Chasing the Market While the Fed Waits

A Reluctant Equity Rally Fuelled by Flows and a Central Bank in No Rush to Cut

Hi everyone,

This article is structured in three parts: first, I discuss my view on equities, then I discuss my views on interest rates, and finally, I share how I navigate markets in my trading account. Let’s dive right in!

Equities: A Flows-Driven Market

Morgan Stanley’s Mike Wilson recently highlighted a key driver of equity performance: relentless inflows.

Retail investors are buying roughly $5bn/day

Systematic/CTA strategies are adding another $5bn/day

Corporates are executing buybacks worth about $5bn/day

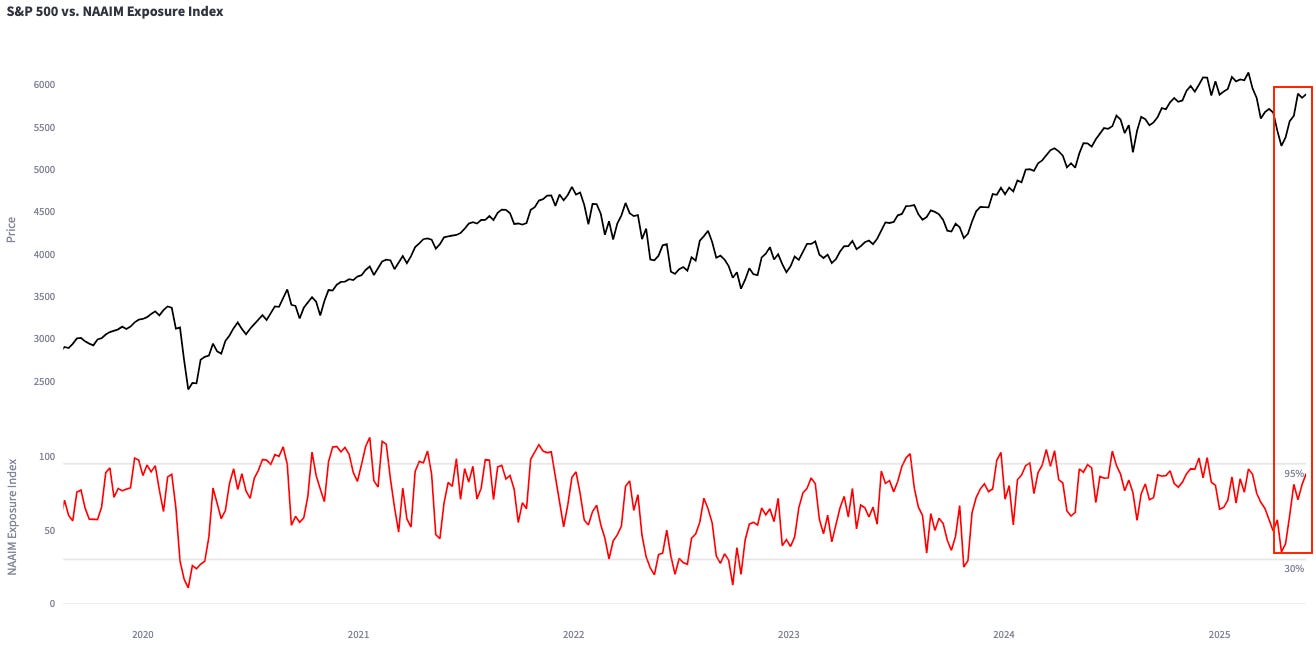

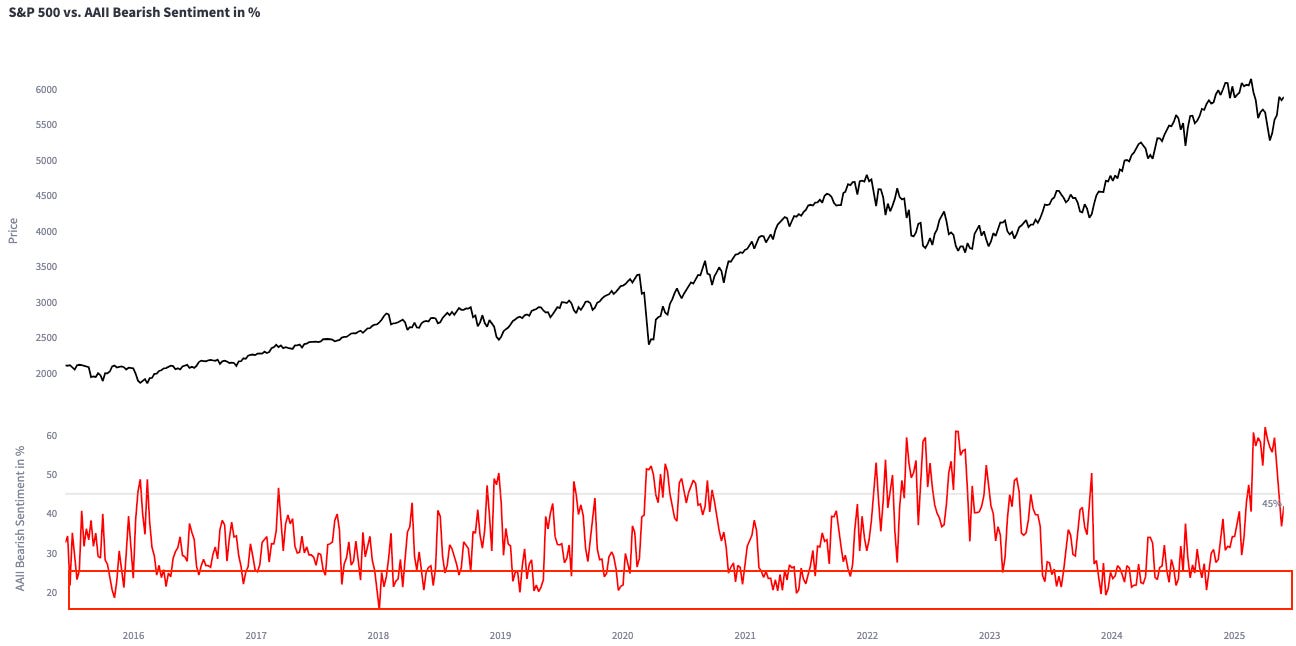

That’s approximately $15bn/day in S&P500-linked demand. At the same time, underinvested institutional investors - particularly discretionary hedge funds and long-only mutual funds - are being forced to chase the rally after lagging performance since early April. The NAAIM Exposure Index suggests that active managers have been running with 50–90% equity exposure since April.

