripple effects across all financial assets, including equities. We’re already seeing signs of this dynamic: equity volatility has increased on auction days.

So far, the 5% level in 30-year yields has held. As long as long-term inflation expectations stay anchored, investors with long-duration liabilities - such as pension funds and insurance companies - are likely to step in and buy 30-year bonds if yields push meaningfully above 5%.

We are entering a new regime marked by re-shoring, de-globalization, and rising geopolitical tensions. The low-inflation decade of 2010–2020, when inflation averaged just 2%, appears to be over. Looking at a broader historical context, average U.S. inflation over the past 125 years is around 3%, and since the U.S. abandoned the gold standard in 1971, the average has been closer to 3.9%.

Long-end yields reflect three components: inflation expectations, real rates (i.e., growth expectations), and the term premium. If long-term inflation expectations rise to 3–3.5%, real rates normalize around 1–1.5%, and the term premium climbs to 1–1.5%, 30-year yields could reprice higher - potentially reaching a range of 5 to 6.5%.

Turning to the U.S. dollar: in recent weeks, the USD and U.S. Treasuries have begun behaving like assets from an emerging market. Typically, higher yields would support the dollar, but that hasn’t been the case. Bond investors are mainly concerned about inflation and fiscal spending, while the dollar is being driven by global capital flows.

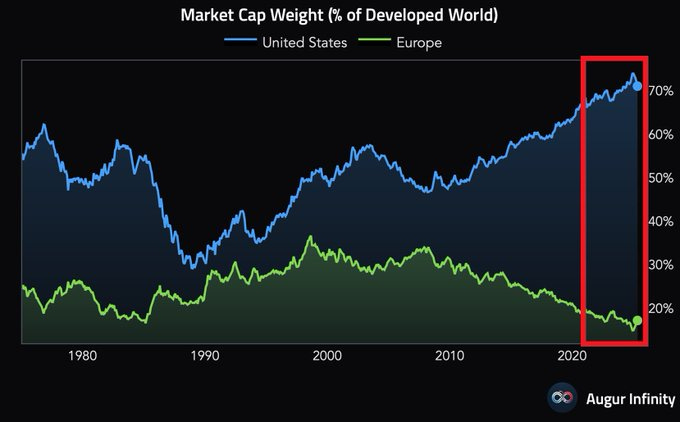

The U.S. has been a magnet for global capital for decades, and both domestic and international investors are heavily overweight U.S. assets. For instance, U.S. equities now make up 70% of the developed world’s total market capitalization - a staggering concentration.

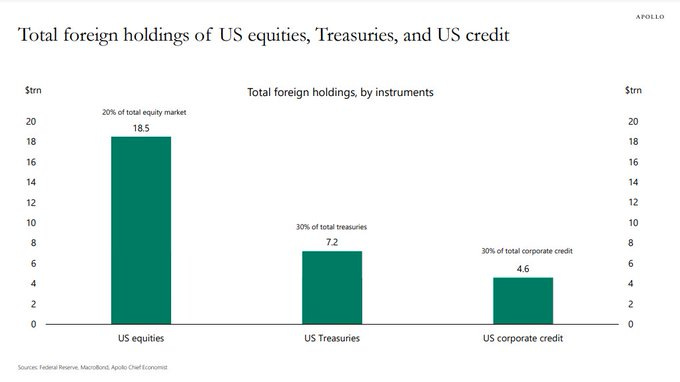

According to Apollo, foreign investors hold $18.5 trillion in U.S. equities (roughly 20%), $7 trillion in U.S. Treasuries (about 30%), and $4.6 trillion in U.S. corporate credit (also around 30%). If foreign demand for U.S. assets fades - either through active selling or simply a lack of new buying - it could place meaningful downward pressure on the U.S. dollar.

Over the past decade, U.S. dollar strength during risk-off episodes incentivized foreign investors to leave FX exposure unhedged. But that dynamic appears to be shifting. With the dollar weakening in recent months, foreign investors may be increasingly inclined to hedge their currency exposure - implying steady or growing USD selling pressure.

Combined with elevated U.S. equity valuations, these structural shifts in rates and FX markets present a strong case for reducing exposure to U.S. assets. The structural bear case for the US dollar is that this dynamic becomes a (bearish) self-reinforcing feedback loop. For now, the DXY has yet to decisively break below its July 2023 lows.