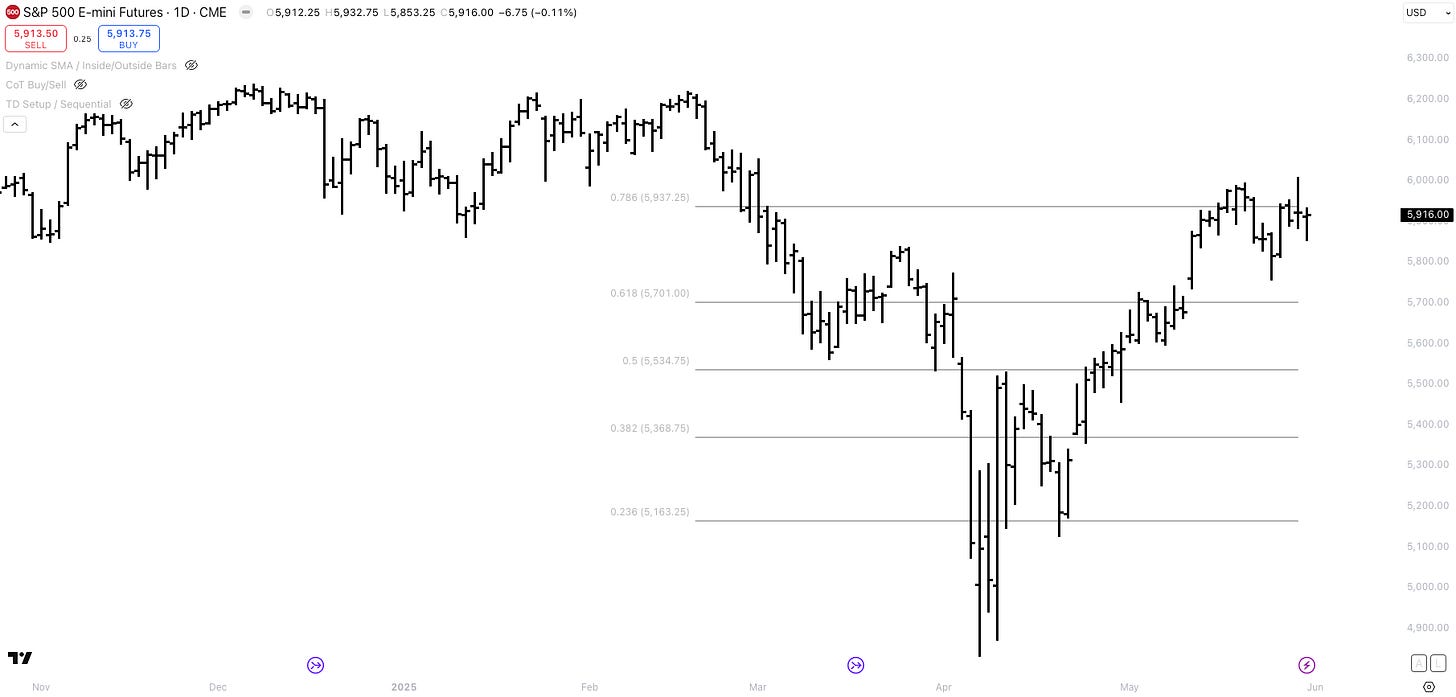

Despite a 23.3% rally from the lows, sentiment remains surprisingly bearish. The AAII Bearish Sentiment has declined but remains elevated.

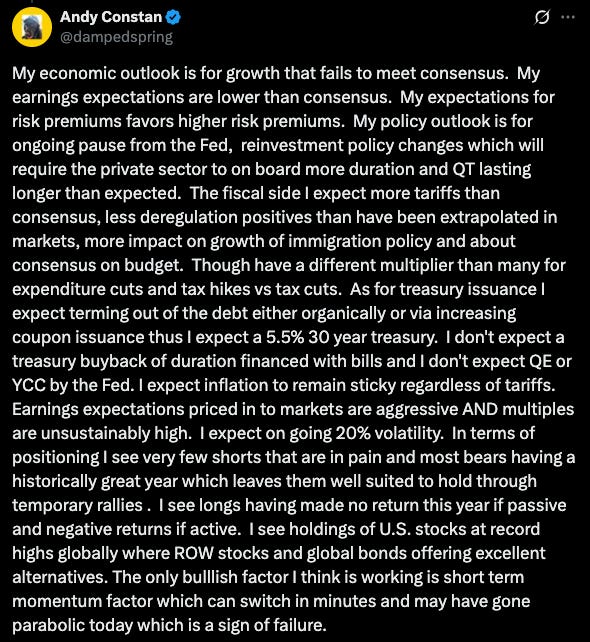

On X, the discourse is split into two camps:

One argues the Trump tariff story is priced in and risk-on will continue

The other points to stretched valuations, policy risks, and softening data

The following two X posts show what I mean. The bull case:

And the bear case:

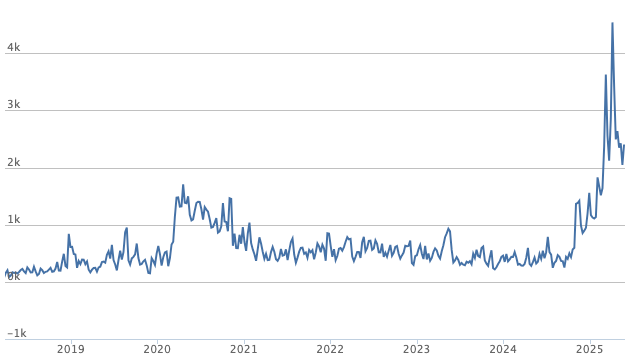

I think both X accounts are great follows. Their opposing conclusions - based on the same macro landscape - underscore how uncertain the outlook remains. See the chart of the Economic Uncertainty Index below.

My opinion can be summarised in a few bullet points:

The flows: Flows remain bullish. Institutional investors are underinvested and need to chase the market higher.

The economy: For the market to sell off, the economic hard data needs to deteriorate. I do not see that happening right now.

Tariffs of 10-15% will hit corporate profits by only 0.5%

Fiscal deficits will remain at 6-7% (front-loaded in 2026 & 2027)

Tax cuts will boost domestic consumption

Accelerated depreciation will boost domestic and foreign investments

Energy prices will remain low with OPEC+ increasing production

Global growth could accelerate with Europe and China stimulating

AI will increase capex, boost productivity and lead to higher profit margins

The tape: The price action is much better. Negative news, e.g., tariffs, do not result in the market trading lower anymore.

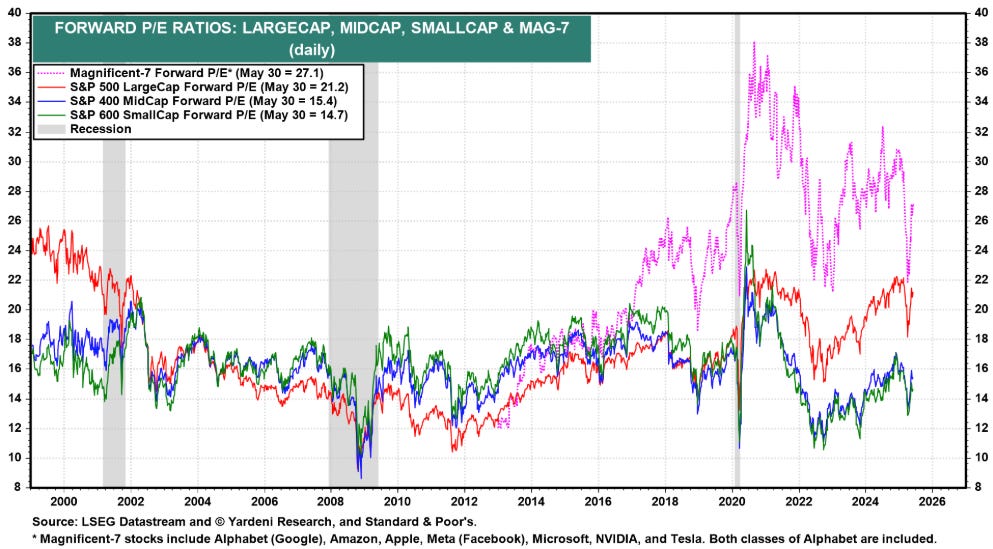

Valuations are stretched - especially on a headline level. But the 21x forward PE for the S&P500 is distorted by the Mag-7, which trade at an average 27x. The equal-weight S&P500 trades at 17x, and the S&P Midcap 400 at 15x - both near their 20-year median. In short, the “average stock” isn’t outrageously expensive.

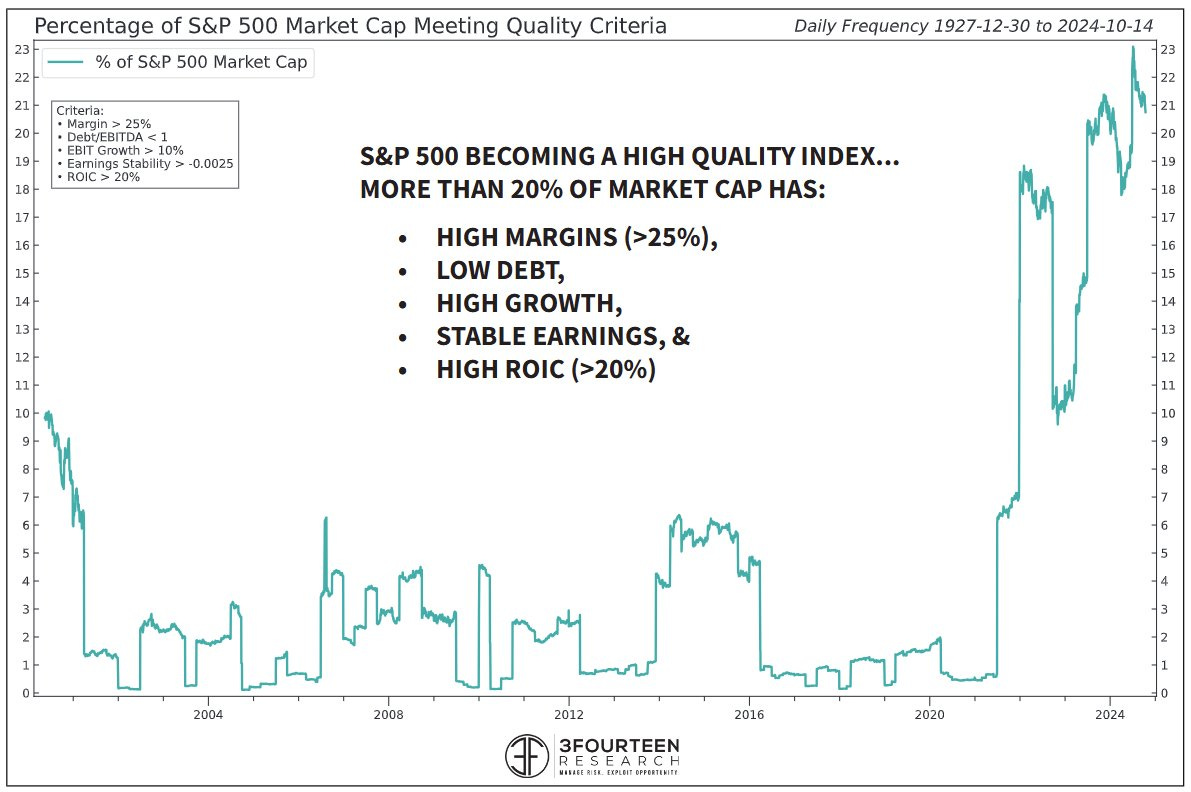

Also, historical comparisons to 1950–2000 markets miss the structural shift created by the internet. The Mag-7 have billions of global customers and high-margin scalability, which warrants higher multiples. The chart from Warren Pies below supports the idea of structurally elevated PEs for a high-quality S&P500.