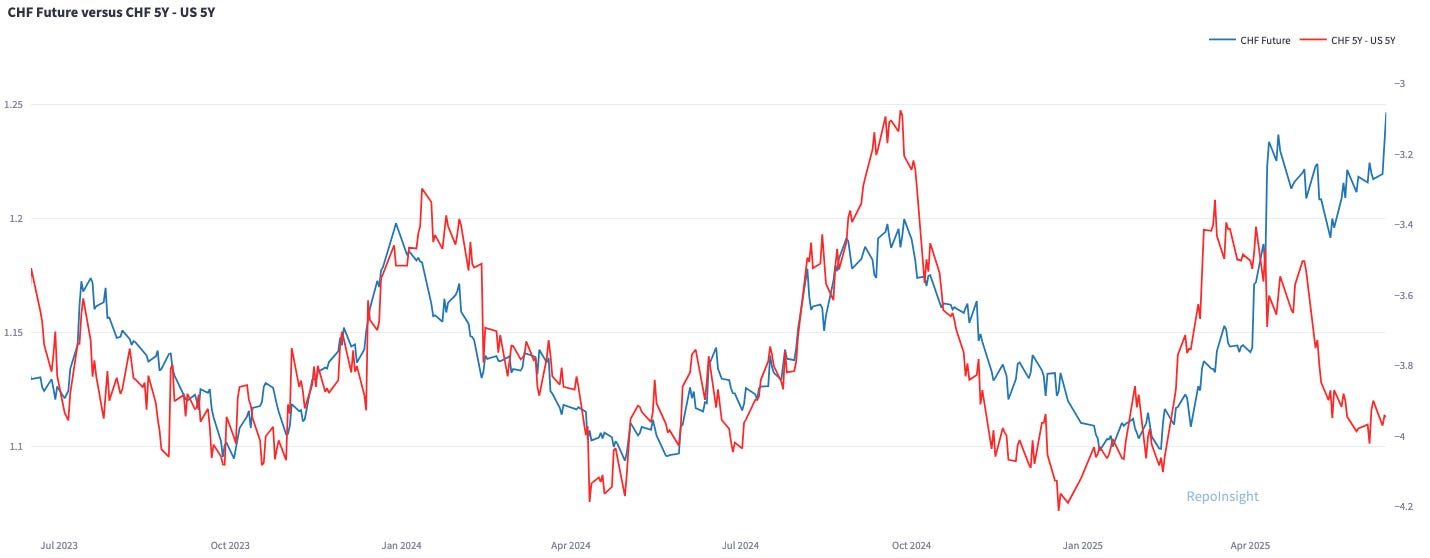

The most bullish argument for the U.S. dollar is positioning. Sentiment has gotten very bearish, and currencies like the JPY, EUR, CHF, and GBP have already rallied significantly against the dollar. If a bullish catalyst emerges - such a stronger U.S. data - it could catch many investors wrong-footed. A good example of this setup is CHFUSD, which has diverged meaningfully from the 5-year yield differential.

My trading style is contrarian. I am trying to pick turns when positioning is getting extreme and the tape is improving, i.e., bearish news do not lead to further sell offs. I will continue to monitor the US dollar from a bullish perspective - because that is my trading process - but I acknowledge the structural bearish headwinds and will be careful to cut my losses if the position goes against me.

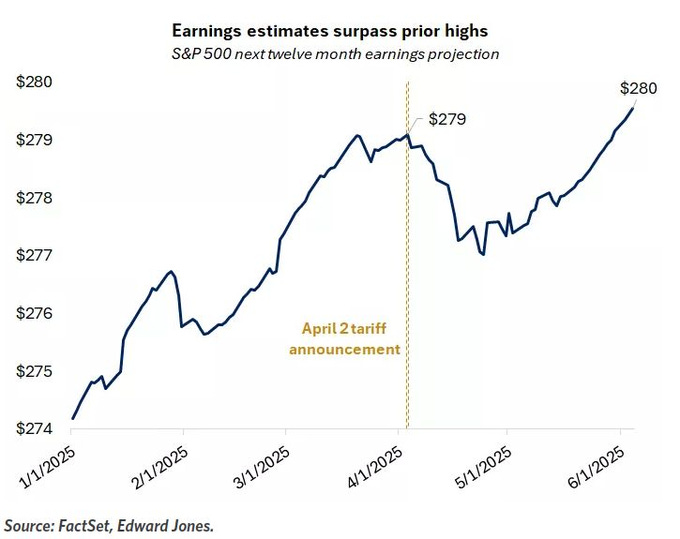

Let’s turn to equities. I remain long the S&P 500 and have rolled my futures position into the September contract. I don’t see a U.S. recession on the horizon, and in the absence of sustained, growth-negative surprises, I expect equities to continue drifting higher. Next-twelve-month earnings estimates have already climbed to new highs and equities have traded exceptionally well in the past few weeks.

AI’s impact on profit margins could become visible over the next two years. Big Tech cut new graduate hiring by 25% last year - largely because AI can now perform many of those entry-level tasks. Even if AI progress stalls - which it won’t - it could still replace many white-collar roles over the next five years, including tax consultants, lawyers, auditors, investment bankers, marketers, HR professionals, and more.

Dario Amodei, CEO of Anthropic, estimates that AI could eliminate up to 50% of junior white-collar jobs within the next one to five years. This shift would boost corporate margins but could also weigh on consumption. In the short run, however, I expect the margin expansion to more than offset any drag from reduced spending.

4. Trade Tracker / Portfolio Update

My positions remain unchanged - I’m still long the S&P 500. On Monday, I converted euros back into US dollars but reversed that move on Wednesday after it went against me. Year-to-date, the account is up 7%. Unfortunately, my current job does not allow me to trade everything, e.g., Euribor futures. If I had more flexibility:

I would look to go long the US dollar, preferably against JPY or CHF.

I’m also keeping an eye on the metals complex, especially silver, for potential short opportunities, given the extended positioning.

I’d consider fading the 9.5bps of hikes currently priced into Euribor futures for 2026.

5. Closing Thoughts / Outlook

Next week features four key central bank press conferences to watch:

Tuesday: BOJ press conference

Wednesday: FED press conference

Thursday: SNB and BOE press conferences

Looking ahead, two critical dates stand out: July 4th, the deadline for the “Big Beautiful Bill” in the House, and July 9th, when the current tariff pause is set to expire.

I hope you enjoyed this article. This is not investment advise and all views are my own. I write these articles because they help me to stay disciplined and transform my thoughts into actionable trade ideas. I always appreciate your feedback, likes and comments!