Source: Warren Pies on X

I am still long the S&P500 from April 24th.

Fixed Income: Zero Cuts in 2025?

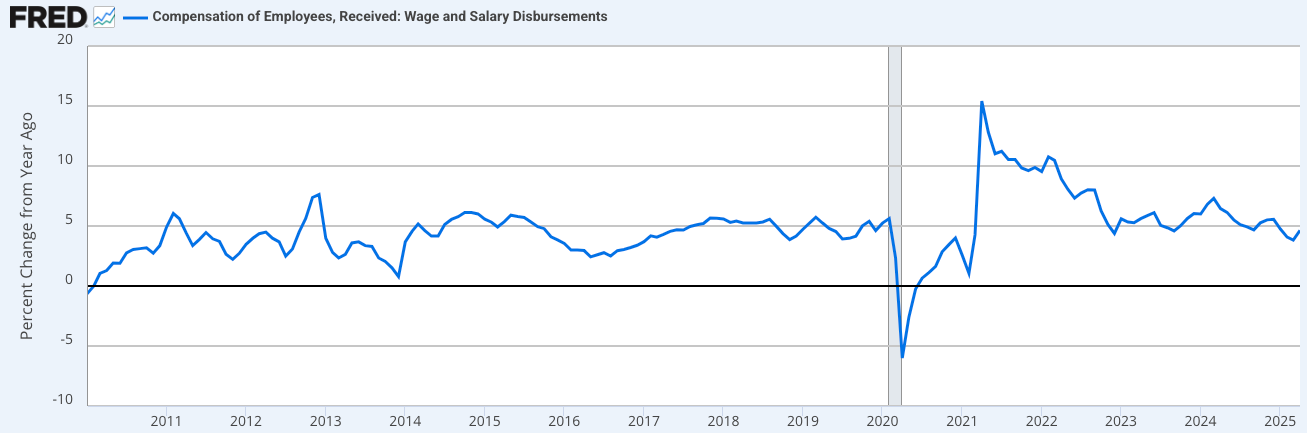

Friday’s personal income report came in hot: +0.8% MoM vs. 0.3% expected. While a big chunk was driven by transfer receipts (e.g., Social Security), employee compensation and small business income were solid too. The income-driven expansion remains intact, with nominal wage growth at 4.6%.

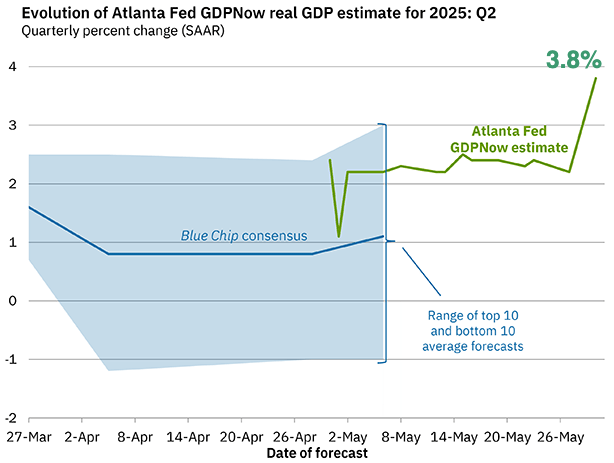

The Atlanta Fed’s GDP Nowcast is forecasting 3.8% GDP growth in Q2-2025 now.

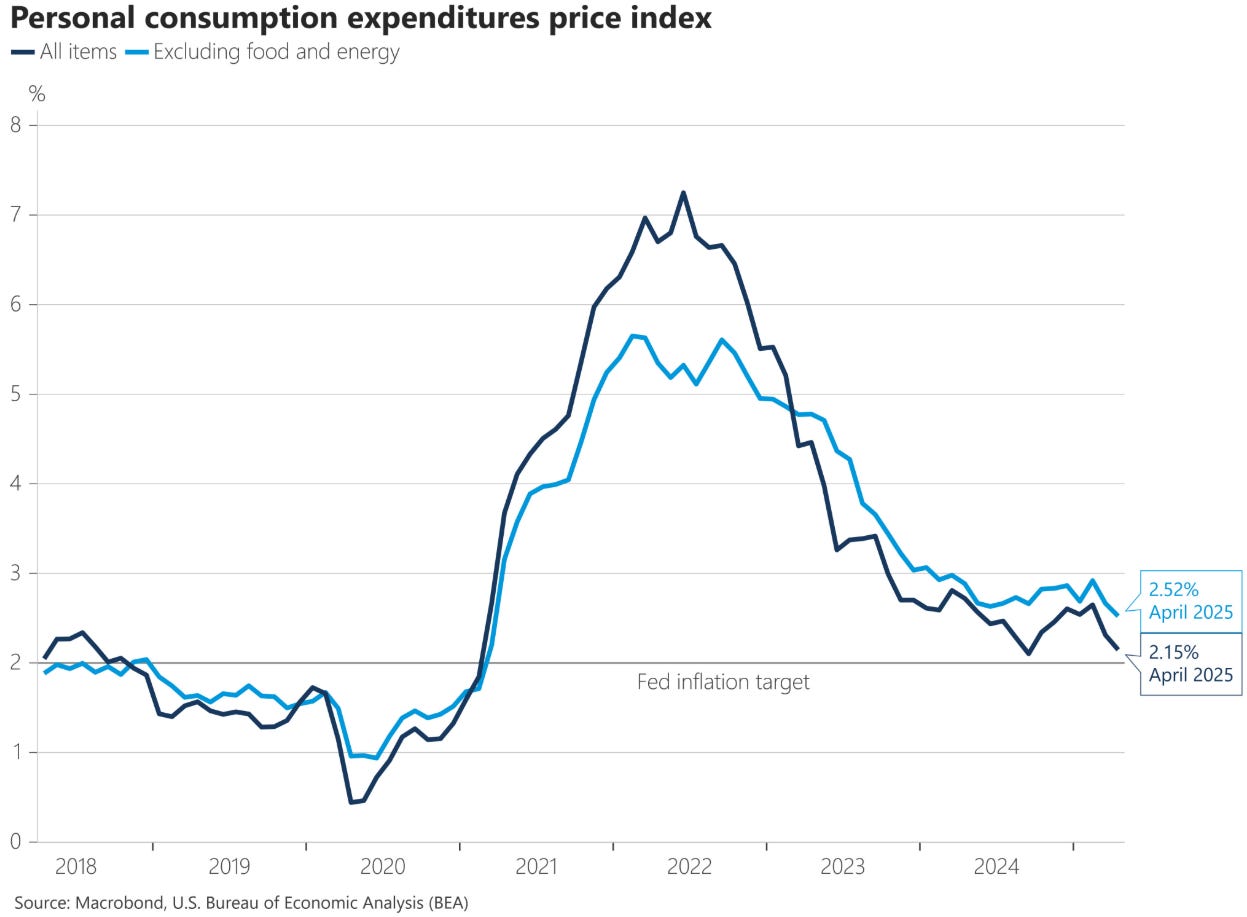

Meanwhile, core PCE printed at 2.52% YoY - right in line with expectations - while headline PCE came in at 2.15%. With core inflation still above the Fed’s 2% target and the labor market holding up, Powell has little reason to cut rates prematurely.

Source: Nick Timiraos on X

All eyes are now on next Friday’s nonfarm payrolls. Consensus expects +130k jobs and an unchanged unemployment rate of 4.2%. Since Trump took office, net immigration has fallen sharply, which will likely suppress job creation but also stabilize the unemployment rate by limiting labor force growth.

As long as:

Inflation remains above target

GDP grows at 2–3%

Unemployment stays low

…there’s little justification for the Fed to ease aggressively.

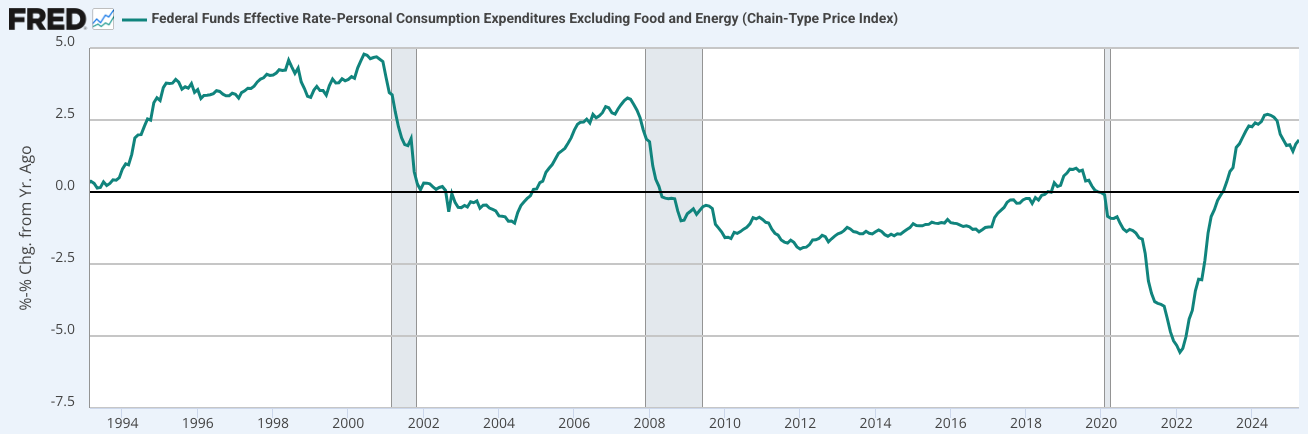

The real policy rate (Fed funds minus core PCE) sits around 1.8%, which the Fed probably considers sufficiently restrictive. What is the upside for the Federal Reserve cutting interest rates when the economy is still growing and the labor market remains tight? If inflation resurfaces, everyone would blame it on the Federal Reserve.

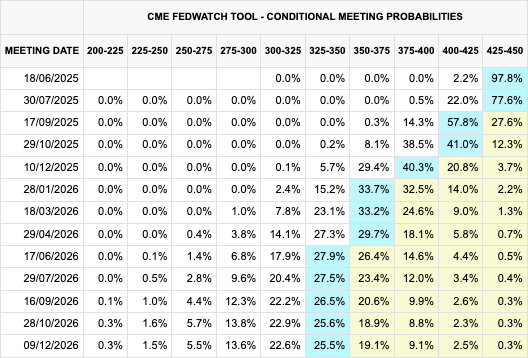

The short-end is currently pricing 2x more cuts in 2025. I think there is the possibility for zero cuts in 2025 if the labor market does not deteriorate.

The short-end has already started pricing less cuts in 2025 (short SOFR Dec25) and more cuts in 2026 (long SOFR Jun26). When Trump announced the 90-day pause on reciprocal tariffs and equities bottomed, the short-end started to sniff out the Federal Reserve will not have to cut rates aggressively in 2025.

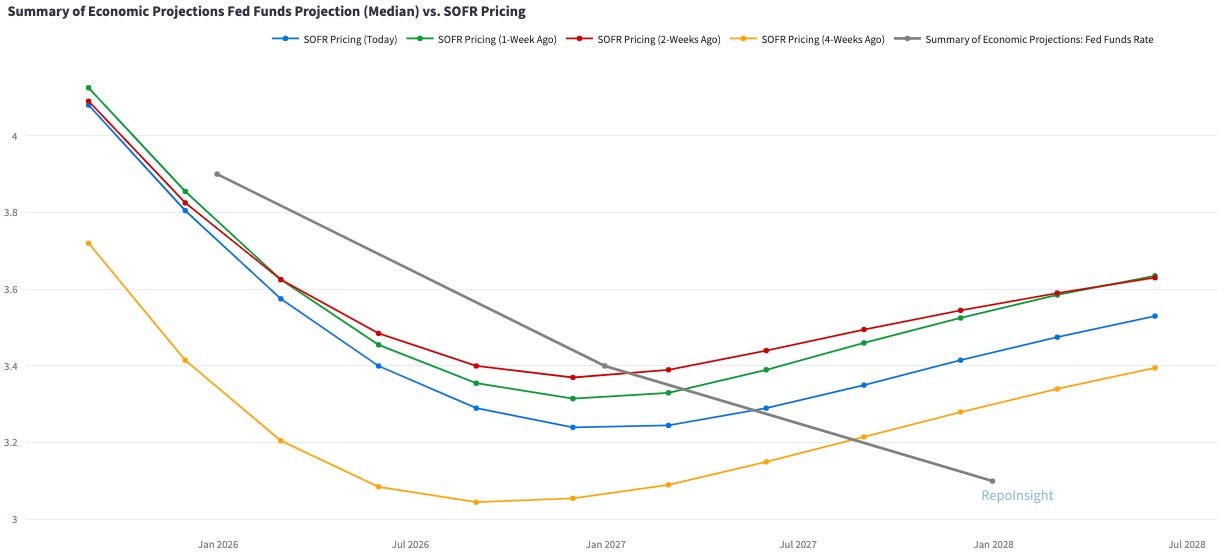

The SOFR curve has moved up quite a bit from just four weeks ago. Still, SOFR futures imply more easing than the Fed’s March Summary of Economic Projections (SEP):

2025: Fed median = 3.9%, SOFR-implied = 3.81%

2026: Fed median = 3.4%, SOFR-implied = 3.24%

I lean toward fewer cuts in 2025, but after the recent repricing, the risk-reward is less compelling. Two cuts have already been priced out of the curve.

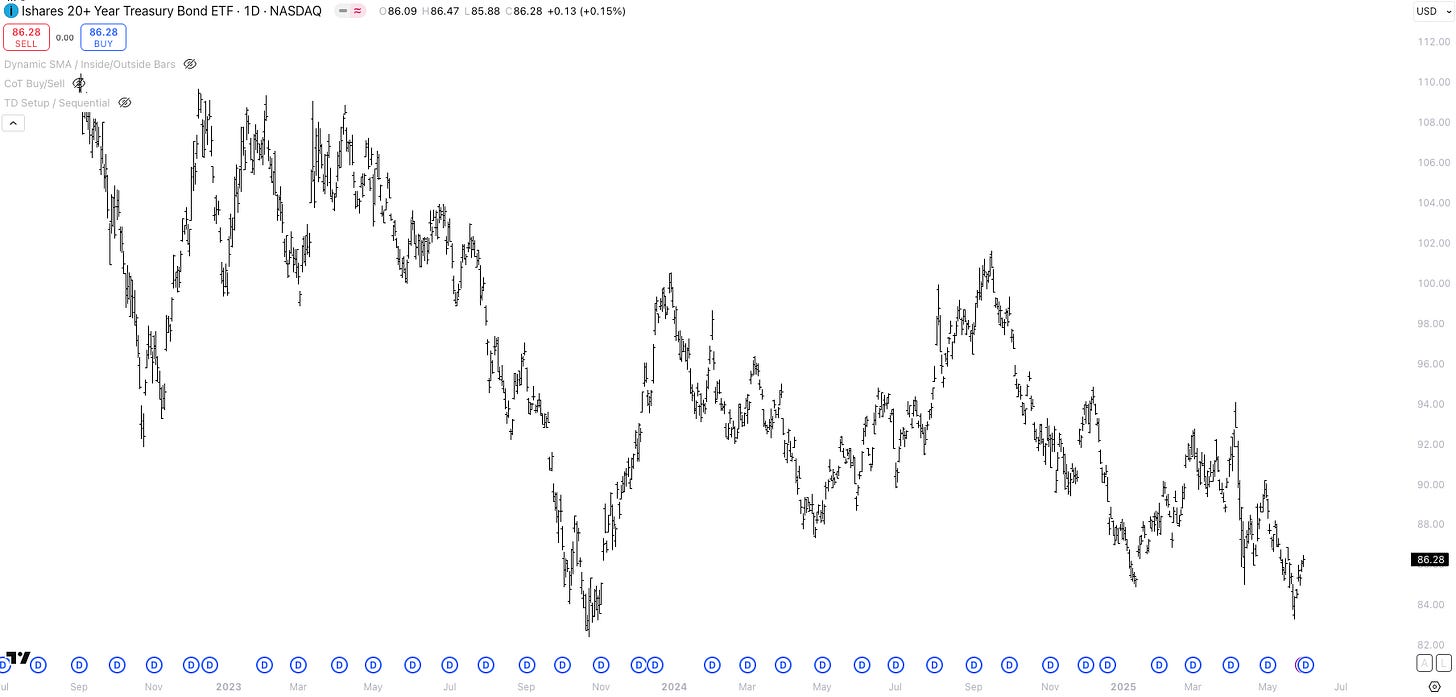

With 5y yields at 3.96%, 10y yields at 4.40% and 30y yields at 4.92%, I do not see any great opportunities in fixed income right now. If the bond vigilantes push 30y yields above 5% again, TLT calls (or spreads) could be an interesting play with limited downside.

Trading and Portfolio Management

My current positioning remains unchanged:

Long S&P500

Long USD cash in a EUR-denominated account

Last week’s article, “The Art of Doing Nothing,” still holds true. Sometimes, inactivity is the right move.

Year-to-date, the account is up 6.9%.

Max drawdown: -2.85% over 9 days

Correlation to S&P500: 0.28

Correlation to BlackRock’s 60/40 (AOR): 0.31